Polarizer Predicament Prompts Possible Problems

Some polarizer manufacturers did add capacity in late 2019 and last year, but none expected the increase in display demand caused by the COVID-19 pandemic, especially after the very poor display industry results in 1Q last year. Nitto Denko (6988.JP), among the top three polarizer producers, licensed their technology to others (at least two Chinese producers) rather than expand, and BenQ Materials (8215.TT) focused on increasing production efficiency, in lieu of new capacity. Samsung SDI (006400.KS) and Sumitomo Chemical (4005.JP) added some capacity in 2018, while LG Chem’s (051910.KS) polarizer expansion came in 2019. Cheng Mei Materials (4960.TT) (formerly Chi Mei Material Technology) while one of the smaller producers decided in 2018 to add enough capacity to increase its share almost 2X by mid 2020, but prices for polarizers continued to rise in 2019, as raw suppliers such as FujiFilm (4901.JP) and Konica (4902.JP) increased prices that were passed on to polarizer manufacturers and then to panel producers last year.

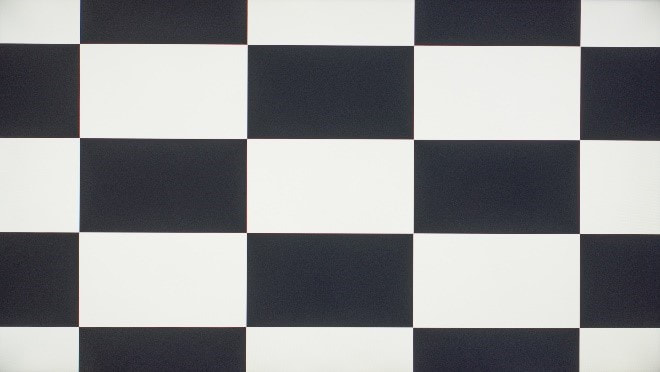

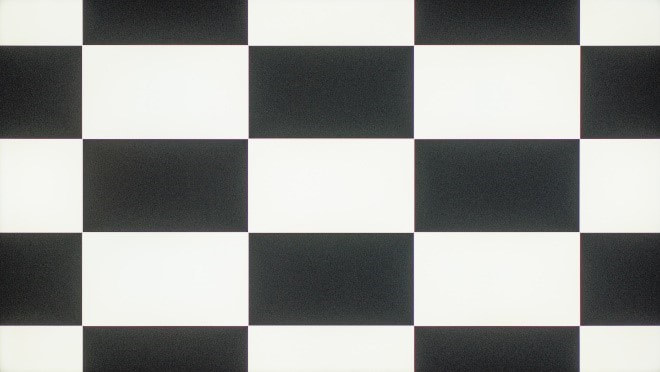

Jump forward to the present, and we see comments from the Chairman of Cheng Mei Materials (aka CMMT), despite their capacity expansion to four production lines (from two), citing continuing shortages of the films and other upstream materials needed for the production of polarizers. In fact, he stated that the shortages were more severe than imagined, leading to the company being able to meet only 80% to 85% of customer orders, and that he expected the shortages to continue through 2021, particularly with certain polarizer types. The materials shortage is not as severe for VA (vertical Alignment) type panels as it is for IPS (In-Plane Switching) panels, both of which are common in TV sets. IPS panels have excellent viewing angle characteristics, meaning the picture quality remains high as the viewer moves off center, but such panels have lower contrast and mediocre black uniformity. VA panels have poor viewing angle characteristics but are of higher contrast and higher black uniformity. These two 20 sec. videos and the comparisons below show the differences using a Sony (SNE) IPS based TV and a Hisense (600060.CH) VA based TV.

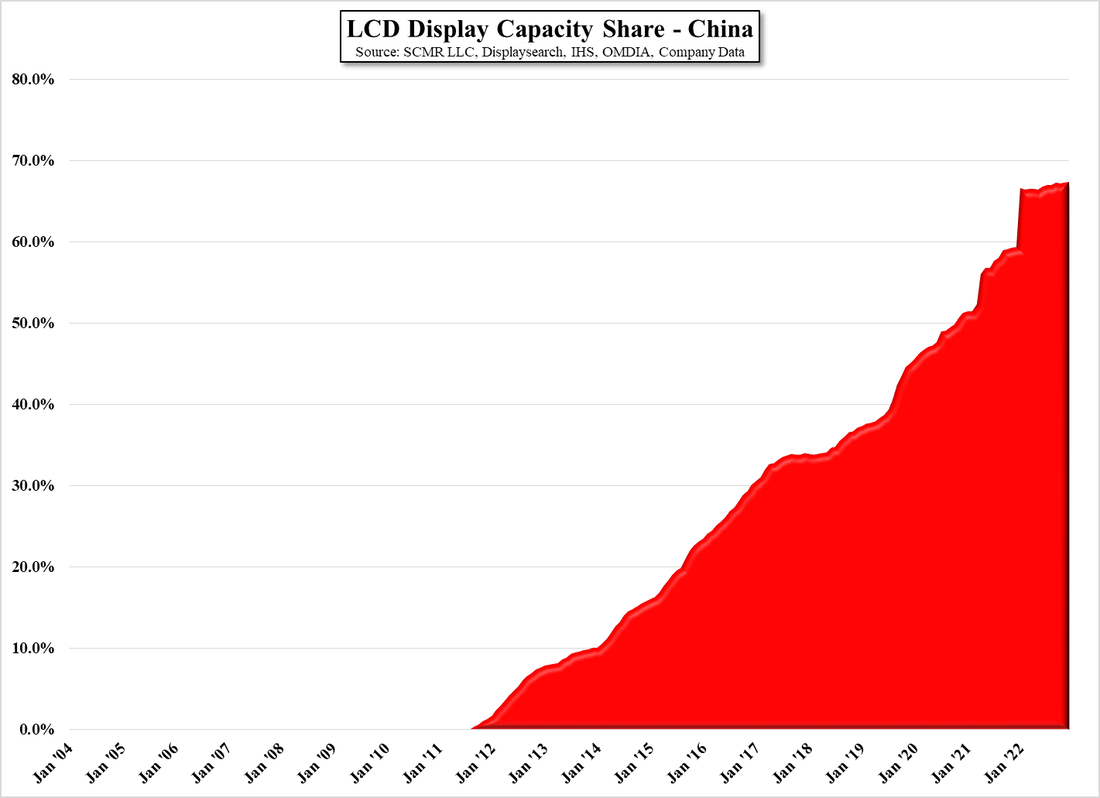

The shortage of polarizers will have an increasing effect on LCD panel producers if demand remains strong, and given China’s increasing share of the LCD display market, the effect will be greatest on that region. As long as demand remains strong, panel producers are able to justify panel price increases by citing the increased cost of materials, polarizers included, but we expect that polarizer capacity will remain tight even if demand slows. This will make it exceedingly difficult for panel producers to justify such cost increases as demand slows in the future and can trigger a more rapid decline in panel producer profitability than might be the case if polarizers were not in short supply.

https://youtu.be/BS-daH4gk84

https://youtu.be/8uLoA8YxAuk

RSS Feed

RSS Feed