QD/OLED Production, decisions, decisions…

Potential technical issues aside, which will likely be addressed by SDC in the second or third generation product, parent Samsung Electronics has been supportive concerning the new product offering but has been a bit hesitant on the prospects for the technology during its development and early production. It was surprising to see that Sony was first to announce the availability of the technology in its TV line (shipping expected next month) but Samsung is now offering almost immediate delivery (1 day) through Best Buy (BBY) and is said to be scheduled to receive .5m QD/OLED panels from SDC this year. While that is a small number of units compared to Samsung ~50m units shipped last year, it would reflect more the early production stage of the technology and Samsung’s lack of information as to how the new technology will be accepted by consumers.

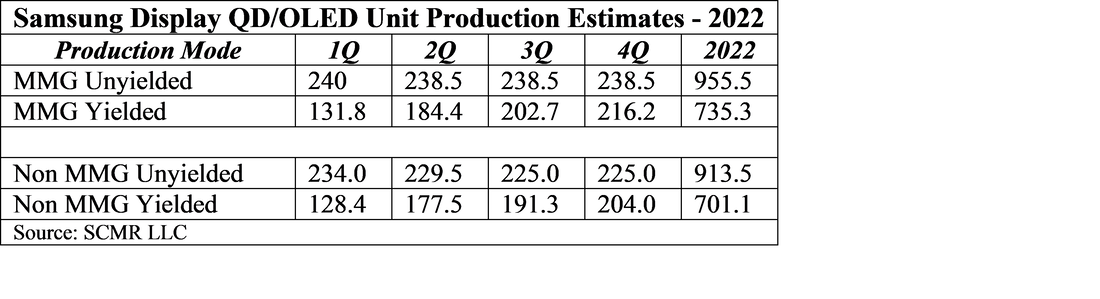

That said, Samsung Display, who will be the sole source of QD/OLED displays to Samsung, Sony, and Dell, must also be realistic as to how many panels they are able to produce this year, and we look at the most important characteristic of panel production, yield, to give an estimate of the number of panels SDC will be able to produce. As the SDC QD/OLED fab is configured as a Gen 8.5 15,000 sheet/month line, we have to make a few assumptions before walking through the actual estimates. First, we assume that the fab was built to accommodate MMG (Multi-mode glass), which allows the lines to mix different size panels on the same Gen 8.5 substrate, however most Gen 8.5 OLED lines process a half sheet at a time. Using MMG would make it impossible to process a half sheet because of the configuration (3 65” & 2 55” panels/sheet or 3 65” panels & 3 34” panels/sheet), so we did calculations for both MMG and non-MMG configurations.

We also have to make some assumptions as to how many of each panel size Samsung Display is producing[1], which would be based on consumer demand, which is still an unknown, however we build in a roughly two to one ratio for 65”/55” as the price differential between the two is ~35% and the screen size of the 65” model is ~40% larger, with roughly 15% of production going toward the 34” (monitor) size.

The most important metric in the calculations is yield, as QD/OLED is a new technology and has a number of process steps that are different than typical OLED display production. Typically yields are quite low when production begins as tools need to be tuned to mass production levels, however it has been rumored that SDC was having trouble with yield and had been moving into mass production with yields in the 50% range. We expect this was a reason for parent Samsung Electronics’ reticence about promoting the technology late last year, however a recent internal memo from SDC management to employees indicated that yields are now 75% with a target (timeframe?) of 90%+. It is rare for any company to publish actual production yield, especially for a new product, but it seems that SDC wanted to encourage the fab staff to have an optimistic view of the potential for the product and the prospects for their continued employment on the project. This gives us some clarity as to where the production yields are currently, which we build into our model below. As noted, while we are less sanguine about the use of MMG at this fab, we present both MMG based and non-MMG based estimates.

[1] Available to SCMR LLC clients.

If they decide to expand, equipment suppliers will be pressed to also meet such deadlines, which can complicate such timelines. All in, QD/OLED, or at least Samsung Display’s version of the technology is just beginning to emerge but there is little time to make educated decisions as to expansion plans or SDC will be limited to current production levels until 2024. While this would certainly give the technology a chance to mature a bit, other display technologies will also improve and QD/OLED will face a stronger challenge from competitive TV display technologies. Decisions, decisions…

RSS Feed

RSS Feed