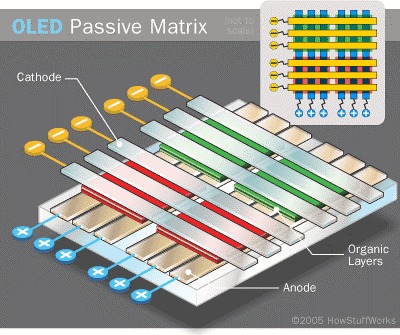

Most investors are a bit fuzzy on the difference between AMOLED[i], the most common form of OLED display, and PMOLED[ii], a form of OLED display that is used less often, but is RiT’s stock and trade. A Passsive Matrix Display addresses each sub-pixel by sending signals down a mesh of horizontal and vertical pathways. At the point at which the two meet, the sub-pixel (color dot) is turned on, with the intensity based on the amount of current reaching the sub-pixel. This is a simple addressing scheme, but due to the large number of ‘addressing lines’ can only be used for relatively small displays.

An Active Matrix OLED display uses the same sub-pixel arrangement, but does not have the horizontal and vertical ‘addressing lines’. Instead, each sub-pixel is controlled by a TFT[iii] circuit that senses the amount of current (brightness) being sent to the sub-pixel, and maintains that level until it is given new information. This avoids the necessity to keep high current flowing to each sub-pixel and reduces the power consumption of the display. While this is a simplistic description, it illustrates some of the limitations of PMOLED relative to AMOLED, but there is certainly a place for PMOLED displays, particularly in devices that do not need a rapid refresh rate, such as CE device panel displays or monochrome wristbands.

While considered the poor stepchildren of AMOLED displays by many, the PMOLED business was ignored as full motion video became a staple in the mobile display business, however PMOLED has seen a resurgence as low function displays, such as the wrist bands seen below, become more popular. We believe the abilities of PMOLED to provide a relatively low power demand display in circumstances where a full color OLED display would be overkill, is leading to the expansion by industry leader RiT Display. While OLED smartphones and OLED TVs get most of the attention, lowly PMOLED displays seem to be moving from sitting with the cousins at the kid’s table to moving up sitting with Grandma at the adult table in recent months.

[i] Active Matrix OLED

[ii] Passive Matrix OLED

[iii] TFT – Thin Film Transistor

RSS Feed

RSS Feed