Samsung Doubles Down in Image Sensors

Samsung announced today the ISOCELL HP1, a 200MP image senor and the ISOCELL GN5, a 50MP version with high speed auto-focus. The new sensors use a process that Samsung calls Chameleon Cell, which senses the lighting environment and can combine between 4 and 16 adjacent pixels to gather more light in low light environments. If light is sufficient, all 200 0.64um pixels are used individually. The sensor is 1” x 1.22” slightly smaller than the 1” x 1.33” 108MP ISOCELL HM3 and can shoot 8K video at 30 frames/second and 4K video at 120 fps.

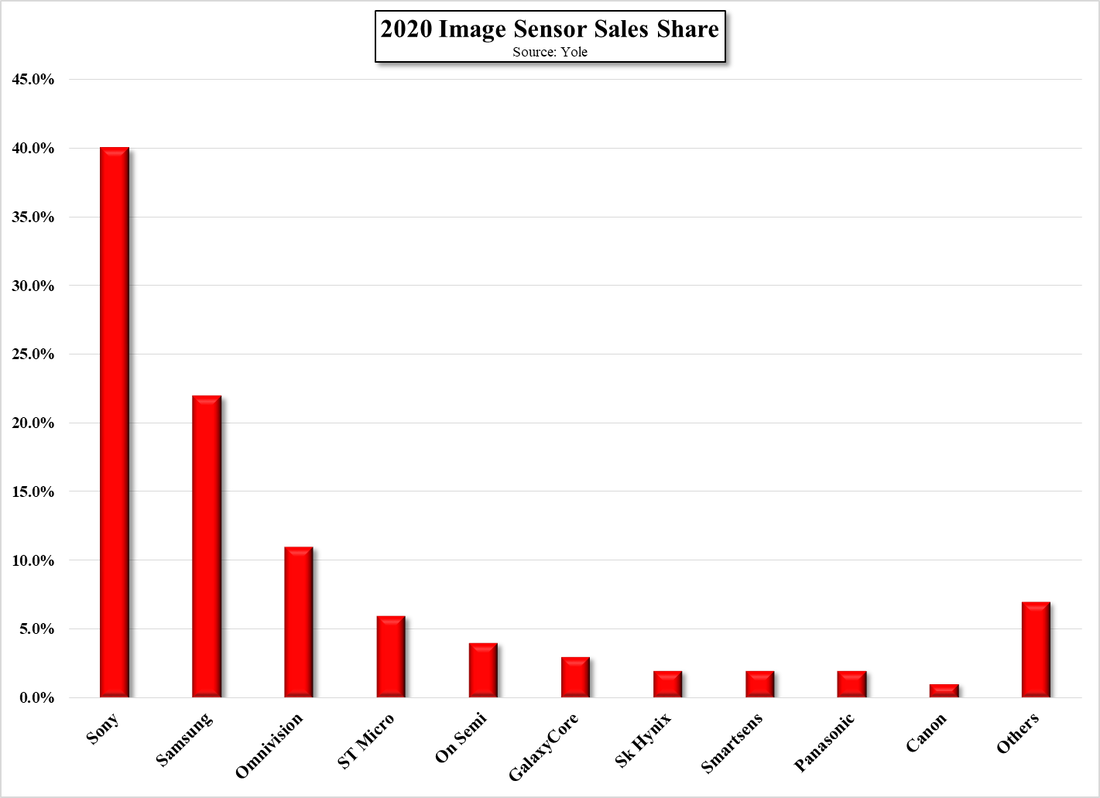

We would expect the next Galaxy S series, due out in January 2022 to be among those sporting the new sensor, which will undoubtedly be followed by high pixel count versions from Sony and others, but it seems that Samsung has pushed the image sensor boundaries a bit faster than others and continues to set the pace. While pushing higher quality image sensors into the smartphone market is certainly a plus for consumers, we still try to grasp at what point such features reach a point of diminishing returns. Hopefully there are enough consumers who would be able to tell the difference between images taken with such high pixel count sensors and would count such as a reason to pick smartphone models with same, but the size of that consumer base seems to get smaller with each iteration as we expect most look at their smartphone cameras as utilitarian devices that can capture selfies, food pics, cat videos, and dogs with Frisbees when called on and are less concerned recapturing Ansel Adam’s-like images for coffee table books.

RSS Feed

RSS Feed