In 2016 SDC began converting some of its older Gen 7 LCD capacity to OLED and in 2017 shut down additional older fabs in South Korea, sold equipment to Chinese panel producers, and leased the facilities to affiliates. As SDC added small panel OLED capacity it found interest continued to build for small panel OLED displays with Apple (AAPL) releasing its first OLED iPhone, the iPhone X in late 2018. Firmly convinced that Chinese large panel LCD producers would continue to build capacity regardless of short or mid-term demand, SDC continued to push forward with its large panel reduction plans, culminating in 2020 when it sold its remaining large panel LCD plant in Suzhou, China to Chinastar (pvt) for over $1b US.

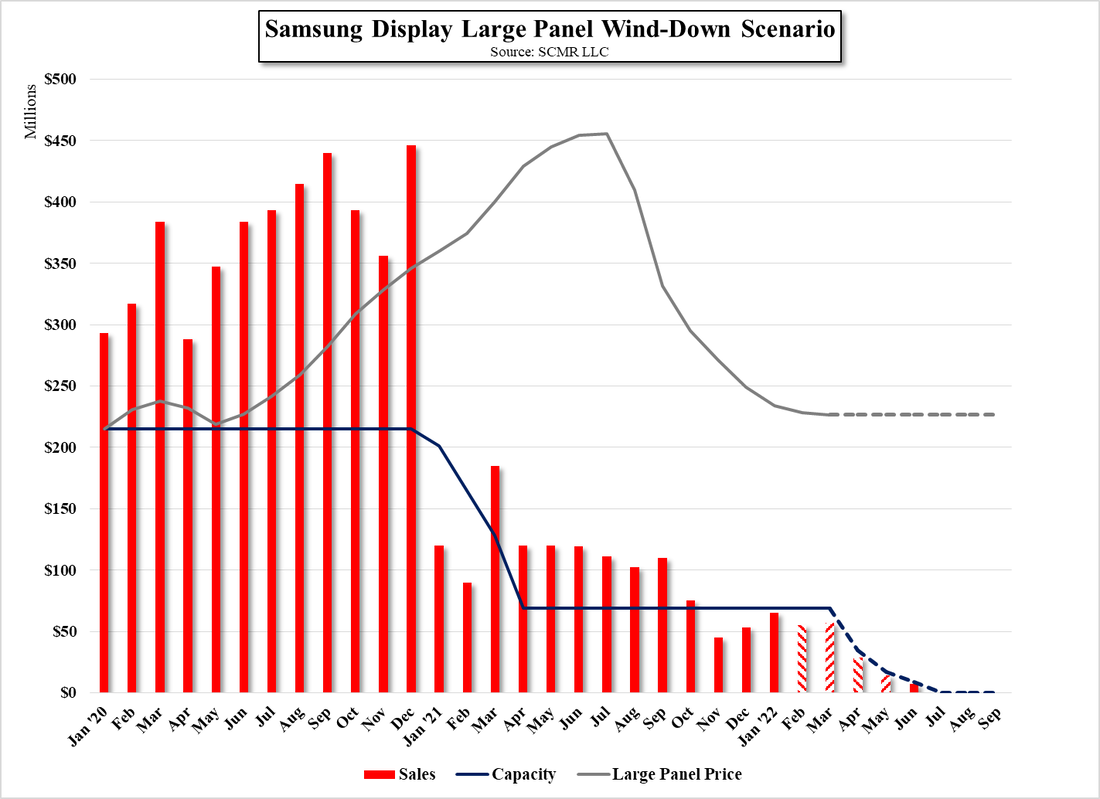

SDC has been converting its larger (Gen 8.5) LCD fabs in South Korea to OLED over the last two to three years to small panel OLED and one for its new QD/OLED large panel production line, and has additional idle capacity for QD/OLED expansion should the technology become in demand. What remains is SDC’s last large panel line in Asan, South Korea, and that was kept open at the request of parent Samsung Electronics when large panel prices increased as the COVID-19 pandemic began to spread. While the operation of the fab was likely profitable for Samsung Display during the large panel price increases that began in July 2020, those prices peaked a year later and have fallen quickly to pre-pandemic levels.

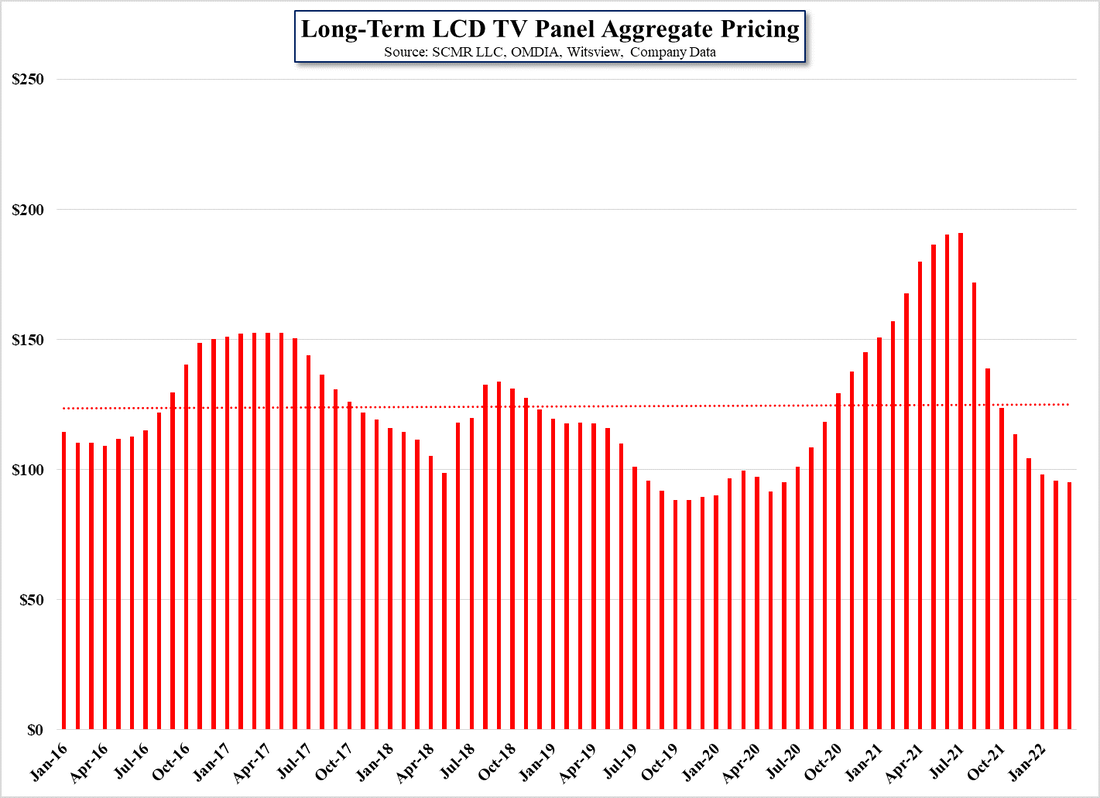

This puts SDC back in the same position it was in in 2020, that of competing against the Chinese in the large panel market, and likely making only a small profit or no profit while doing so. As the aggregate price of TV panels is only 7.5% above the lowest point during the last 5 years, SDC sees little need to continue to compete in that business and will likely end that last production fab this year. Samsung Electronics buys all (other than what it still gets from SDC) of its TV panels from other suppliers and while faced a difficult times during the pandemic related price increases, is now taking advantage of the price declines, without the burden of the losses at SDC that such declines caused in the past.

While there will always be large panel LCD price cycles, Samsung Electronics can use its buying power to exert price pressure on outside panel producers, who clamor for Samsung’s business to fill their capacity, while SDC operates in the OLED world that has completely different demand characteristics. While it has been a bumpy road over the last year for both Samsung and Samsung Display, the logic behind SDC’s original decision to exit the large panel LCD space seems to be proving out, leaving them little need to remain in the large panel business.

RSS Feed

RSS Feed