Samsung & LG Preliminary 2Q Results

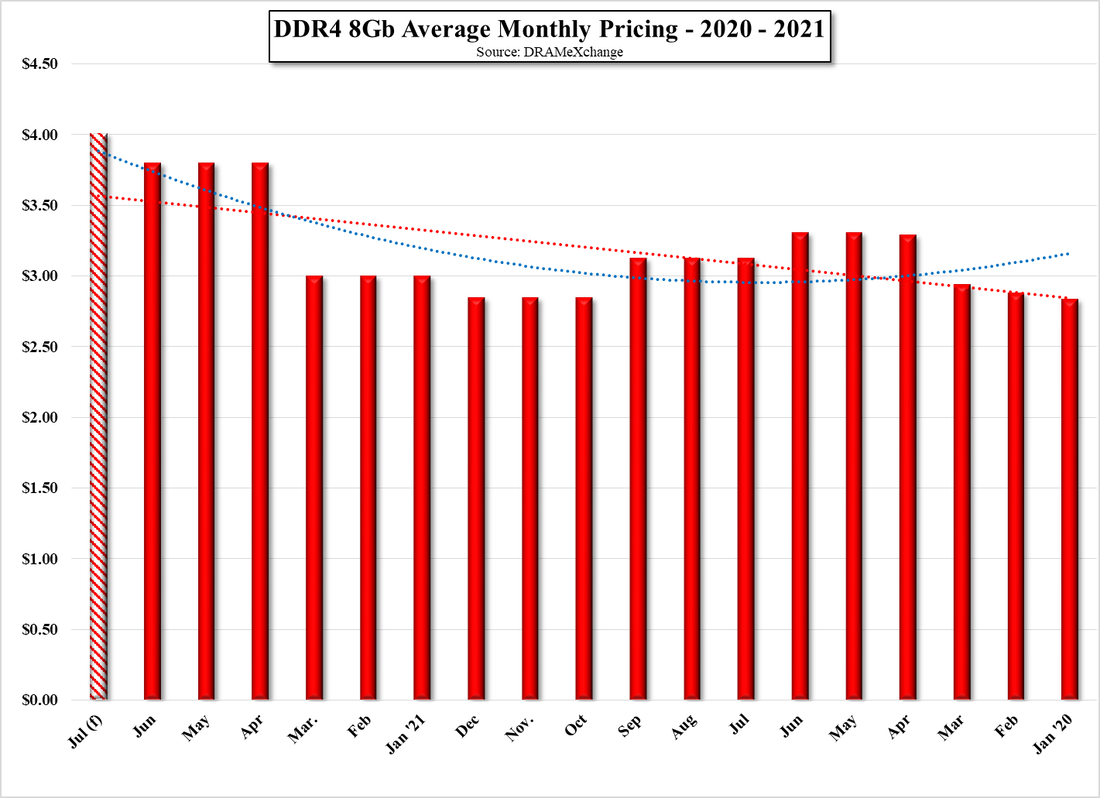

While Samsung does not give detail when it releases preliminary numbers, the general consensus is that the quarter saw a one-time gain from a ‘take-or-pay’ deal with Apple (AAPL) of ~500b won ($439.7m US) and that much of the strength in the quarter came from semiconductors, where DRAM prices rose 26.7% in 2Q, after a 5.3% increase in 1Q, leading to an expected 22% increase in operating profit for the segment. Expectations for smartphones are less sanguine, with shipments down substantially from 1Q as Galaxy S21 sales slowed, and while y/y comparisons for Samsung Display (pvt) will show the reduction in SDC’s large panel production, we expect display to see positive results as panel prices rose through the quarter, albeit less for small panels where Samsung shines. Details later this month.

RSS Feed

RSS Feed