Saved by the State

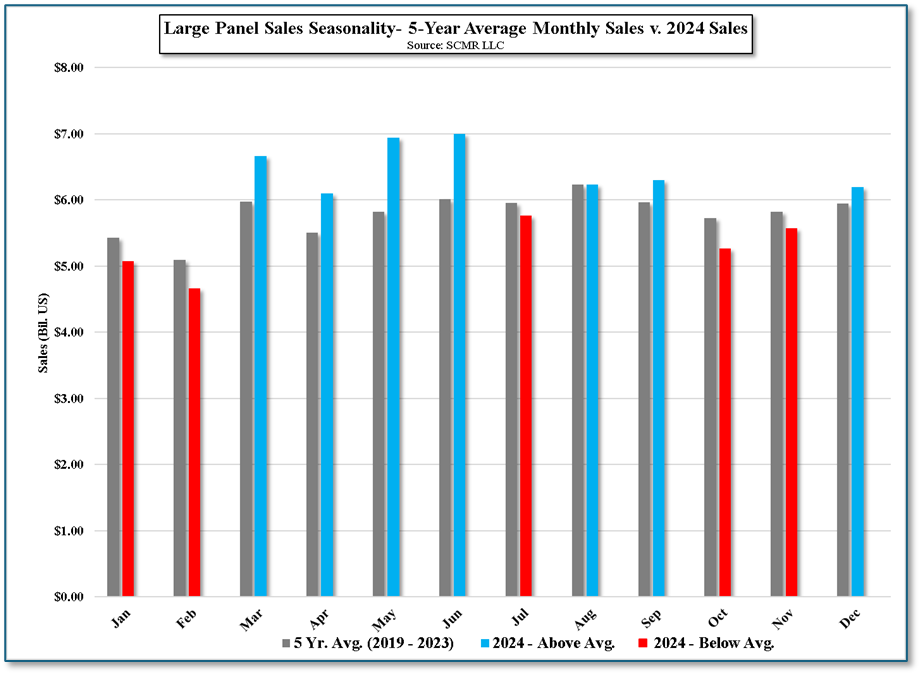

All in, while the first half of 2024 was stronger than 2H, the Chinese government was responsible for keeping large panel producers from ending the year on a more sour note. Their “Swap Old for New” program, which included TV sets at the end of August, helped to stimulate enough Chinese consumer demand to put a halt to sliding TV panel prices, which peaked in July and began a rapid decent. The subsidy program offered consumers a subsidy of between 15% and 20% depending on the energy efficiency of the TV. And TV brands found ways of meeting the energy requirements without redesigning those sets that did not qualify.

The program continues into 2025, however it is unsure whether TV set demand in China for 2025 has been pulled into 2024 because of the subsidy program. If that is the case (we believe so), it has the possibility of causing large panel producers to overproduce heading into 1Q, under the belief that the ongoing subsidies will continue to stimulate set sales. In 4Q Chinese TV set brands Hisense (600060.CH) and TCL (000100.CH) increased sales targets and panel purchases as a result of the subsidy program. With Chinese New Year coming at the end of this month, it will be March before can get a read on actual TV set shipments in China. This issue, along with the potential for additional tariffs on Chinese goods, will be the drivers for large panel producers in the early part of the year, making it considerably more difficult to plan production, although we expect Chinese TV set brands will continue to target higher TV set sales and panel purchases until they receive some indication that they are no longer stimulating incremental demand. That would typically lead to a more conservative production stance in 2Q, but with the tariff wildcard and the possibility for a bit of overproduction in 1Q, it could go in almost any direction.

RSS Feed

RSS Feed