Semiconductor Catch 22

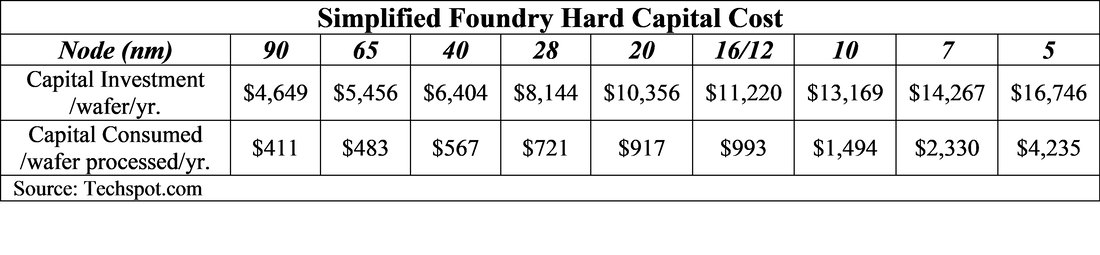

Building out semiconductor capacity takes lots of money and time, so a quick fix for the situation, despite the headlines, is not new fab construction as it will do little to change near-term capacity, and the capital investment cost of building smaller node fabs is easily twice that of building 28nm fabs, where the real capacity is needed. With all semiconductor buyers competing for limited fab capacity and some of that fab capacity allocated to very specific products, prices continue to rise and while semiconductor foundries are making big plans for adding capacity, there is a Catch-22 that will slow those plans and extend the time it will take to bring that new capacity into the market.

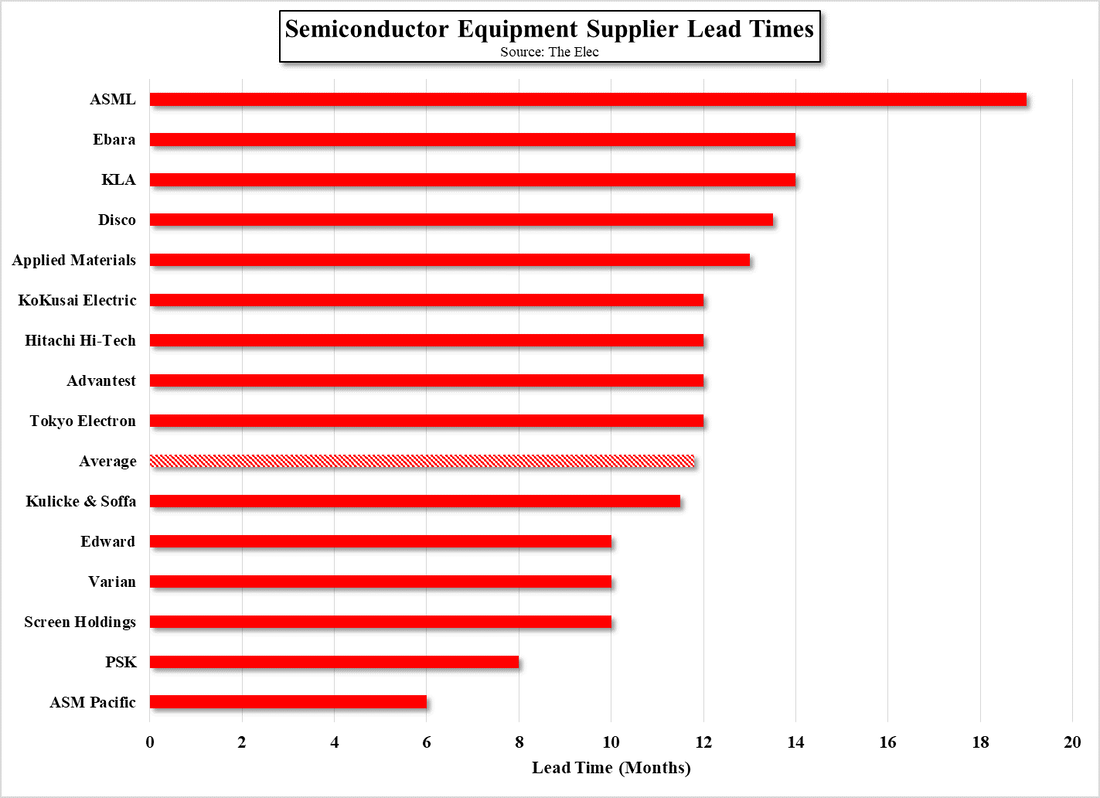

Unfortunately, the same seems to be happening to semiconductor equipment suppliers who face shortages of the components they need to produce the semiconductor equipment that will eventually add enough capacity that we won’t have any semiconductor shortages, but such issues for tool vendors have extended equipment lead times by some extraordinary amounts, leading to an extension of the shortage cycle, a perfect Catch-22. Demand has also contributed to the lead time issue, as semiconductor foundries have been stepping up orders for equipment as they face maxed out utilization rates and have to turn away business, but they do have the option to raise prices for what they are able to produce, which they have. While equipment suppliers technically have the same option, higher prices make little difference if you cannot deliver product, so the supply chain slows and the crisis remains.

Based on the data we have seen (see below), average semiconductor equipment lead times have increased from between 3 to 6 months last year to ~10 months in the 1st quarter of this year and have continued to increase to between 11.3 months and 12.3 months on average, with some extending out as long as 24 months. Based on the mid-point of those suppliers that gave a range, the average equipment lead time is 11.8 months, with both US and Japanese companies averaging 12.1 months and 12.2 months respectively. ASM Pacific (522.HK), a supplier of dicing and bonding tools and Korea’s PSK (319660.KS), a supplier of dry stripping tools, being the lowest at 6 months and 8 months respectively, while ASML (ASML), Ebara (6361.JP), and KLA (KLAC) are the highest among those that were polled, at 19 months (average) and 14 months respectively, with the latter two the same.

RSS Feed

RSS Feed