Shoe is on the Other Foot

TSM recently indicated that it would be spending ~$2.88b to expand its 12” 28nm fab 16 line in Nanjing, which makes logical sense in terms of filling current and future demand, but has been maligned in the Chinese press for using “Mainland policies, resources, hydropower, and low-cost talent”, and further “dumping at low prices in the Mainland, and squeezing out China’s emerging chip manufacturing companies.” Much of this comes from public opinion rather than industry, which removes those who would understand why a global semiconductor shortage is devastating to all industrialized economies and leaves those who see the question from a very different perspective, but it is unusual to see China engaging in a debate about protecting one of its fledgling industry’s against foreign incursion.

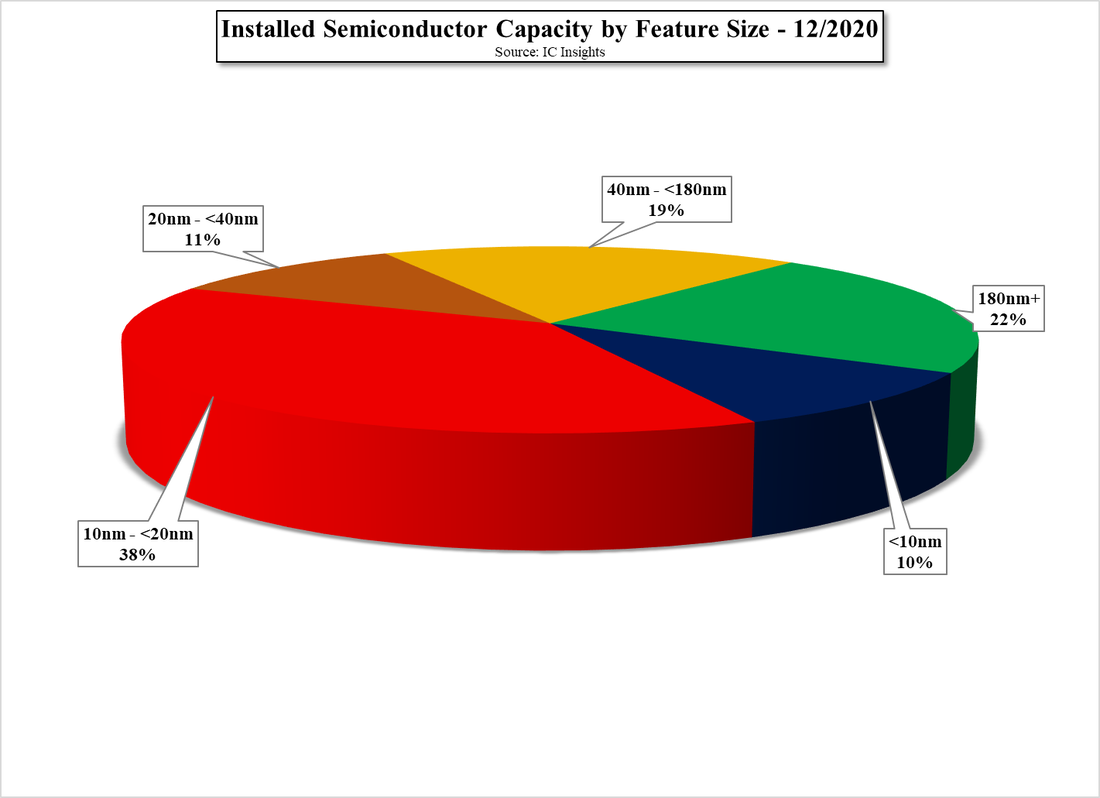

China’s largest semiconductor foundry SMIC (688981.CH) has already approved a plan to build a new 28nm fab in Shenzhen that will produce 40,000 wpm when completed and existing SMIC fabs at or above 28nm are building out additional capacity, which we expect is the root of the anger toward TSM’s expansion, especially since SMIC is not considered to be at the same technical level as TSM, despite both working at 28nm. China is expected to be able to produce ~1m wpm this year (all nodes combined), which keeps the impact of the TSM expansion, which will not be completed until 2023 to a minimum.

The dumping issue is more one of misunderstanding how the semiconductor industry works, as chip level prices decline as less mature nodes come on line and mature fabs reach fully depreciated status., and since the same shortages face Chinese companies, TSM’s expansion in China will help to alleviate that position for many Chinese ODM’s who are currently vying for off-Mainland capacity against other large ODMs. Should the Chinese government to try to limit TSM’s 28nm expansion by not offering the same financial and physical resources that it offers to its own semiconductor companies, would be a bit like cutting of one’s nose to spite one’s face. In the long run it will hurt, but defending China’s economy from semiconductor ‘dumping’ is a bit ironic after years of accusations of China’s product dumping on other economies.

RSS Feed

RSS Feed