Shortages – What’s Changed?

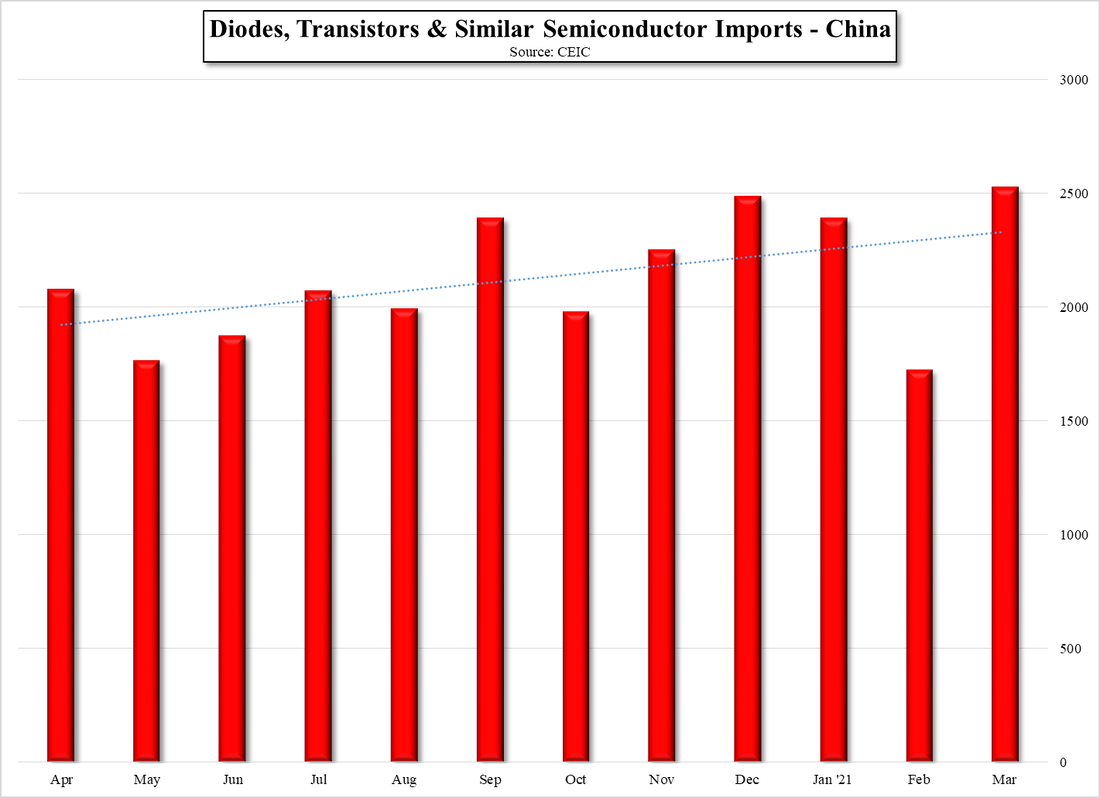

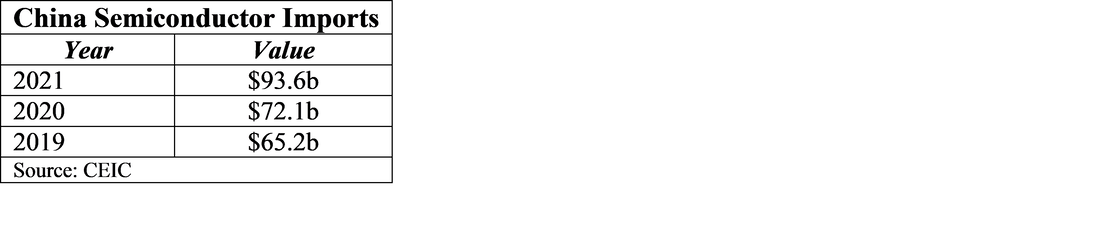

Fig. 5 indicates that China has been increasing its semiconductor imports at a steady pace over the last year (actually longer) and March set a new semiconductor import record. More telling are the 1Q comparisons, with 2021 seeing a 29.8% increase in semiconductor imports in China vs. last year’s 10.5%, so there is little question that China has been more aggressive than usual when it comes to semiconductor imports, but we do not believe that the underlying force that is driving this behavior is COVID-19 demand, but more of a mindset change brought about by the trade restrictions placed on Chinese companies by the previous US administration, particularly those placed on Huawei (pvt), which have had a devastating effect on companies that have found themselves unable to produce products that were routinely sourced in earlier years.

Over the last two years, we believe such trade restrictions have changed the way Chinese CE managements look at inventory. When sourcing was unrestricted, many Chinese CE companies operated under JIT inventory rules, maintaining low inventory levels to keep costs low and avoid end-of-year write-offs. Once it became apparent that the US trade restrictions would have a real effect on sourcing, Chinese buyers became more aggressive and began building inventory in components that were specified in the US restrictions. After early January, when it became apparent that the new administration was in no rush to change the government’s stance on such restrictions, Chinese CE companies and OEM/ODMs stepped up ordering to build inventories further, unbalancing the supply chain even further than it already was.

While this might seem a rather simplistic explanation as to why semiconductor shortages seem to get further out of control this year, we have seen almost every level of component, from raw materials and pre-cursors, passive components, PCBs, and semiconductors of many types, rapidly escalate in price, which we believe is based to a degree on increased demand, but more so by a need to increase component inventory levels by Chinese CE companies, who might have been less aggressive in previous years.. Whether this is a ‘new’ psychology that remains a part of the CE mindset in China, or whether such buyers return to JIT sourcing if demand slows is unanswerable, but our real concern is how quickly such a change might be effected.

We expect the initial change would be slow with orders that have been pushed out by months being brought back to shorter lead times, but if demand stays weak, it would seem logical that some of those orders would be ‘postponed’ and CE companies would work down existing inventory. All in, the CE space faces a higher than normal risk level once semiconductor demand slows or turns negative, with a similar situation facing the display space. We have mentioned a high wire act before as the poster child for CE in 2021 and that seems even more so as the year progresses. JOHO.

RSS Feed

RSS Feed