Simple Math

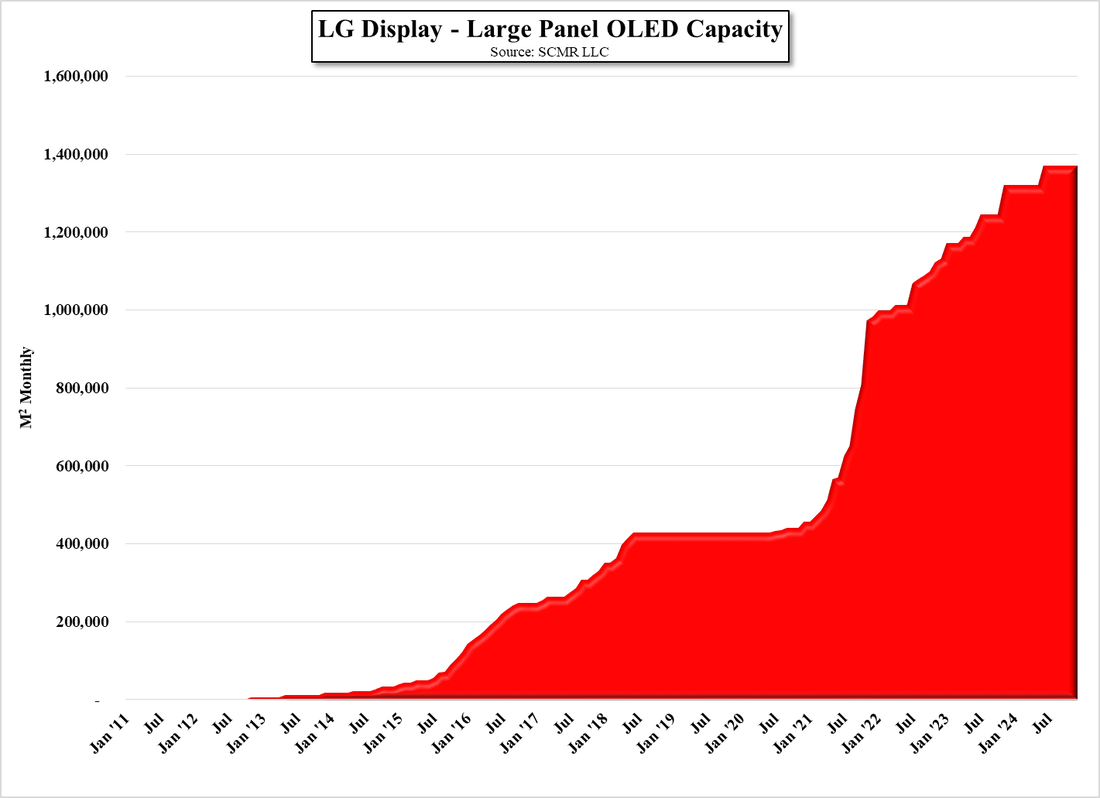

Based on our estimate for capacity growth at LG Display this year, which we set at 50.3%, that would push LGD’s panel capacity from last year’s 3.65m to 5.485m this year, so where do the other 615,000 sets come from based on external estimates? Some of that comes from higher yield, which LGD is able to achieve just from building experience, particularly at the company’s newest OLED TV fab in Guangzhou, China, but that would not likely account for all of the increase, so we have to look elsewhere.

Typically LGD had offered OLED TV panel sizes of 55”, 65”, and 77”, but began offering 48” panels late last year and now also offers 42” panels, and by using a production process called MMG (Multi-mode glass) not only can LGD increase substrate efficiency, but can produce 48” panels at the same time as larger sizes. Given that smaller panel sizes should be able to produce less expensive TVs, it is logical to expect that once the smaller sizes are made widely available OLED TV set manufacturers will see higher unit volumes as the smaller sets become more popular. There is an offset however, which is the increasing average size of OLED TVs, which is helped by a generally lower price as LGD’s production become more efficient, but the table below shows that for each smaller panel size LGD should be able to produce ~30% more units.

Of course fabs don’t run according to such tables as the number of units cut from a particular size substrate does not equate to 100% efficiency, nor does the fab completely dictate the size of units being made available to customers, but there is some give and play between what the fab ‘wants’ to produce to be more profitable, and what the customer believes they can sell most profitably. However by adjusting the mix between larger and smaller sizes the number of units can be changed significantly, with (even without MMG) two less 77” panels produced allows for eight 48” panels to be produced, making up what would be ~50,000 panels each month this year to reach updated estimates. We are not saying that LGD is making such a change, but pointing out how sensitive the panel mix is to unit volumes and how easily relatively small changes can influence volumes.

While the math behind panel estimates is relatively simple and tends to be primarily based on capacity, as long as demand remains at or above capacity the math holds true, and in the case of OLED TV panels, while they sell at a premium to LCD TV panels, the rapid increases seen in LCD TV panels has narrowed the gap, which should give OLED TV demand a continuing boost, along with the smaller and less costly offerings. Smaller panels bigger unit numbers.

RSS Feed

RSS Feed