Single’s Day Crosscurrents

Pre-sales for the ‘holiday’ (not a legal holiday) began on October 24, and ‘Phase One” of the holiday began on October 31 and ran through November 3rd, with the big push starting on 11/10 and continuing through 11/11, the ‘official’ Single’s Day. Last year Chinese on-line retailers felt pressure from the government to rein in some of the massive promotional programs that are part of the holiday, with key influencers generating millions in a matter of minutes when they promote specific products, but this year, with government investigations into large Chinese on-line retailers intensifying, those promotional programs are toned down even further than last year.

The theme seems to have changed from one of “buy, buy, buy” to one that looks to generate customer loyalty, and while there are still the “…spend 300 (RMB, ~$41.44) and get 50 off (~6.91)”, the Chairman’s mantra of “…moderate wealth for a common prosperity…” and away from “…promoting mindless consumption…” seems to have made an even greater impression on on-line retailers this year, while the weakening economic position of Chinese consumers has reduced the contribution from smaller cities, where much of the sales growth has come from in the past.

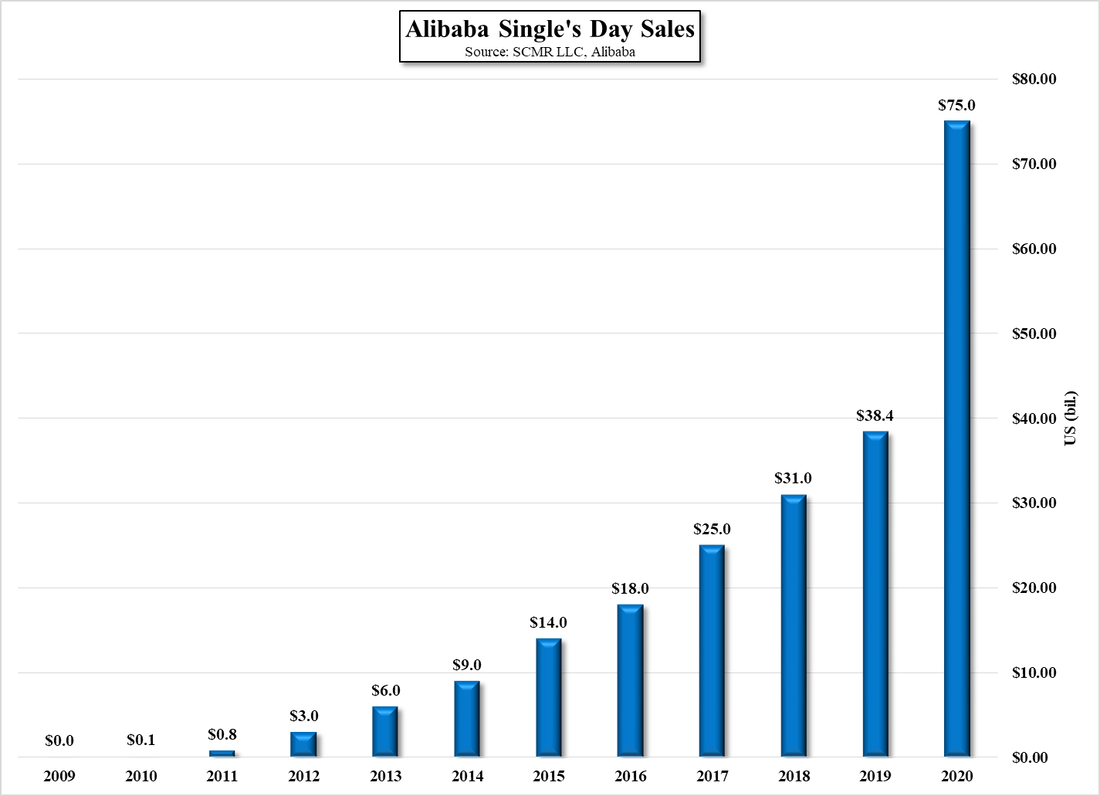

All in, expectations for the holiday are low this year, which we believe is being influenced by the more obvious slower growth In the Chinese economy and the continuing issue of the country’s strict COVID policies that have been limiting travel, manufacturing, and commerce in general. We expect there will still be a positive spin put on results, but in a more subdued fashion, with more of a nod to rational behavior and less toward the “…we sold 100,000 lipsticks in the first 60 seconds…” On-line retailers are certainly not going to miss a chance to hawk whatever they have to sell, but will be careful not to promote so aggressively that they fall further into the purview of government regulators, or worse, a statement from Chairman Xi.

RSS Feed

RSS Feed