Singles Day is Today

While expectations for the extended holiday (11 days) still call for growth of ~15% this year, that compares to 26% last year, as China’s GDP growth of 4.1% in 3Q was lower than last year’s 3Q growth of 4.9% and lower than 2Q’s 7.9% and inflation is also increasing, with the PPI rising 13.5% y/y last month after a 10.7% increase in September, and the CPI rising 1.5% y/y last month, 2x the rate in September. Many Chinese companies built inventory levels earlier in the year in anticipation of component shortages and rising inflation but have sold out much of that lower cost stock and are now faced with raising prices or facing lower margins.

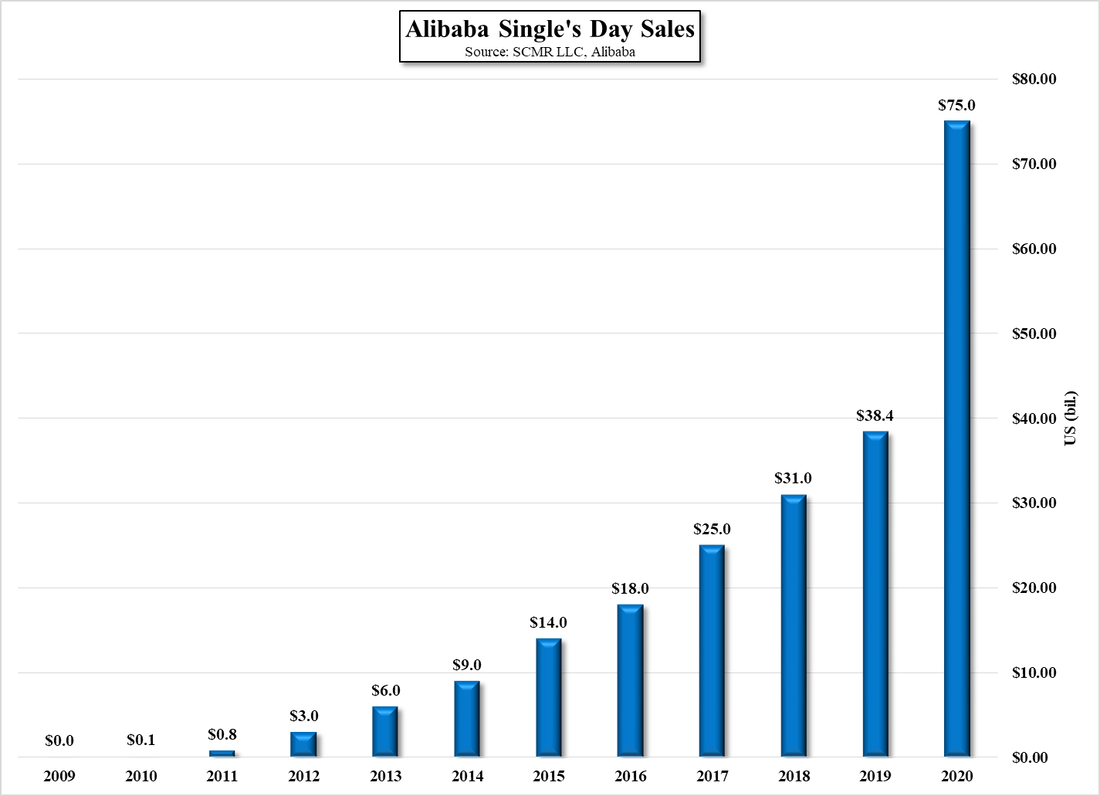

While these are cyclical economic issues that face many businesses globally, the Chinese government has been particularly focused on “common prosperity” or the redistribution of wealth, which has taken the form (among other ways) of increased scrutiny concerning anticompetitive behavior among large on-line businesses. Alibaba saw a $2.8b fine, with others either under investigation or having decided to ‘donate’ billions to government sponsored social programs to join the ‘redistribution’ as President Xi Jinping makes it a ‘priority’. Specific warnings to on-line retailers, such as banning the practice of raising prices before putting them on sale for the holiday, or limiting marketing messages to consumers, have made on-line retailers in China a bit more cautious this year, which could be reflected in a slower holiday growth rate, and companies have been focusing on ‘woke’ promotions and vouchers this year, as opposed to those that are absolute revenue generators. Whether all of these factors make a difference to Chinese consumers or if they are sustainable over time remains to be seen, but its still going to be the globe’s biggest shopping day.

RSS Feed

RSS Feed