Slicing 5G

5G architecture allows both the network bandwidth itself and its services to be ‘sliced’ according to the requirements of the customer, which will allow carriers to provide specific service packages for each customer. This is particularly important for use in manufacturing and logistics where functional network needs vary considerably. In logistics traffic notification requirements require low latency and high reliability, while infotainment would require higher bandwidth but less need for low latency and in manufacturing the ability to move large amounts of tool or process data would be key.

While the above are just examples, the ability of 5G to be sliced gives it a flexibility that was not available in 3G or 4G and the design of 5G itself also allows carriers to automate the slicing process dynamically, meaning the ability to create a ‘slice’ in minutes. So in the case of a traffic accident, a network operator could create a network ‘slice’ for first responders separate from that used by the general public for live streaming to social media, and then close the slice when the accident is cleared. Much of this will be done under SLA’s (Service Level Agreements) that will specify the needs of customers while adjusting to the variabilities of traffic, performance needs, and other variables, and while 5G a more complex architecture than 4G such networks are ‘virtual’ in the sense that they are ultimately programmable, allowing automation to take over once the initial settings are made. This allows for changes to be made easily and cost effectively for the carrier.

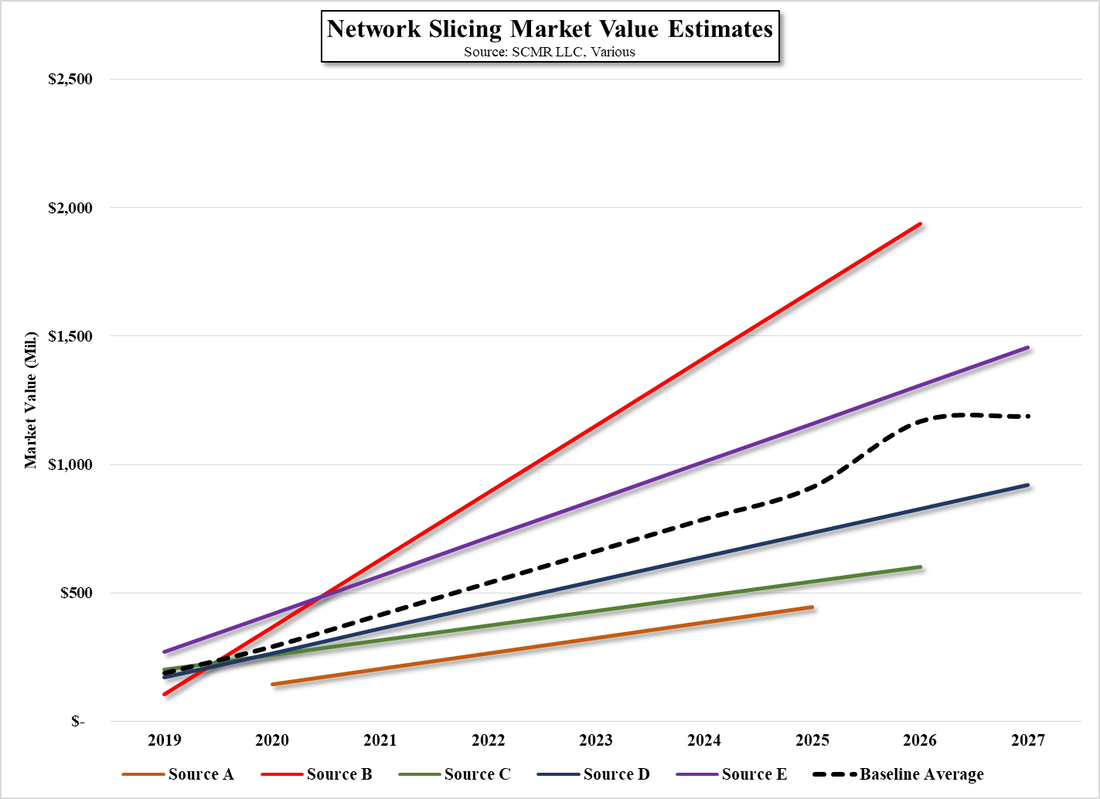

Industry estimates concerning the network slicing market are to say the least, unreliable, as inclusions and exclusions in terms of hardware and services can make a vast difference. Figure 1 shows five estimates for the network slicing market, showing how considerable the variations are between estimates for the 2025 – 2027 periods and even the variability for past periods, such as 2019, where the estimate differences are between $105m and $270m. While we expect to arrive at a more detailed market value for the network slicing market as we can make additional determinations as to what should be included, we have created an ‘baseline average’ from the existing estimates to lessen the effect of outliers. The baseline average sets 2019 at $187m and 2027 at $1.189b with a CAGR of 22.8% for the network slicing market.

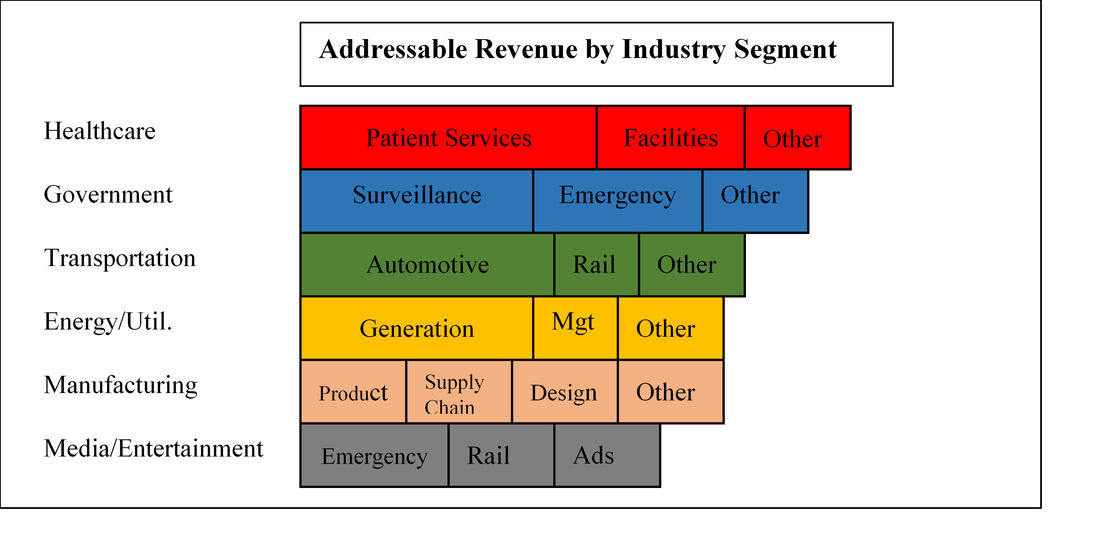

A study done by Arthur D Little looking at more than 400 digital use cases in 78 industries indicated that six of those industries would have 90% of revenue potential addressable for network slicing and that one or two use cases would account for much of the revenue in each industry. This gives carriers a better understanding of where to focus their attention, with the total revenue potential for these six industries ~$180b out of a ~$200b potential market. Figure 2 shows the relative breakout by industry and sub-segment for each of the top six. While we expect there is some question as to how the potential revenue for each segment is determined, it does show which segments and industries have the most potential for generating network slicing revenue.

All in, the network slicing market is growing as 5G rollouts continue, represents a key source of service revenue for carriers and is almost completely hardware agnostic, allowing network slicing systems to allocate network services using AI and predictive algorithms while still meeting SLA requirements. Carriers and network operators can oversee the networks and make ad hoc changes but the cost of changes and short-term requests or allocations would be low relative to private networks or ‘one size fits all’ 4G provisioning, and initial SLAs could be easily tailored to the specific needs of each customer without building a ‘network’ for those specific prerequisites. While network slicing will not be something that shows up in headlines as 5G service expands, we expect businesses, network operators, and carriers will be focused on ways in which they can offset the cost of building out 5G service to mobile customers by using network slicing to create new types of SLAs and use applications scenarios for their business customers.

RSS Feed

RSS Feed