SMIC & Samsung

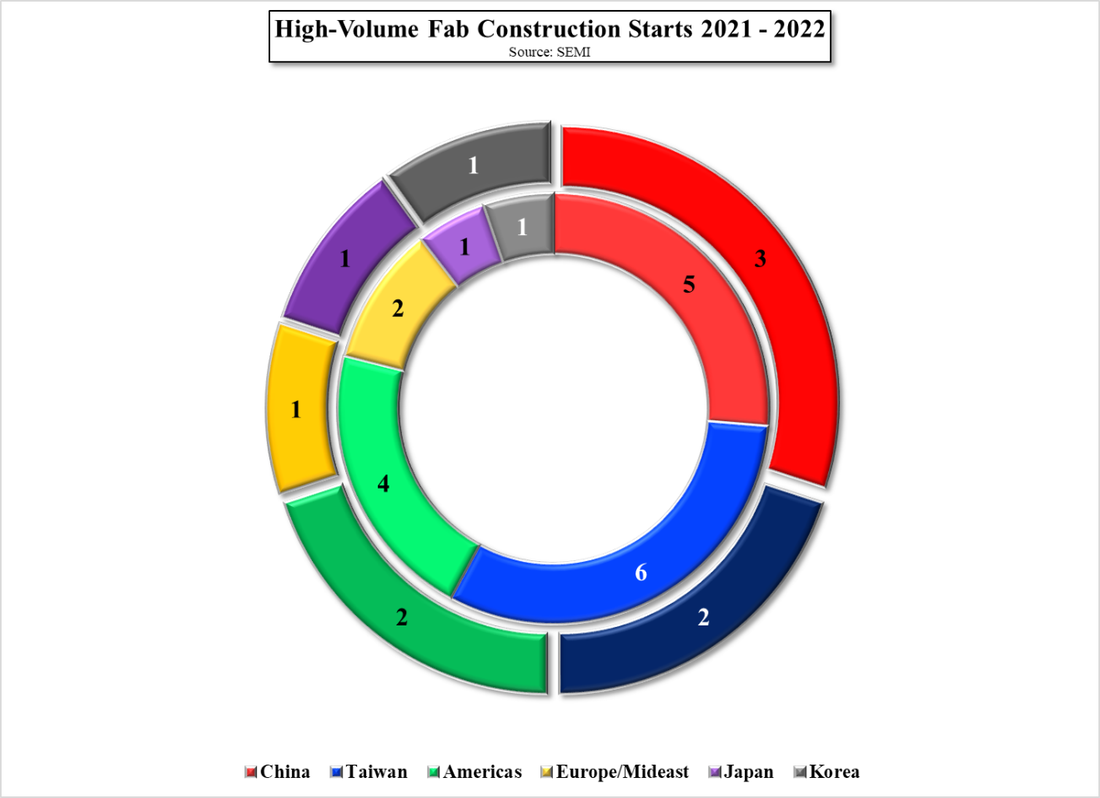

At the end of June, according to SEMI, 19 high volume fabs will have started new construction before the end of the year and another 10 in 2022. 15 of the 29 fabs (excluding SMIC) will be foundries, with the largest producing ~220,000 wpm (200mm equivalents). 22 of the 29 fabs will be 300mm lines, with the rest between 100mm and 200mm. The combined output of the 29 fabs is expected to be ~2.6m wafers/month[1] and spending for 300mm fabs in 2022 is expected to reach $17b, an all-time high, but will outpace 300mm wafer production if no additional wafer capacity is announced this year. Hopefully new chip production capacity will not outpace demand in 2023 – 2024, but if wafer capacity expansion does not match capacity, it will be a moot point.

[1] 200mm equivalents

RSS Feed

RSS Feed