Sold

In 2020 Ichigo (2337.JP), a REIT and asset manager, took over the reins at JDI and has been trying to reshape the company into a profitable entity. It has not been an easy task given the intense competition in the display space and the older LCD fabs that have been part of the company culture. Ichigo has been selling underused assets and consolidating facilities while developing new technologies, particularly a photolithography-based OLED deposition technology called eLEAP, but the INCJ has, after 13 years finally sold its last remaining shares in JDI, ending its participation in the company’s development.

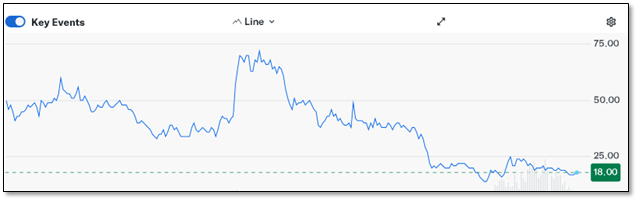

The INCJ had invested ¥462 billion ($3.08 billion US) in Japan Display over the years and has announced that it has recovered ~66% of that investment (¥ 307.3 billion or $2.050 billion US) through stock sales in recent months, with a loss on the project of ¥154.7 billion ($1.03 billion US), for which the chairman of INCJ apologized in a public statement. This leaves Japan Display in the hands of Ichigo and its public shareholders, who have not been a happy lot over the last five years. We do give Ichigo chairman (and JDI CEO) Scott Callon credit for taking the many steps necessary to try to right a ship that was poorly managed for many years. Hopefully the company will reach its goal of a return to profitability next year.

RSS Feed

RSS Feed