Stacking Up

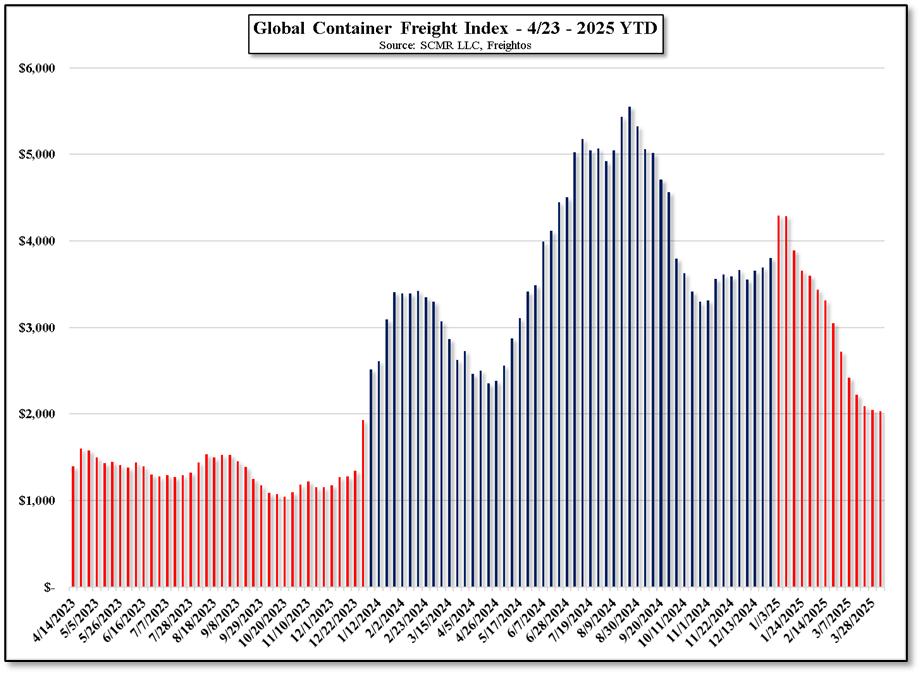

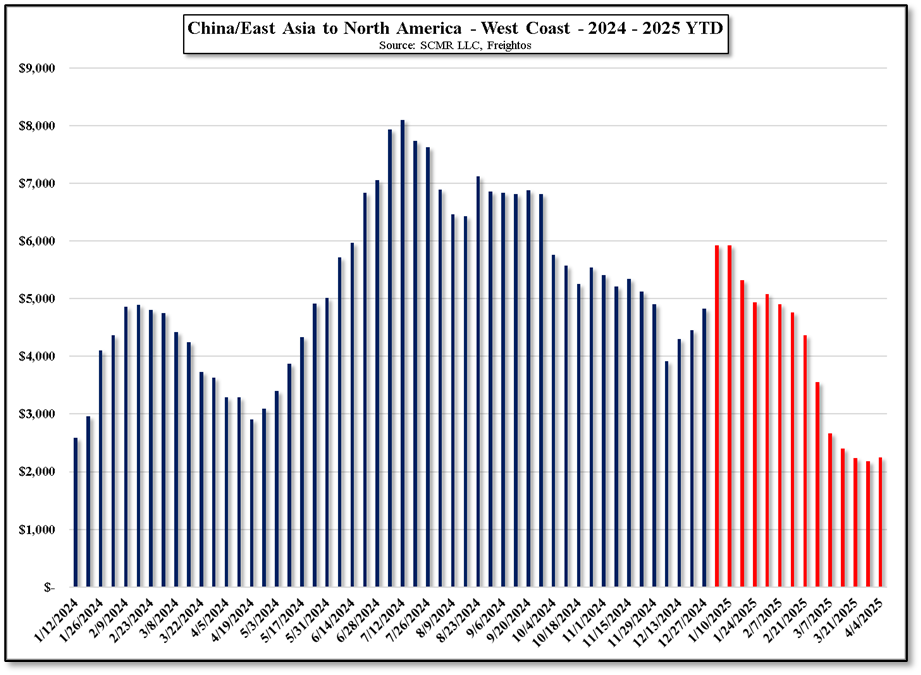

Now, with the tariffs in place and plenty of inventory sitting in containers and warehouses, shippers have little incentive to be aggressive and the charts below point to that fact. March container price (index) dropped 24.6% and is now down 46.6% for the year, even with the recent US/Houthi escalation, while the China route index is down 53.5% YTD after a 38.5% drop in March. We expect April (down ~1% in week 1) to drift lower unless the tariff situation escalates or abates, but there is also the chance that the fear of a global tariff-related recession begins to worry manufacturers as it seems to be doing to consumers.

With inventory already in the States, it will take some time for higher prices on CE products to surface, perhaps giving a false sense of hope to economists and prognosticators, with some CE products likely having benefitted from the push to buy before the new tariffs hit, but as consumers see a year’s worth of 401-k profits vaporize, we expect they will not only be a bit more careful about spending, but will see the inevitable price increases as a further hindrance to new purchases.

As we are heading into the slow shipping season, the likelihood of container shipping prices moving up in 2Q are small and seem to be getting smaller, so the question then becomes whether we can hold the levels seen in the charts below or do they crack before the end of 2Q?. Right now we favor little change, but things seem to change on a daily basis.

RSS Feed

RSS Feed