Steady As She Goes?

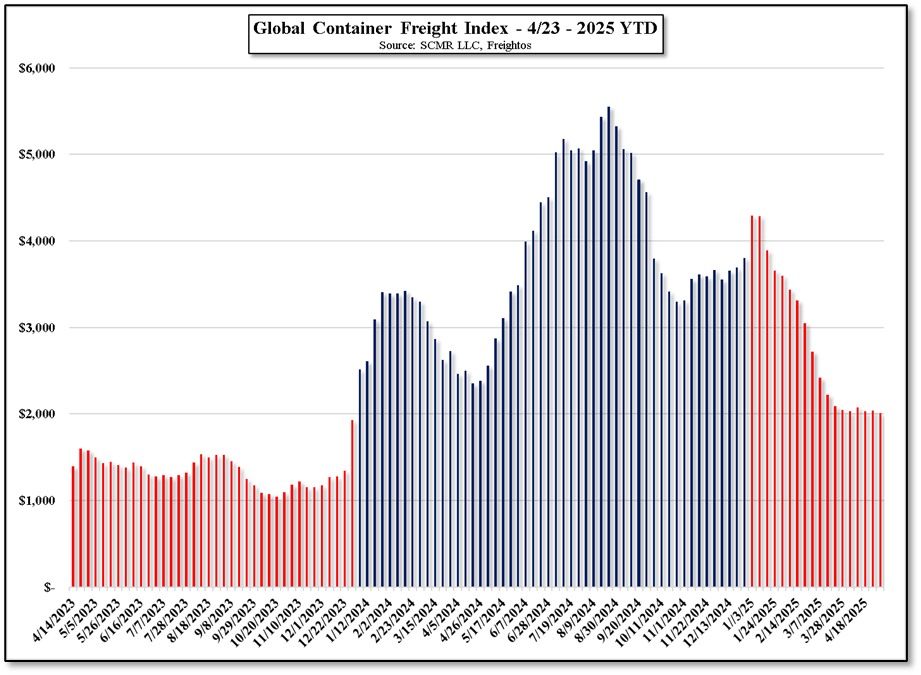

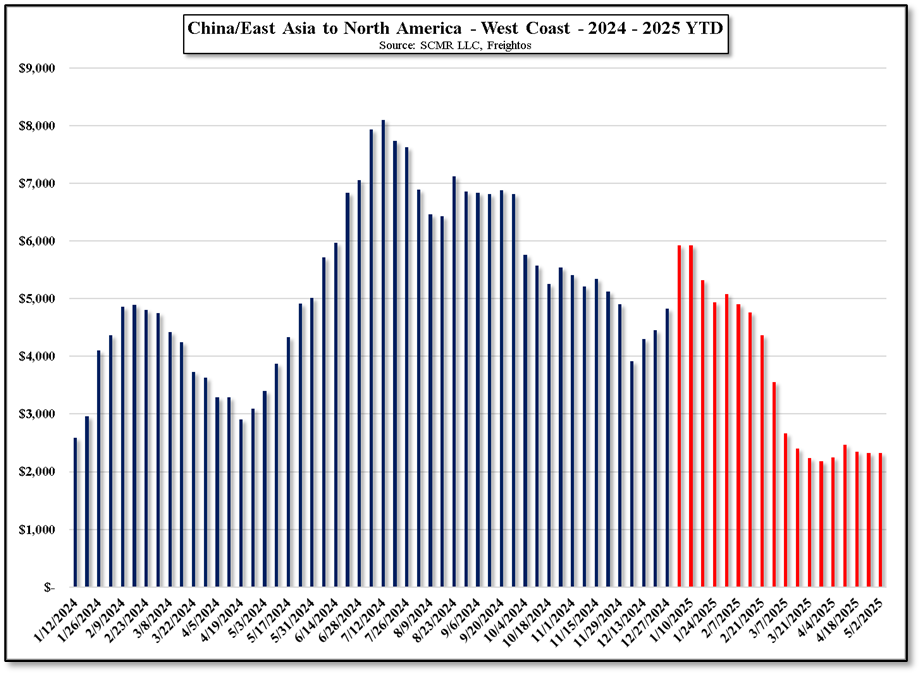

Container rates generally have been flat over the last few weeks, certainly lower than this time last year (China/East Asia to US West Coast rates are down 31.8% y/y) but still higher than pre-Red Sea crisis rates. With considerable talk about Chinese shipping cancellations one might expect rates to drop further, but some retailers are making the bet that if they schedule a shipment from China now, by the time it is loaded and shipped, the US/China tariff situation will be settled, and that has kept rates from falling further. As many CE companies pulled in shipments to fill warehouses in the US, the panic that bare shelves might incite has yet to begin, but those willing to bet on a quick settlement will also be the first to restock shelves even if no deal is reached, albeit at a much higher price.

That bet also has other implications. If they are correct and the US and China settle their trade differences quickly, there will be a snapback in shipping, likely leading to a short-term rise in container prices as capacity is constrained. Ports would likely see considerable congestion with shippers desperate to offload and get ships back to China to get as much low tariff product to the US before anything else changes. But more likely, negotiations will be drawn out and an eventual interim solution will be reached, which China will honor for a short while and the administration will use as a victory lap.

We note that in January 2020, President Trump signed the “Phase One” trade agreement with China. The agreement was made on the promise that China would purchase an additional $200b in US goods and services over the 2020 – 2021 period. According to US data, they purchased only 58% of the total committed amount, which gave President Biden the justification to continue to apply trade pressure. While the Trump administration will likely use any agreement as an ‘all good’ sign and back off excessive tariffs, we expect that China will do its best to buy only what it needs over the remaining time the current administration is in power.

While this is certainly one scenario, China, as an authoritarian one party state, is less influenced by popular opinion, and at least from the outside, does not seem to be facing much opposition to the tariffs that it has put on US goods. We expect US consumers will be less forgiving if a trade deal is not quickly reached, especially as 3Q winds down and the holidays approach, carrying much higher prices. This makes us believe that an agreement will be reached quickly once negotiations start, and those willing to make the current shipping bet will come out ahead, sort of..

RSS Feed

RSS Feed