Supply/Demand

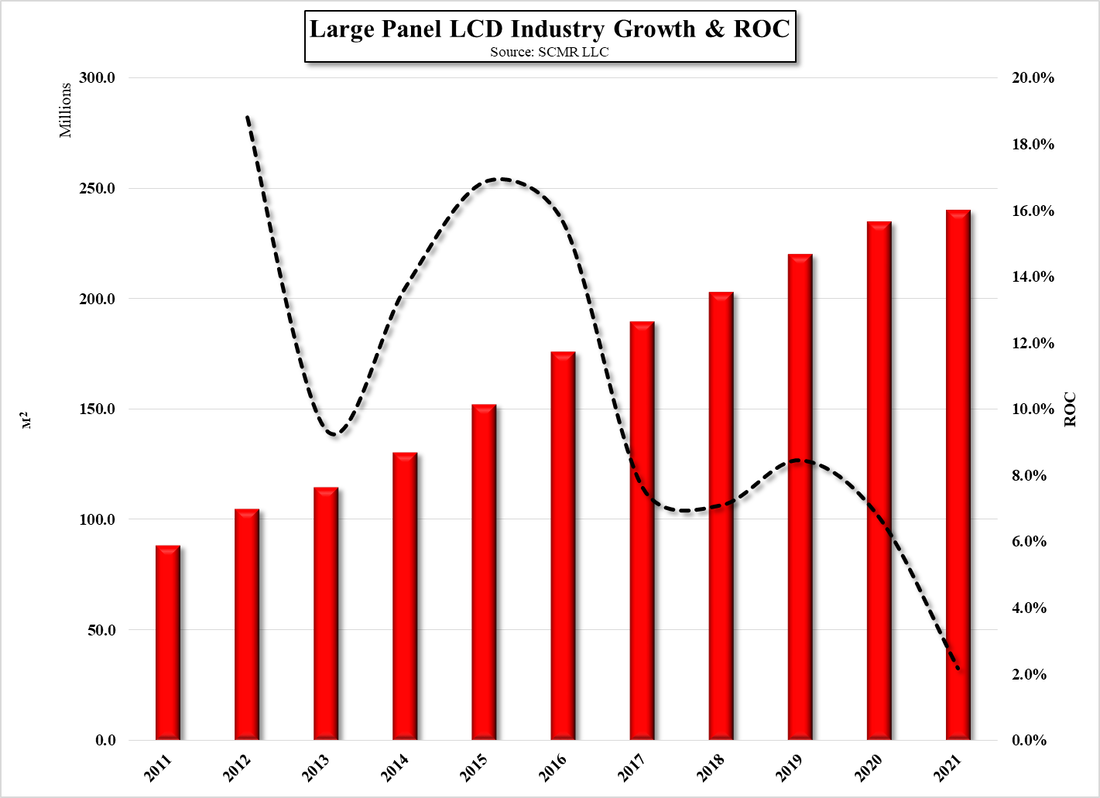

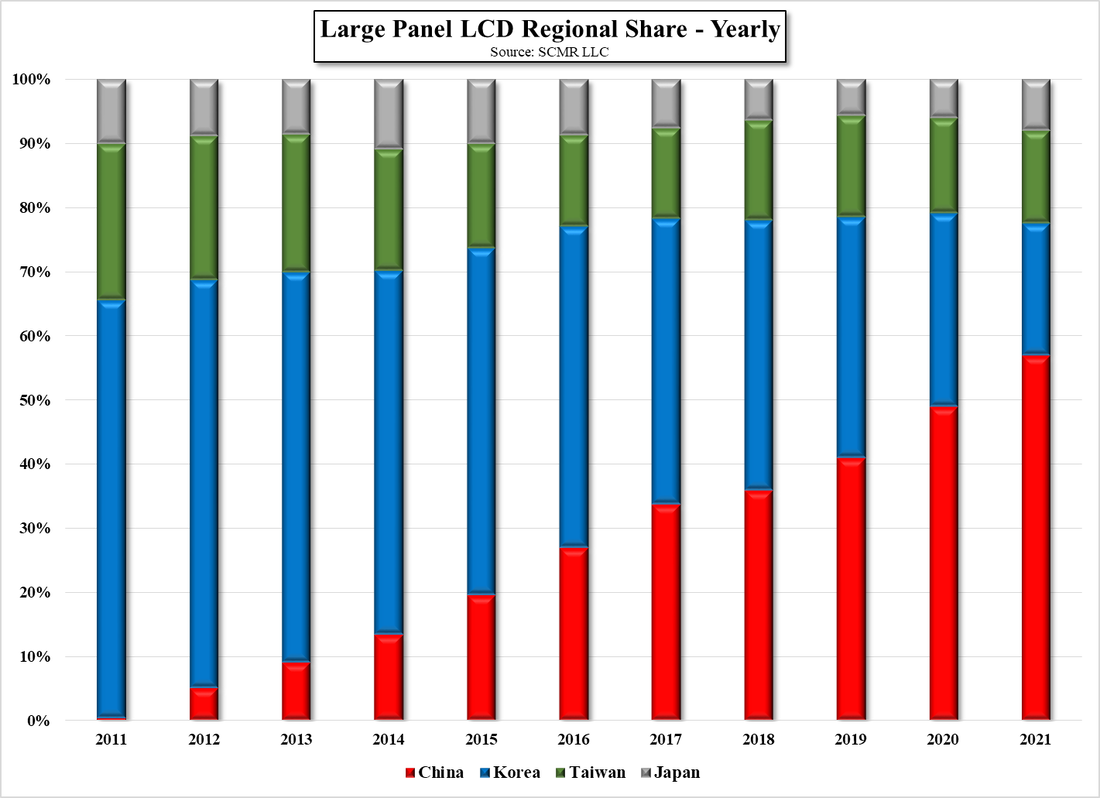

Before COVID-19 became global large panel prices had been in decline, and both Samsung Display (pvt) and LG Display (LPL) the two large panel producers in South Korea, had been making plans to reduce or completely end large panel LCD production. Not only was this a function of large panel pricing which put many panel producers in loss mode, but was also a function of the increasing competition from Chinese Large Panel LCD producers, who had been adding capacity for a number of years and through construction and operating subsidies, were able to produce commodity LCD panels competitively.

As the COVID-19 pandemic both reduced worker availability and increased demand for certain large panel products, the large panel market tightened and panel producers began to see profitability. This changed their outlook, and Chinese capacity expansion plans that had been put on hold began again. At the same time, both Samsung and LG reevaluated their plans for reducing their large panel LCD capacity, given a more profitable outlook, and most of those plans, which would have been implemented at or near the end of last year have been postponed.

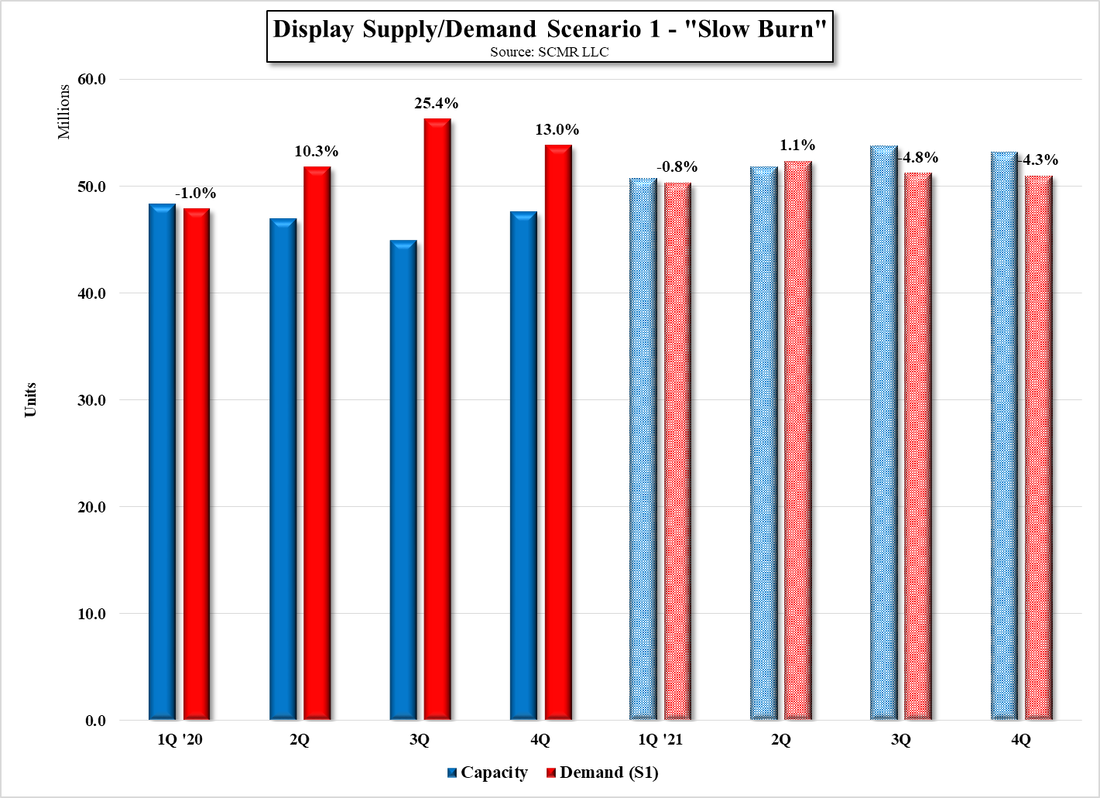

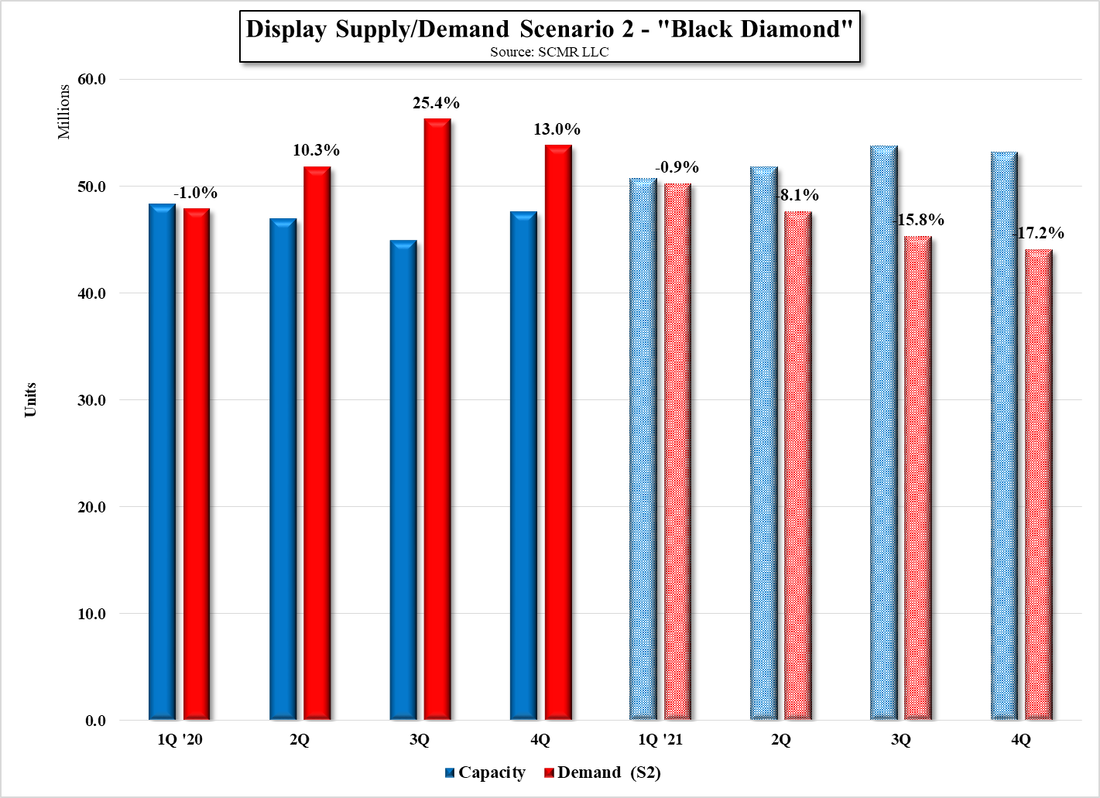

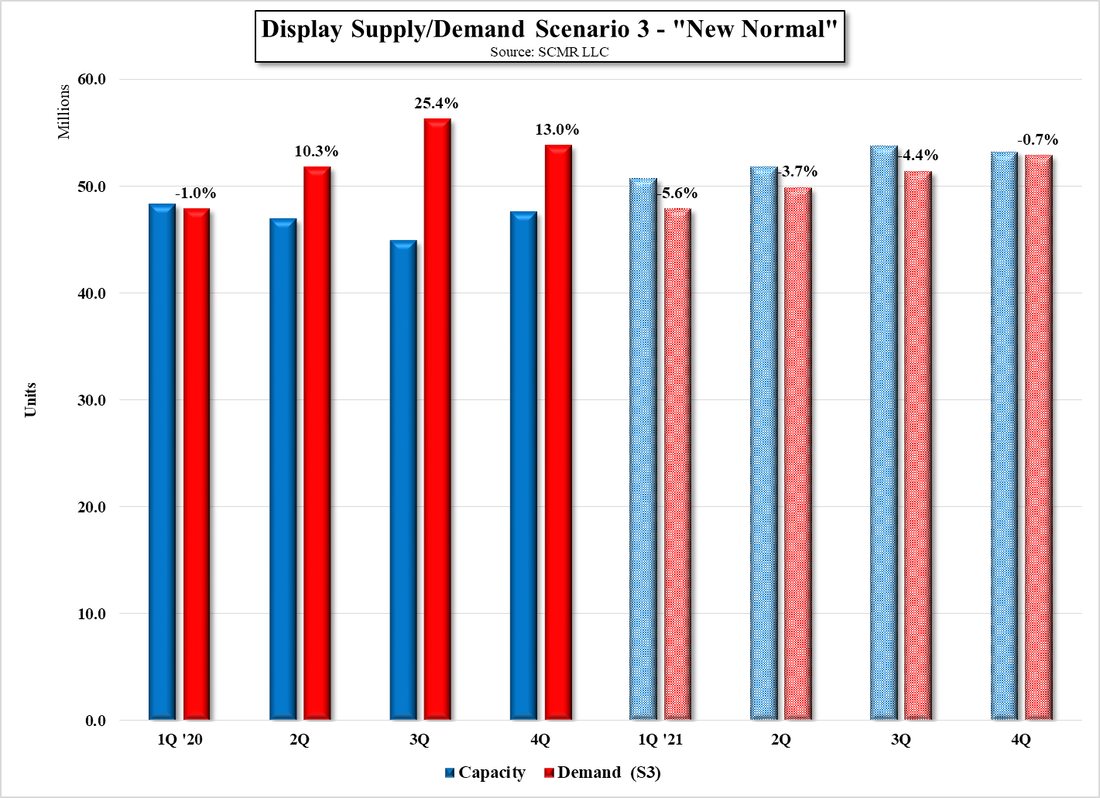

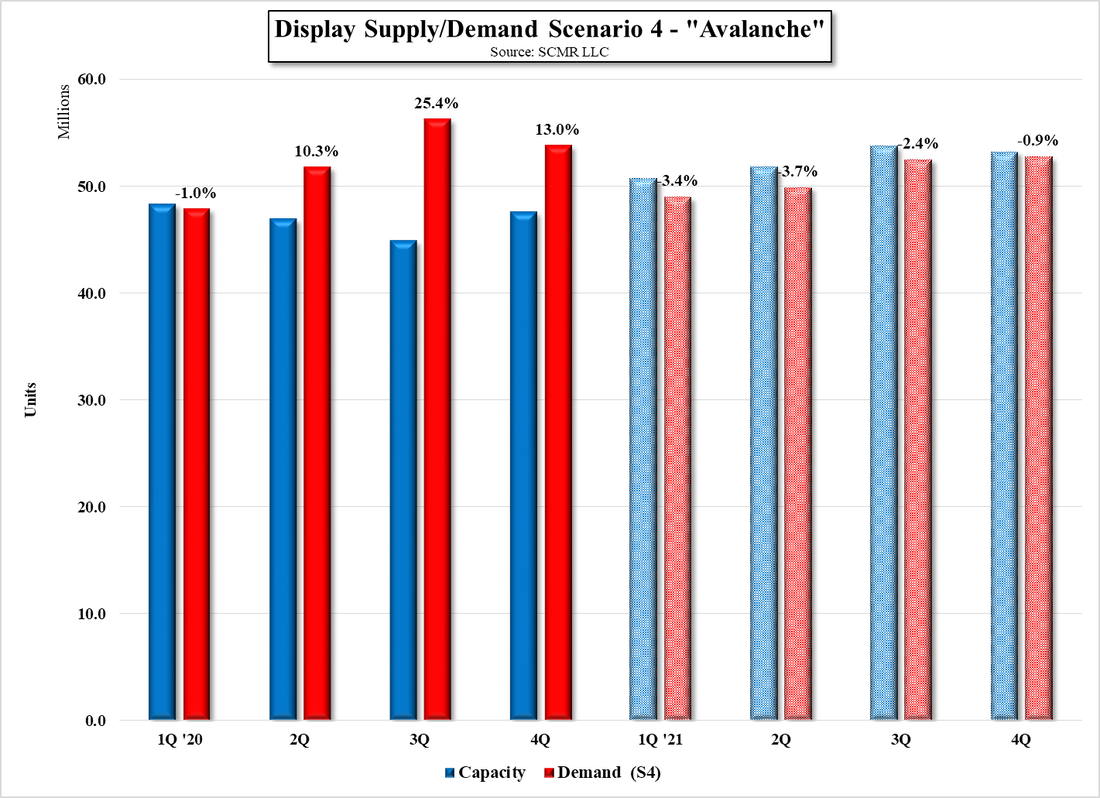

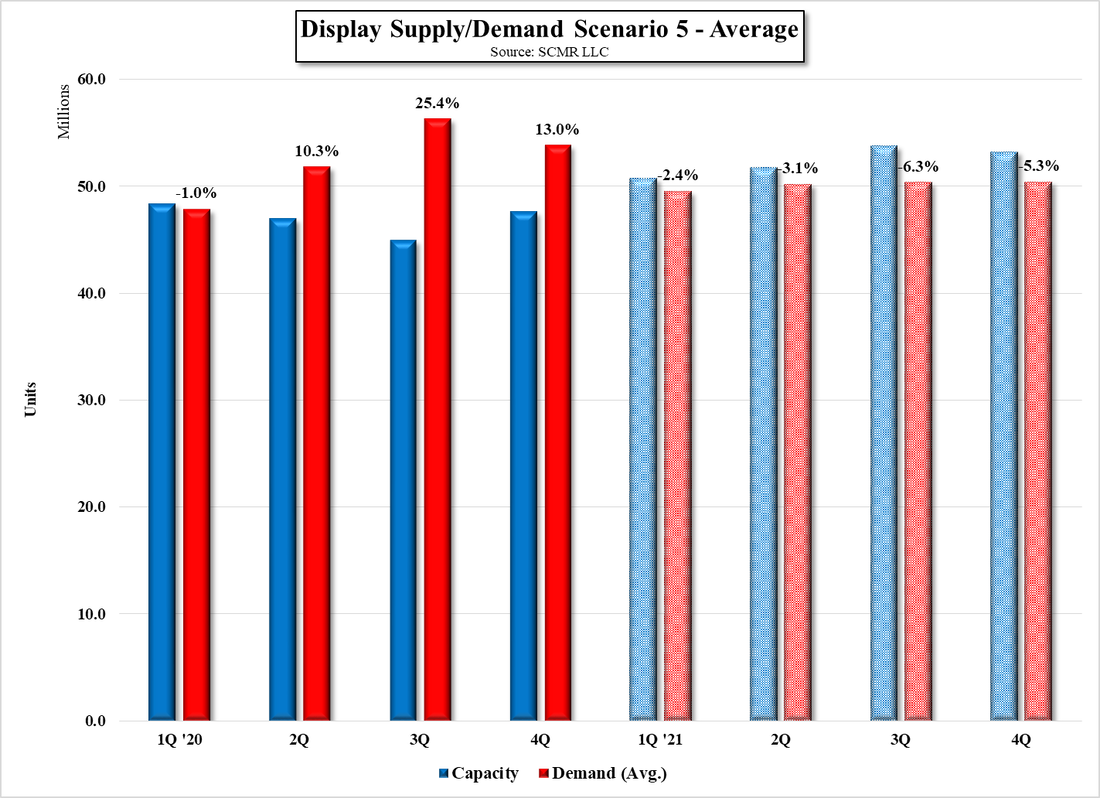

Postponed might not be the proper word here, as we suspect both Samsung and LG will reinstitute those large panel LCD capacity reduction plans at the first sign of a change in large panel price direction, given that the competition from China remains the same or has increased, so while speculation that such plans by Korean large panel LCD producers have been extended through 2021, we believe those plans could change in a heartbeat. At this poi9nt in the year we have little choice but to make certain capacity assumptions for all producers based on current circumstances, but as we did on the demand side, there are a number of possible scenarios for capacity, based on the global COVID-19 pandemic and how it has and could continue to change our lifestyle. Rather than do what would be some very complex calculations, we have chosen to lock in a capacity scenario at this time in order to plot the industry outcome against the scenarios we created previously. Hopefully we will be able to set up an ‘if…then’ set for all 16 possible supply/demand scenarios at a later date, but for now we use the capacity data indicated below.

In the “Slow Burn” scenario, after a year (2020) where demand outstripped supply in three of four quarters, oversupply levels off and at its worst sees ~4.3% of yielded overcapacity, which would likely see panel prices stable or declining. Again we note that each of these demand is plotted against t same supply model.

RSS Feed

RSS Feed