Tablets – A Way to Go?

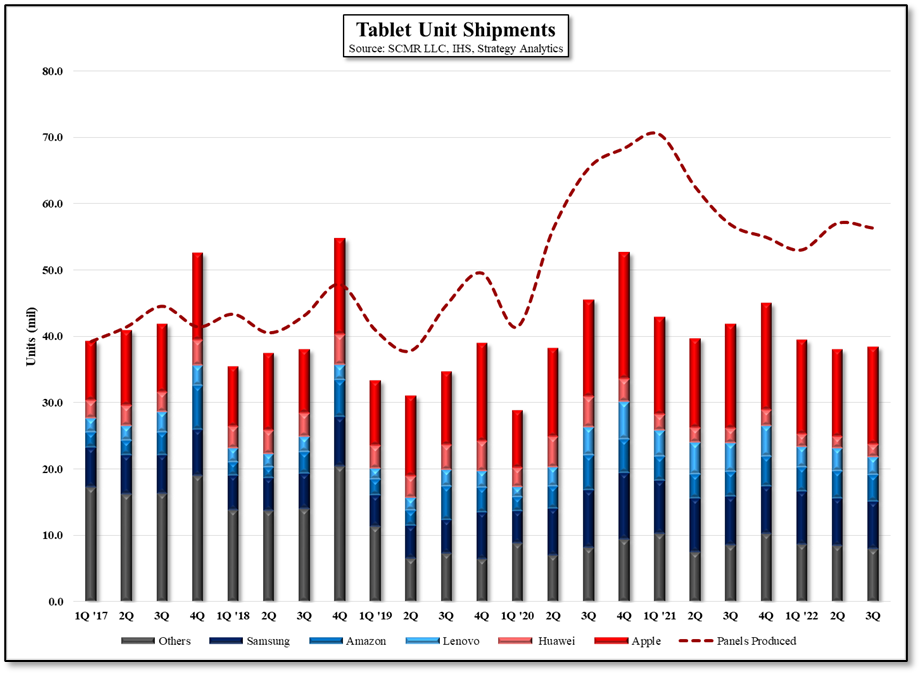

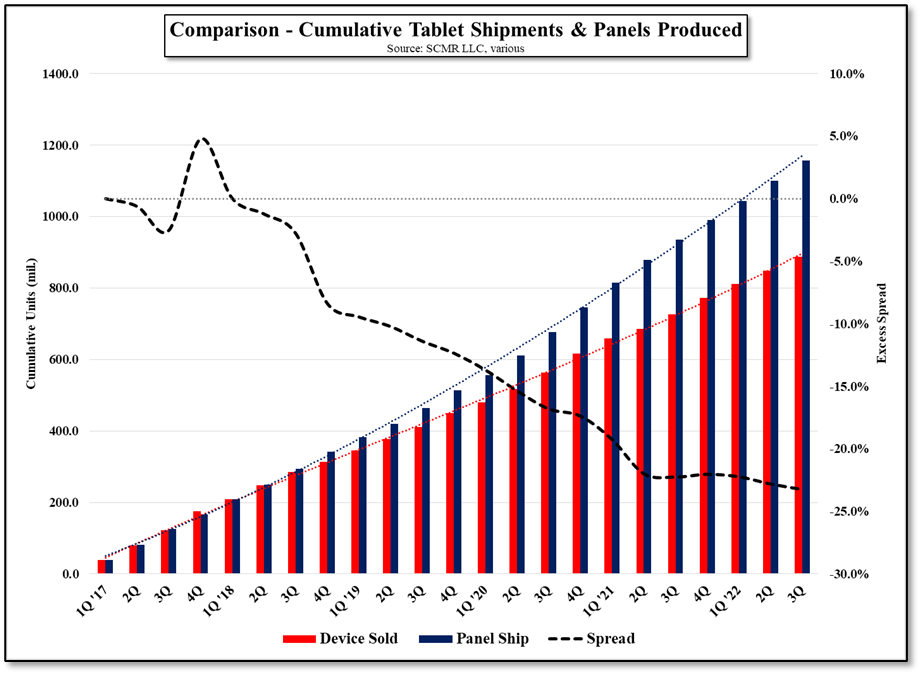

Does this mean tablets have found a new ‘normal’ level, or are they just returning to pre-pandemic levels more slowly than other CE categories? Unfortunately we believe the later based on Figure 3 & Figure 4. Figure 3 shows quarterly tablets shipped by brand and the quarterly number of panel produced. We note that we zeroed the panel production numbers to shipment numbers in 1Q ’17 to show the difference between tablet shipments and tablet panel production, so there are no panel units shown in Figure 3. However in Figure 4 we show cumulative tablet shipments and cumulative tablet panel shipments, along with the spread between the two.

Figure 4 indicates that tablet panel shipments were relatively closely matched to tablet device shipments until the 4th quarter of 2018, when increasing tablet shipments more than offset tablet panels produced, leaving tablet brand buyers unable to meet quotas. Given that this was an untenable situation for tablet brands, panel producers began to step up production, building to both their own and brand inventory. This increasing level of tablet panel production continued through much of the pandemic, with the spread leveling off between ~22% and 23% as tablet sales began to slow last year.

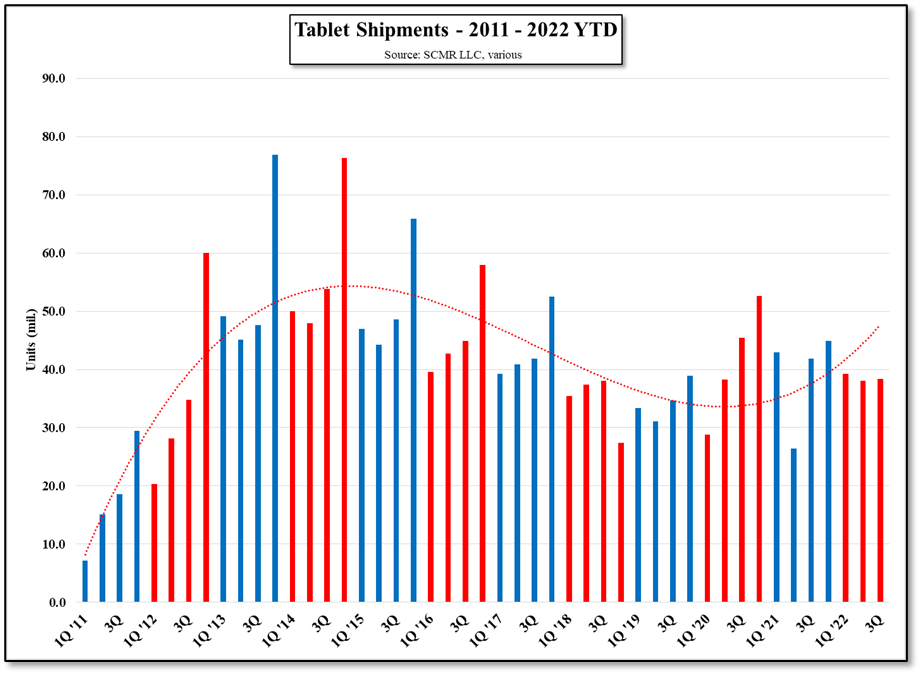

This would suppose that in order for tablets to return to a more steady growth pattern, brands need to reduce inventory levels, reducing the spread between shipments and panel production, while panel producers could lower tablet panel production further, with both parties working toward a more JIT supply chain that will reduce the spread and carrying costs. But this is a lot to ask an industry that has relatively little visibility and is quite sensitive to macro events, which leads us to believe that the slow return to pre-pandemic levels for tablet shipments will continue into 2023, with the typical positive bumps from yearly new model iPad launches that occur in the 4th quarter. Hopefully the long-term trend line curve seen in Figure 2 will pan out to be a harbinger of a more rational tablet market, but we expect more of the same for the next few quarters.

RSS Feed

RSS Feed