Taiwan April Panel Sales & Shipments

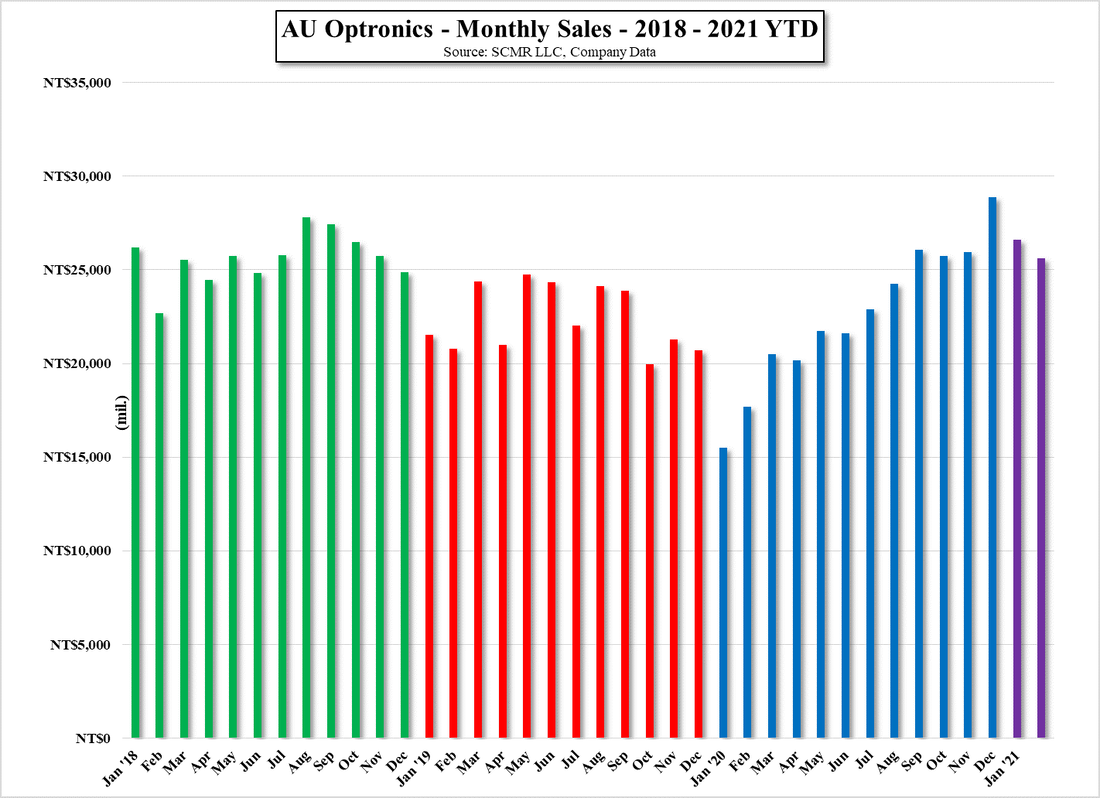

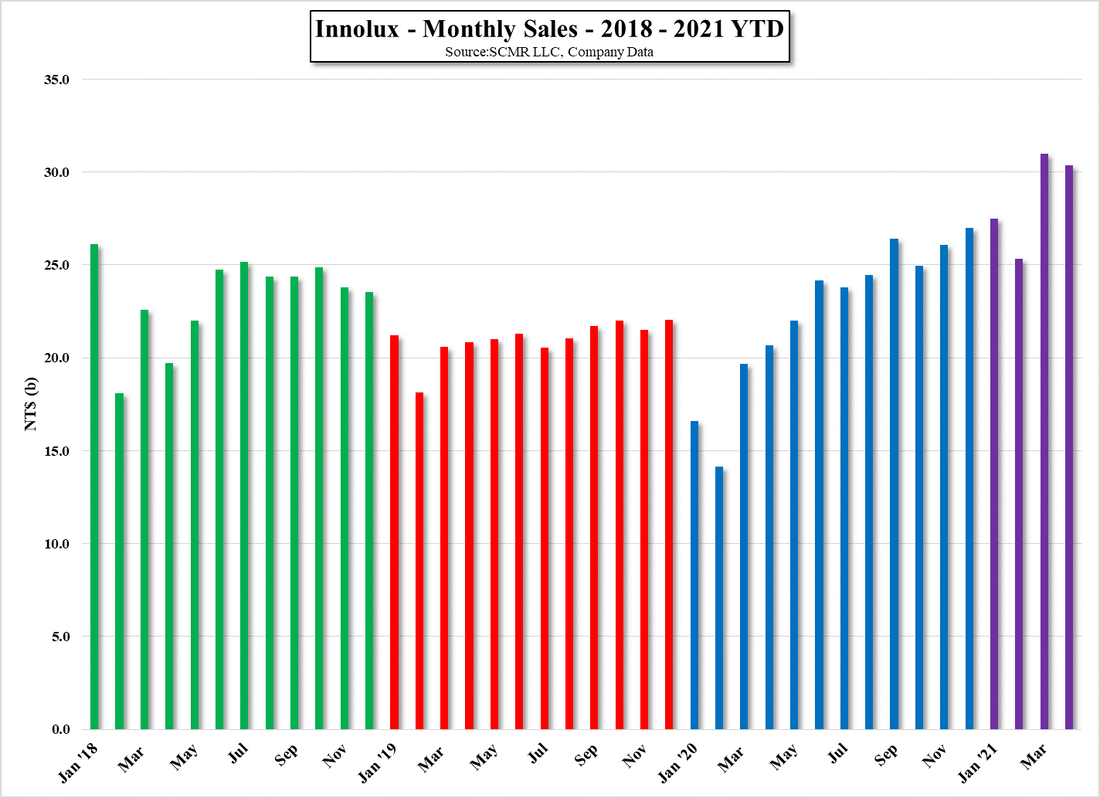

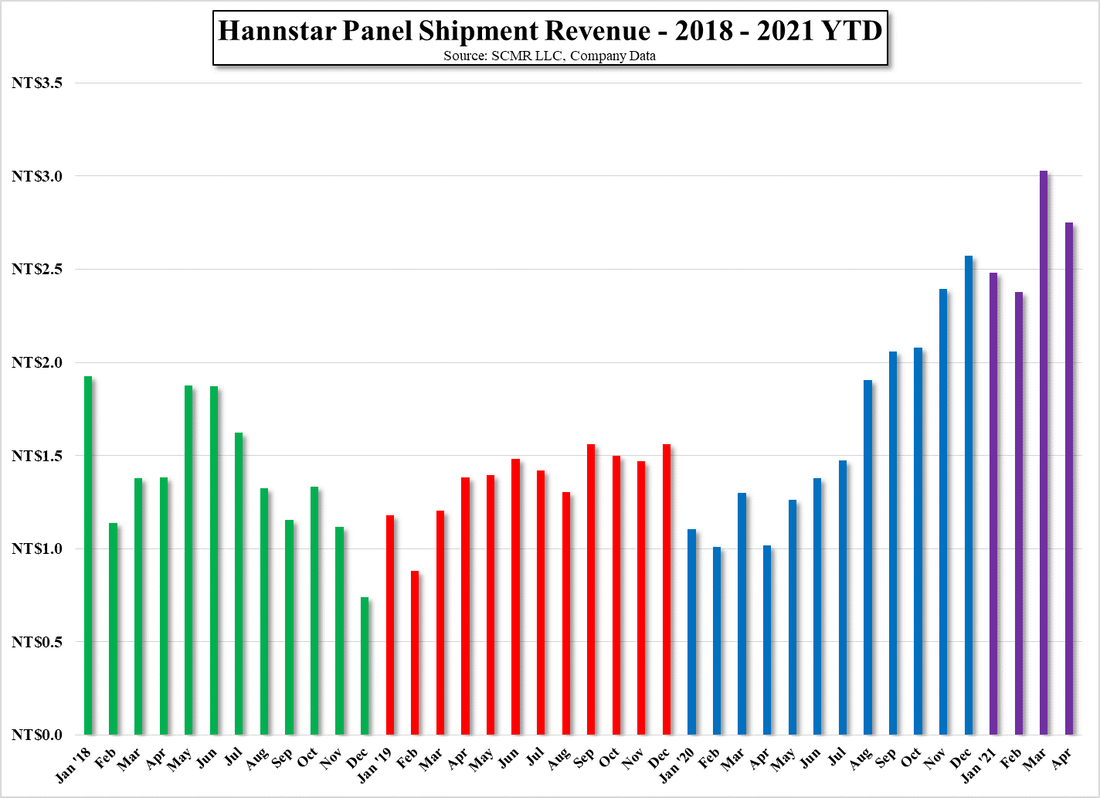

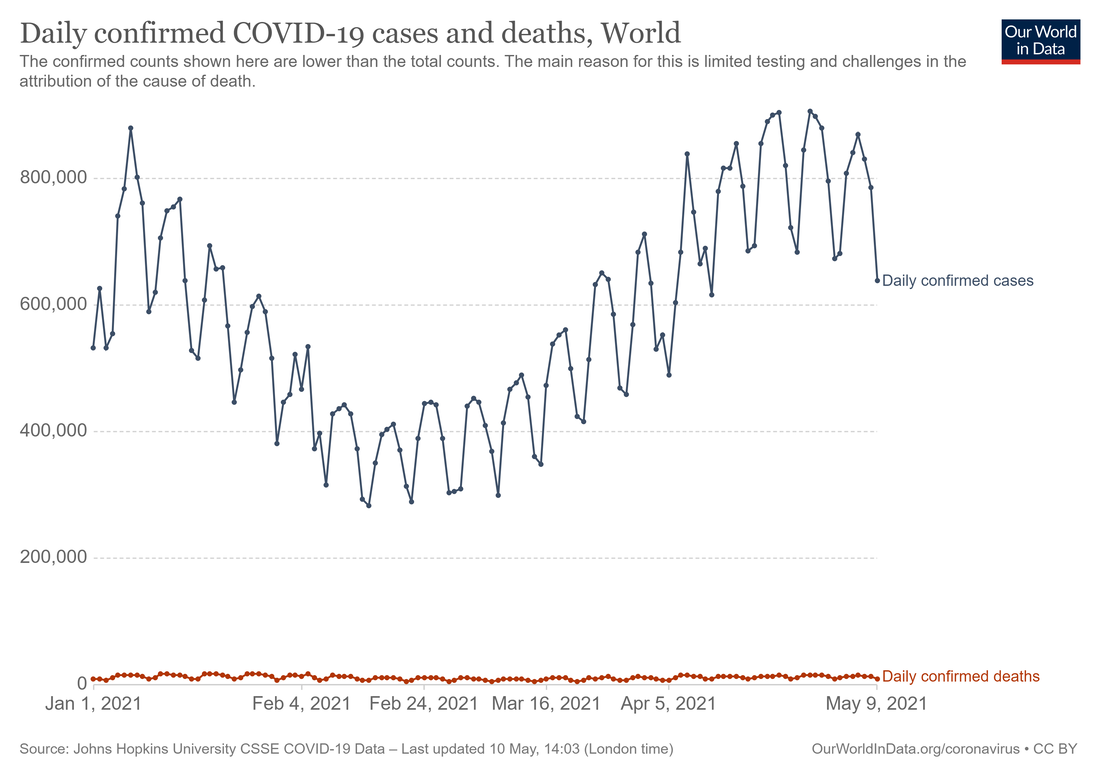

At least for now, component shortages will cap out unit volume, with overall sales dependent on panel price increases, and AUO pulling down some production for yearly maintenance. As a result of the shortages, we expect panel prices will continue to rise, offsetting lower panel volume, at least for the next month or two, but the reduced COVID-19 infection and hospitalization rates in North America and a number of other key CE markets could help to relax global stay-at-home demand during the summer months. While there are a number of wild card countries still facing major COVID-19 outbreaks, the overall global infection and death rate has been almost flat since the beginning of the year.

RSS Feed

RSS Feed