Taiwan May Panel Sales

That said, panel production and pricing is not a perfect indicator but more incremental data in our quest for understanding the current and future state of the CE space. On a long-term basis, panel production is far better at predicting or anticipating CE trends, but many of us have the pressure of making shorter term judgements, and so we present both short and long-term data whenever possible. Panel producers in Taiwan have an exceptional characteristic in that they are required to report monthly sales, which helps to spot trends that can be muted when reporting sales on a quarterly basis, which is why we present such data.

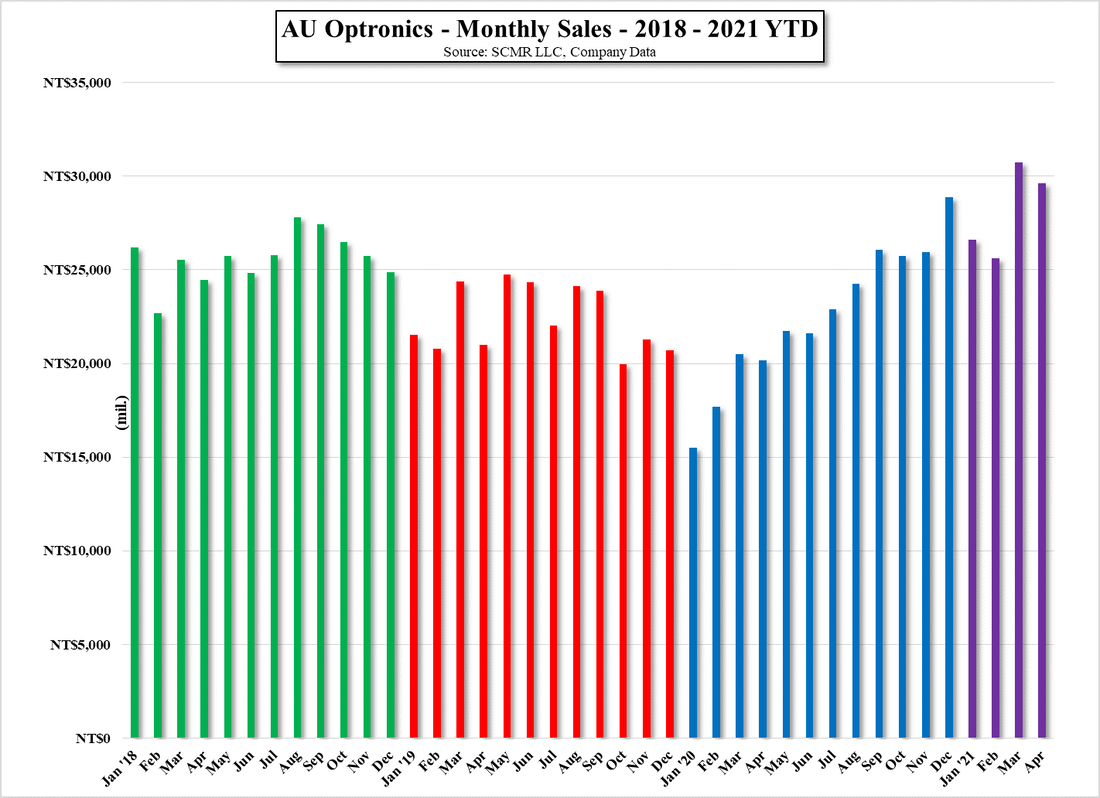

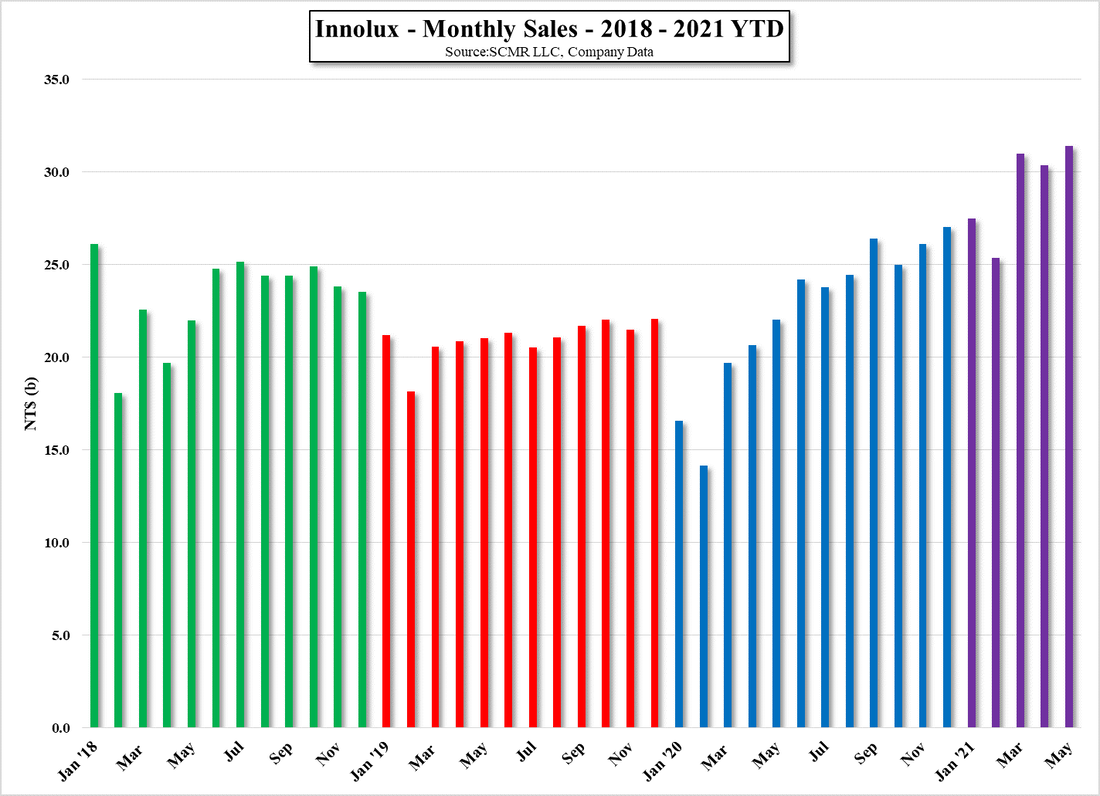

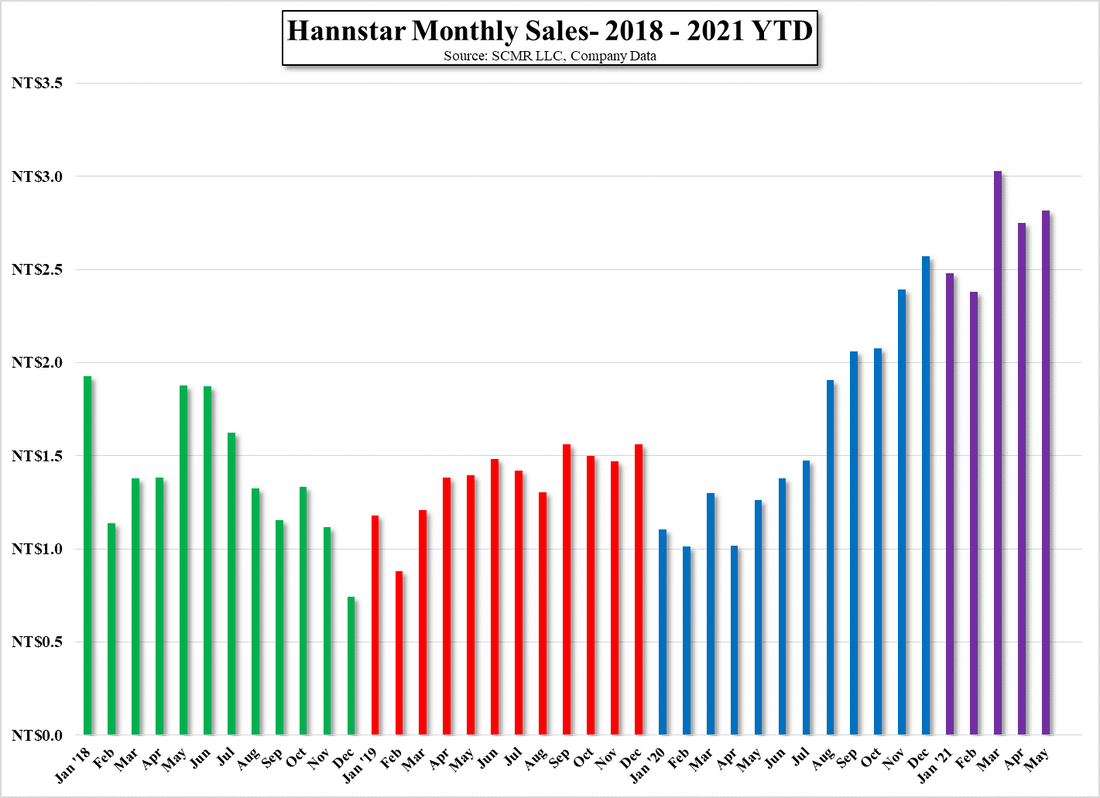

All three Taiwanese panel producers saw a m/m increase in panel sales, and given the weakness seen across much of the CE space in 1H last year, all three were up substantially on a y/y basis, as they have been for since roughly a year ago. AU Optronics (AUOTY) saw the largest m/m increase of 8.5%, followed by Innolux (3481.TT), up 3.4%, and Hannstar (6116.TT), which is really a small panel producer, up 2.4%. With large panel prices up between 3.5% and 5.8% in May, one could draw the conclusion that much of those sales increases were driven by panel price increases, but more likely they were driven by mix shifts and available capacity, which have a greater influence on monthly sales than panel prices, given that short-term production contracts tend to lock in a price throughout the production run.

We do note that, while AUO no longer gives small panel and large panel shipment data, both Innolux and Hannstar saw a decline in small panel shipments, which was likely affected also by the flat small panel pricing seen in May. The panel pricing trend for small panels has been far less volatile this year than large panel prices, up only 5% YTD, so it reflects a more accurate picture of demand for that segment, and we note that for Hannstar, whose primary business is small panel production, small panel shipments are down 4.4% YTD on a y/y basis, singling out the difference between stronger performance for large panel products and weak performance for small panel products.

Again, this is short-term data and limited to Taiwan based panel producers, but the performance of small panel production and pricing is far more normal and becoming predictable once again, while large panel shipments, pricing, and sales are still reflecting the changes to consumer habits as a result of the COVID-19 pandemic. While large and small panel categories have different characteristics, those who say that the current trends in large panel shipments, pricing, and sales are the new ‘normal’, should look to small panel metrics as to what they might look like once the global effects of the pandemic are assuaged.

RSS Feed

RSS Feed