Taiwan Panel Producers – November

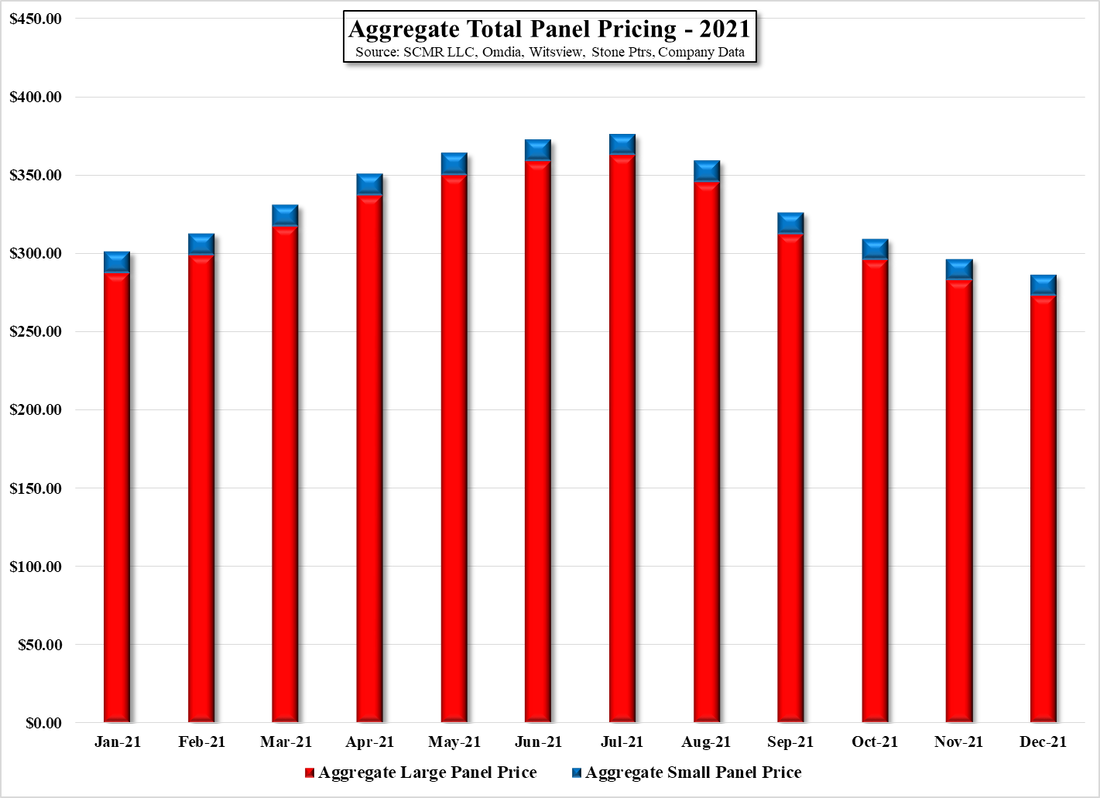

With declining sales across the panel space each month since August, some bounce could be expected but we presume that the general trend of declining large panel prices and weakening IT panel prices continues, although year-end orders might obscure that trend a bit. December tends to be a volatile month for panel producers, with the 5 year average being down 2.5%, but 2020 saw a 3.3% industry sales gain in December after many years of December monthly declines, so our faith in the averages is a bit diminished.

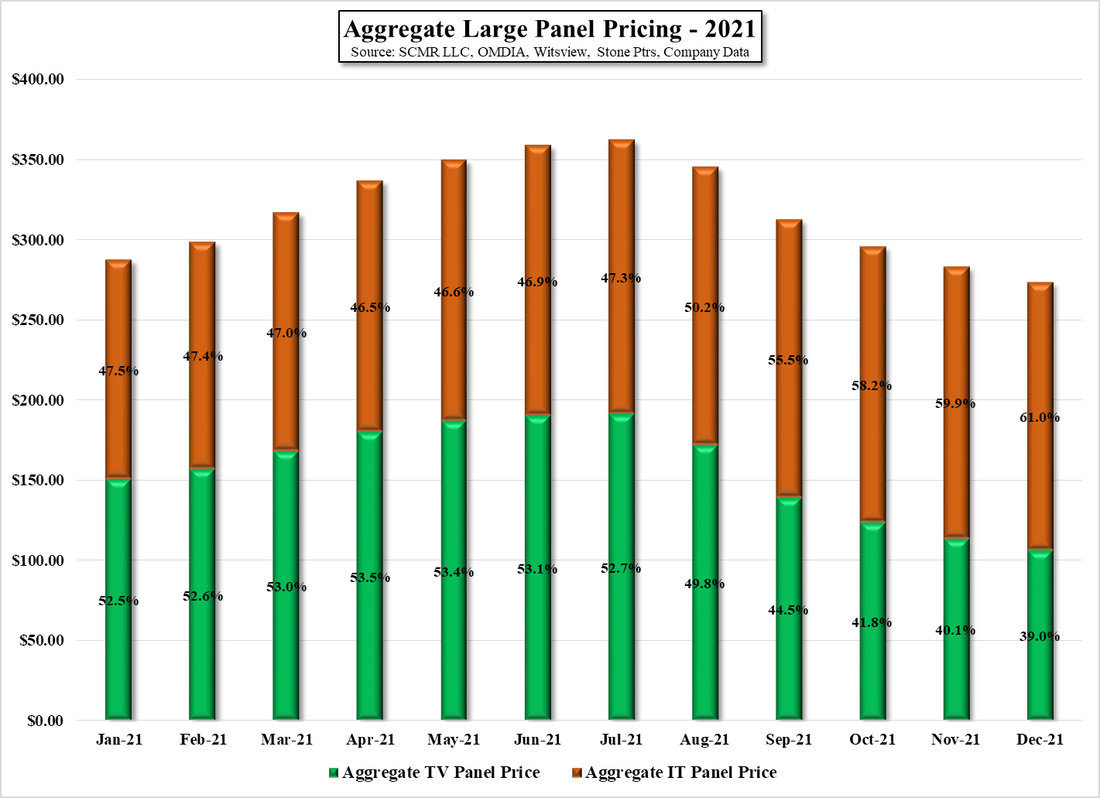

That said, assuming a flat December, AUO’s full year sales will be up 36.5%, with 48.3% of sales in 1H and 51.7% of sales in 2H, not far from the 5 year average split of 47.9% and 52.1%. As TV panel prices have fallen faster than IT panel prices, AUO’s shift away from TV panel production and more toward IT panel production has helped to stave off the effects of the rapid TV panel price declines. While we certainly give management the credit for such foresight, we expect some of that transition was also a result of the increasing pressure on AUO’s TV panel business from Chinese suppliers, who have continued to add capacity and dominate the space in terms of unit volume.

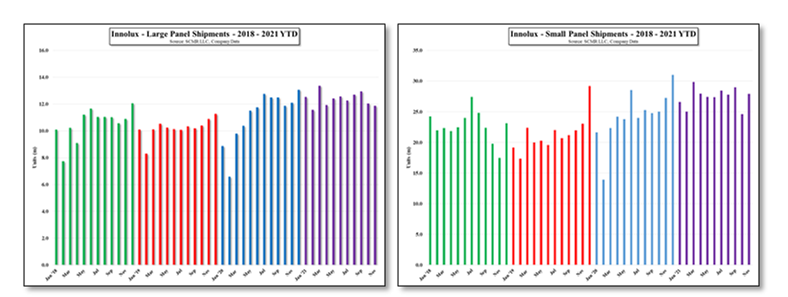

Innolux has been a bit more oriented toward large panel production, which has affected 2H sales a bit more than AUO. 2H share of the full year sales total was 49.4% vs. Innolux’s 5 year average of 53.1%, showing the effects of the more pronounced drop in TV panel prices in 2H. The full year for Innolux was still up 29.71% (assuming a flat December) but monthly y/y comparisons are getting more difficult, just barely keeping pace with last year, while Innolux faces the same competitive issues from Chinese panel producers as does AUO.

RSS Feed

RSS Feed