Taiwan Panel Stuff – July Implications

AU Optronics reported July sales of NT$17.43b ($582.3m US), down 15.8% m/m and down 47.7% y/y against a 5 year July average of -0.5% m/m. This continues the monthly downward trend which began in July of last year as seen in Figure 1. AUO also reported shipment area of 1.3m m2, down 18.2% m/m and down 38.1% y/y, the lowest monthly shipment area since AUO began reporting such data. This is indicative of the weak customer demand and the resulting utilization cuts that have been plaguing the display space since the end of 1Q, and give some indication as to the extent of those utilization cuts. Based on 19 months of shipment area data, the average monthly shipment area is 2.0m m2/month, with the July data down 35% from that number and down 42.9% from the peak (12/2021), and also down 29.0% from the average shipment area for this year (1.83m m2/month).

While it is difficult to disaggregate reduced customer demand and intentional utilization cuts, we estimate that AUO has reduced their utilization rate by between 25% and 30% this year, after being close to 100% for much of 2021. That said, AUO has been able to maintain a relatively stable sales/m2 since the beginning of this year, albeit down from 2021, indicating that the lines that are still in operation are generating 6.1% less sales than they were during last year’s 1st half, likely a result of producers having less choice as to what jobs they take on, meaning settling for less profitable products to fill existing lines.

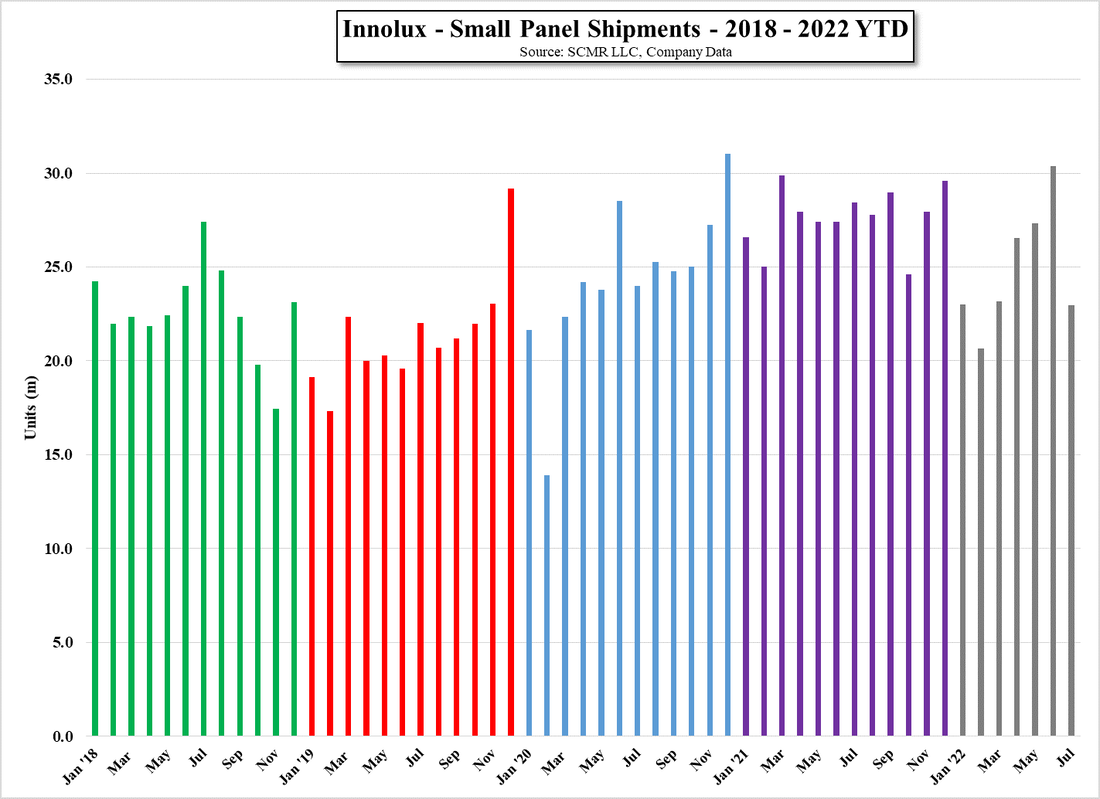

Innolux, Taiwan’s other large panel producer reported sales of NT$15.760b ($526.5b US), down 18.3% m/m and down 51.1% y/y against a 5 year average for July of down 2.2% m/m. Large panel shipments were 8.25m, down 26.2% m/m and down 32.8% y/y, the lowest large panel unit volume since February 2020, as seen in Figure 4, with small panel shipments of 22.97m units, down 24.4% m/m and down 19.3% y/y (Figure 5), putting total shipments down 24.9% m/m and down 23.3% y/y. We believe Innolux has waited a bit longer than most to become more aggressive as to lowering utilization and pulled back large panel production to a larger degree in 3Q.

All in, the effects of lower utilization rates at Taiwanese large panel producers are now becoming more apparent in their monthly sales, while still facing weak panel pricing as Chinese LCD panel producers continue to offer panel price discounts to fill fabs. We expect a little help over the next month or so from easing raw material and component costs, but expect it will take some time for those cost reductions to filter through the display supply chain. Given that panel inventory was certainly higher than normal exiting 2Q, we expect it will take the rest of August at least, to work that down to more realistic levels, which would imply that utilization cuts will remain in place for this month, although we do not expect additional cuts in September from most large panel producers. We believe the holiday season will still be lackluster, but even a small improvement in inflation could help to lift consumer spirits enough to at least keep 4Q in the CE space from declining q/q. It is still hard to get optimistic about the remainder of this year, but at least we can see the possibility that there are a few scenarios where 2023 sees some y/y upside.

RSS Feed

RSS Feed