Taiwan Semi – 1Q ’22 – Quick Notes

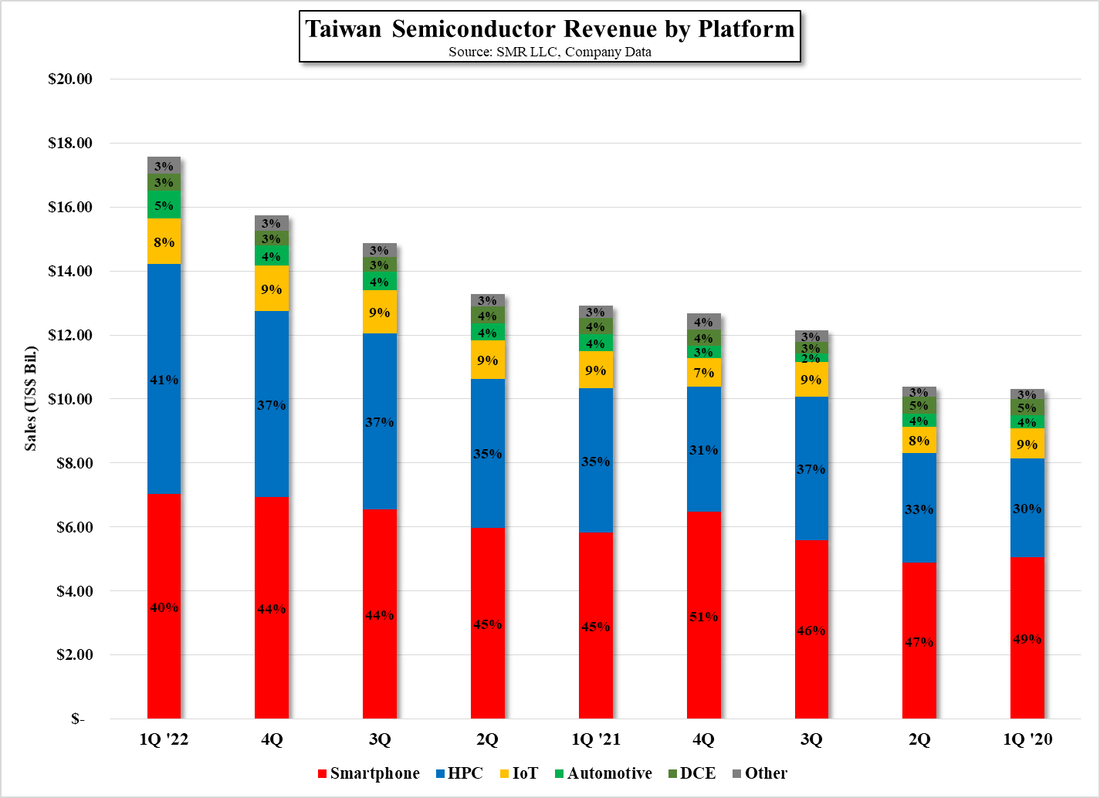

TSM expects supply chain inventory levels to remain higher than historic norms as uncertainty over economic and geo-political issues continues and they continue to see strong long-term demand keeping capacity tight for 2022 and giving them an optimistic view of meeting or beating their full year growth guidance of mid to high 20% levels (with HPC the biggest revenue contributor). When questioned further about weakness in demand for some products (PCs and smartphones) and whether that will lead to semiconductor inventory levels being adjusted downward, they indicated that they have seen little change in customer demand and expect customers to maintain similar higher than normal inventory levels. They see the demand remaining strong for HPC even if the consumer side weakens, which gives them the visibility to see utilization remaining high for the year.

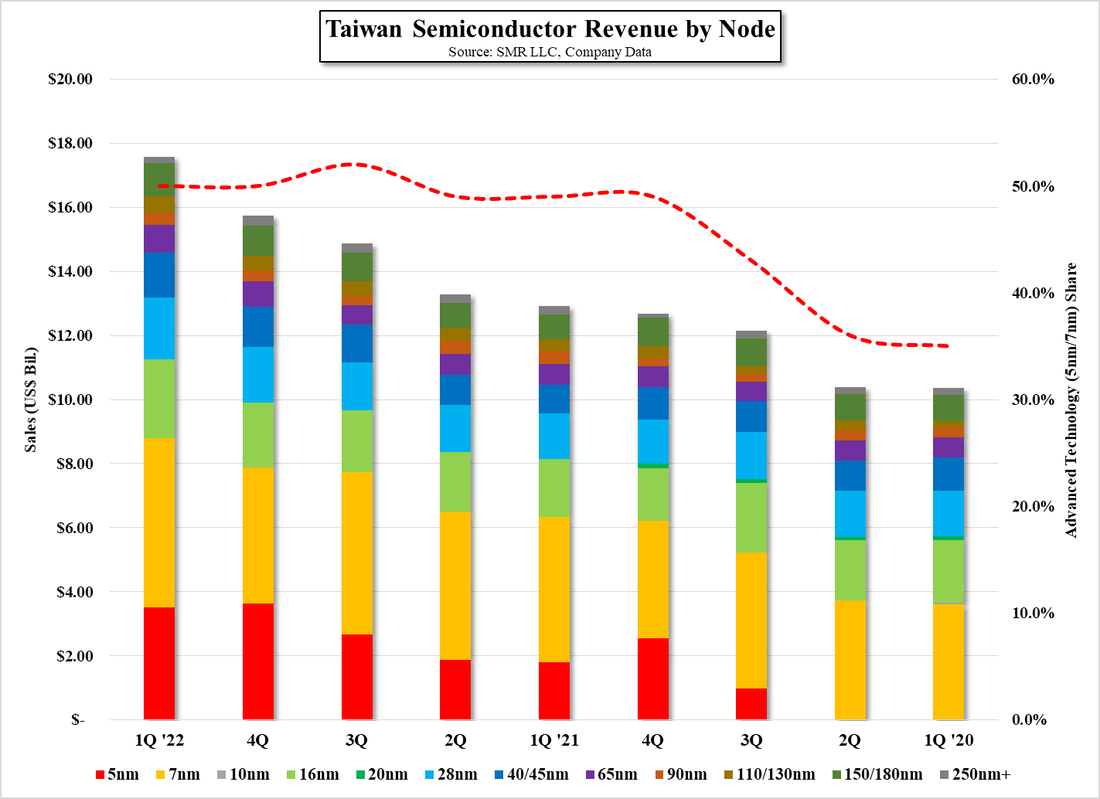

The company also noted that they do not expect any material shortages to affect their business this year TSM also stated that their N3 (3um node) schedule remains on track for 2H ’22 production and revenue contribution in 2023 with N3e one year later, but were unwilling to forecast whether the 3nm node revenue contribution in 2023 will be similar to other nodes in their first year of sales, which has been ~10% of wafer revenue. They did indicate that progress on N3e was ahead of schedule but were unwilling to say that it might be pulled forward quite yet.

While they were not specific, the complexity of the 3nm and smaller nodes seems to be the reason for the caution, with the company indicating that such comparisons ‘will be less relevant going forward’, which sounded like they expect 3nm to be a more difficult node than 5um in generating sales and profitability. Typically new nodes have reached corporate GM within 7 to 8 quarters but the company cautioned that with higher corporate GM targets they were unwilling to predict for 3nm until production begins, although they assured all that they expect to reach those goals on a long-term basis. . They did reaffirm their expectations toward N2 node production in 2025 and continued to hold to their capex expectations for full year capex of $40b to $44b.

.

When questioned about the industry’s capacity growth plans for more mature nodes (28nm+) management indicted that they see the semiconductor industry (ex-memory) moving to a growth rate of high single digits over the next 5 years (typically 3% to 5%) as silicon content/device increases along with the need for increasing computing power, but did not give any indication as to their plans for older nodes other than ‘working with customers to develop specialized products’ that assumedly would sustain those older nodes for an extended period. This seemed to mirror a number of comments on TSM’s obvious focus on advanced nodes which are certainly in vogue when demand is strong. That said, their higher industry growth view and associated advanced node capex is predicated on a continuation of the current demand cycle and the factors that have been driving it, so any change in those factors that leads to a change in demand would have to affect those plans, although the company does not expect same.

There was some concern among questioners about how the company would respond to a weaker semiconductor environment, particularly one where inventory levels were less aggressive, and while the company did acknowledge that they have seen some indications of demand weakness, as noted above, they did not see it affecting their business this year, especially in terms of utilization. While even with the demand slowdown in some consumer products, TSM is counting on HPC as their growth driver, which does have more solid underpinnings than some of the consumer product demand that was driven by COVID-19, but even long-term macro HPC trends can be interrupted by a recessionary environment that pulls in overall spending and while HPC has momentum currently, we would be more focused on server and power computing demand growth than CE product demand when looking at TSM’s risk profile going forward.

RSS Feed

RSS Feed