The Battle for Semiconductor Supremacy

Underlying this issue remains the demand cycle, which remains in question as to its sustainability. As the global (or at least the US population) becomes vaccinated and faces decreased workplace restrictions, does the demand for the ‘stay-at-home’ CE products that stimulated this supply crisis begin to ebb? If so, where will it leave the semiconductor industry and the CE space generally, and how will the industry deal with such potential change? As we have noted previously, we have looked carefully at the display pace and mapped out a number of scenarios that might be applicable over the next few months, at least on the demand side, but things are just beginning to change in the semiconductor space, which could potentially complicate things further over the next few years.

Taiwan Semiconductor (TSM) the world’s largest foundry, has indicated that not only will it spend between $25B and $28B to add capacity this year, against last year’s spend of $17.2B, but it has authorized a spend of $100B total over the next three years, including what potentially will become a GigaFab complex in Arizona. This comes after Intel (INTC) has indicated that it will be spending $20B to build out its capacity, primarily two fabs in Arizona, and Samsung (005930.KS) also indicating that it will spend $116B over the next 10 years for the same purpose although . UMC (UMC) and other smaller foundries have also increased spending plans for new capacity projects, but nothing compares to the new commitment from TSM.

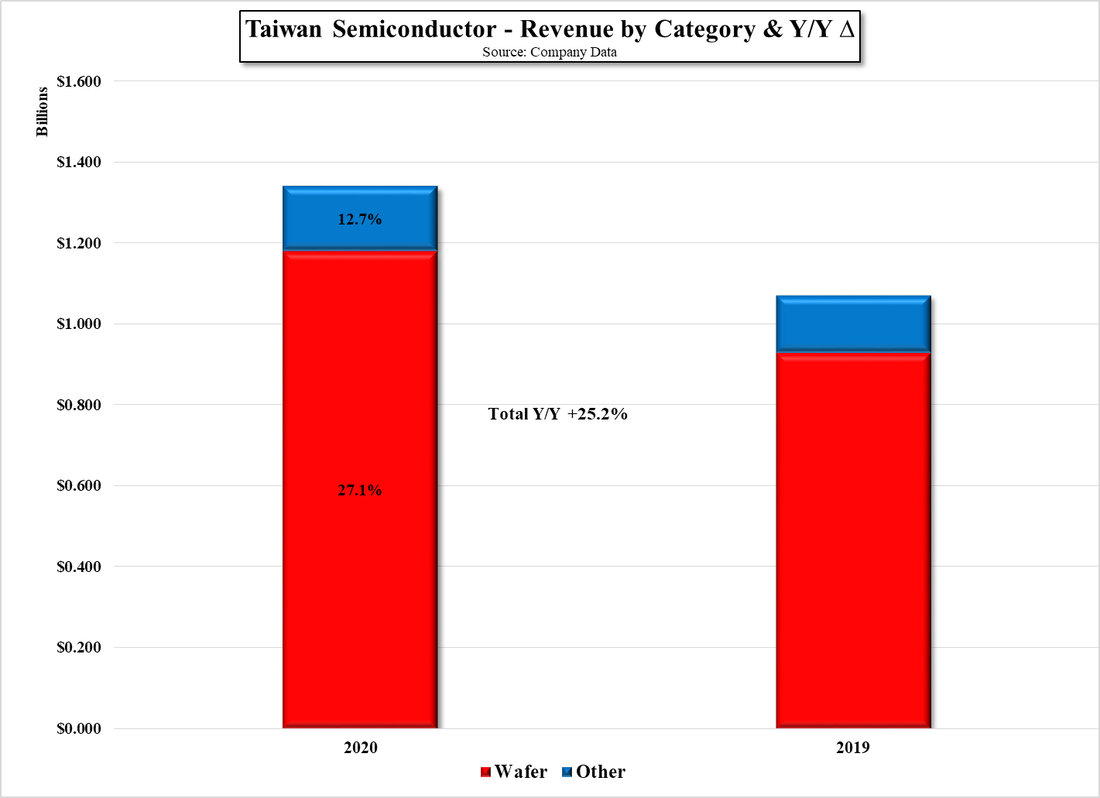

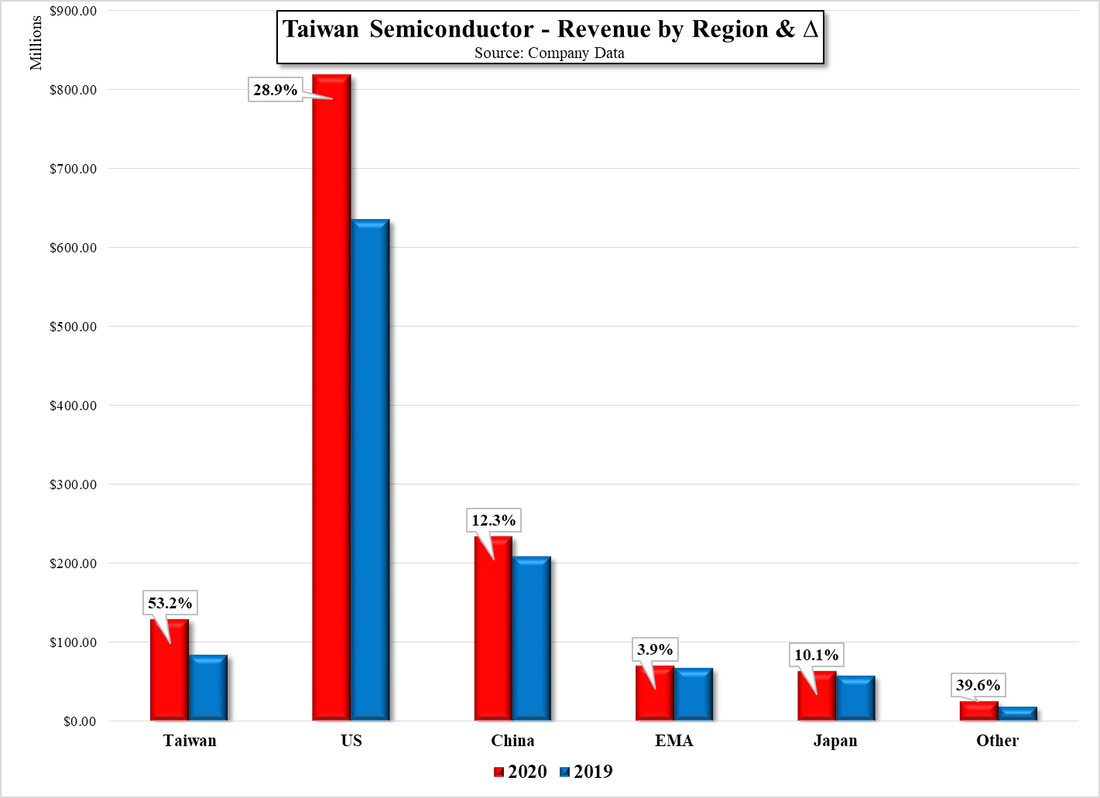

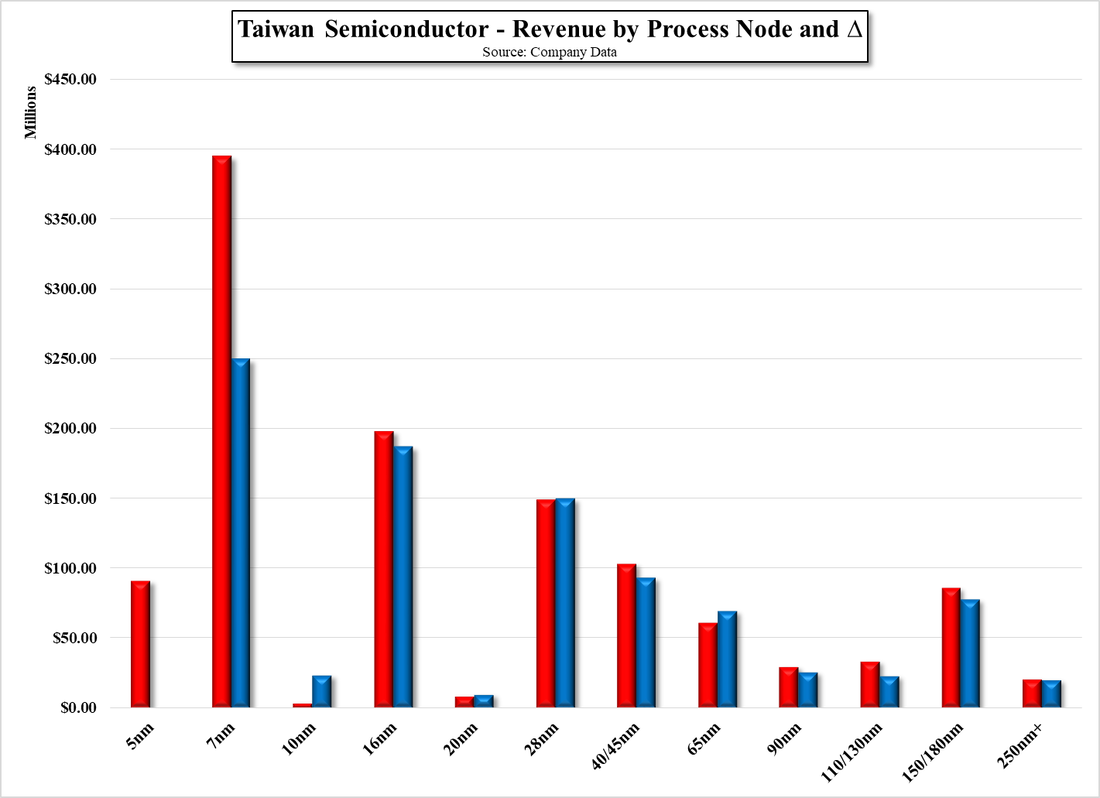

We believe TSM’s largest customer is Apple (AAPL), with 25% of sales in 2020 from ‘Customer A’ and 23% in the previous year with Huawei’s (pvt) HiSilicon (pvt) a likely ‘Customer B’, the only two that are singled out as 10% or greater customers, but TSM provides foundry services for Qualcomm (QCOM), NVIDIA (NVDA), Broadcom (AVGO), AMD (AMD), and Mediatek (2454.TT), all of whom we believe represent 5%+ customers, and over 400 other smaller customers. Samsung is a bit more limited in its customer base, given it uses ~60% of its semiconductor capacity internally, and has less 5nm/7nm capacity than TSM, who derived 41.2% of its revenue from just those two nodes last year, up from 26.9% in 2019.

Given the rapid rise in demand for 5nm/7nm nodes, and the initiation of the 3nm node by TSM next year, we expect much of the new capacity to be added will be under 10nm, however once the spending has been initiated for such large and complex fab projects, it would be difficult and quite expensive to change those plans, at least for the established projects. It seems now that the mindset of foundry operators has changed to the point of becoming convinced that the demand seen over the last year is the ‘norm’ and will continue, and to serve that demand additional capacity must be built, rather than running at 100% utilization and raising prices (TSM has also indicated that it will not be offering typical discounts for maturing products to its customers in 2022 in order to help finance the increase in Capex).

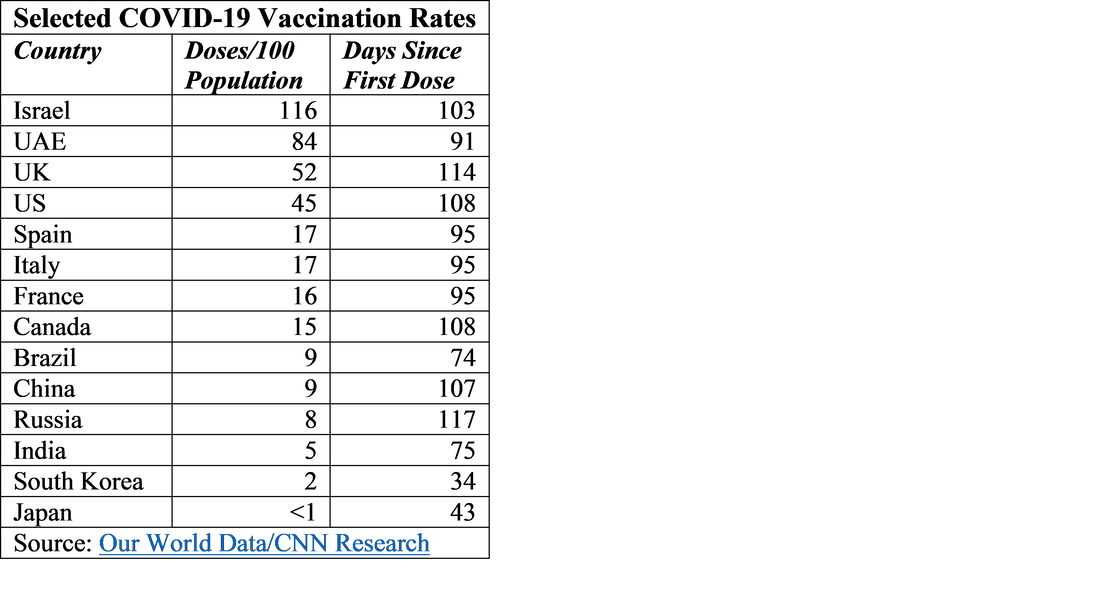

So, it seems to us that we are entering a new ‘higher risk’ semiconductor cycle, that could play out very favorably over the next few years if demand remains consistent with the ‘new normal’ or quite unfavorably if CE demand returns to pre-pandemic levels and growth. It’s a game that CE suppliers have to play, while we get to arm-chair quarterback, but whatever the outcome, much will depend on how the global COVID-19 pandemic plays out in China, the US, India, and much of Europe over the next 12 months and much of that will depend on the vaccination rate, and that is still in the early stages as the data in the table below shows.

RSS Feed

RSS Feed