The End?

- First, no matter who was the market share (units of dollars) in the early days of OLED display production, they faced a loss of share as others began to enter the niche. With Samsung the leader in the small panel OLED space, especially the small panel flexible OLED space, the company was bound to lose share over time, which has been the case. If China’s BOE, Visionox (002387.CH), or Tianma, had been the first to market, they would have faced the same fate.

- Second, on a unit volume basis, Samsung is still the leader in terms of unit shipments for small panel flexible OLED displays. In fact in only one quarter over the last 3 ½ years did Samsung’s unit shipment ratio fall below 2x that of the producer in 2nd place.

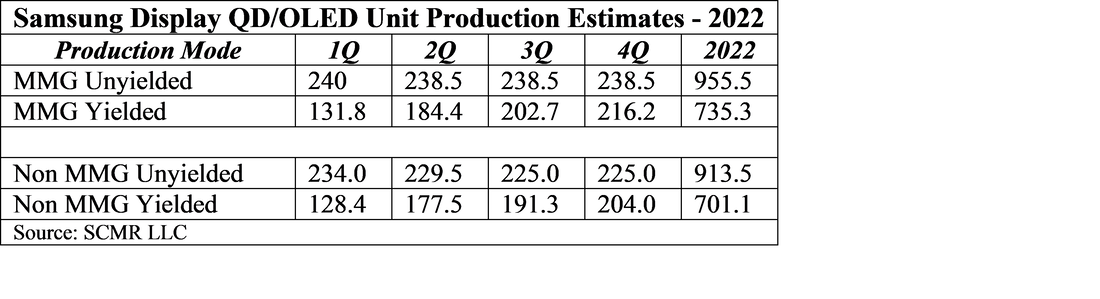

- Third, while panel producers that produce both LCD and OLED displays rarely break out segment profitability, we expect there have been only a few instances when Chinese OLED producers were profitable for two consecutive quarters. Samsung Display (pvt), at least on an operating basis, has been profitable for the last ten quarters, although we note that what remained of Samsung Display’s large panel LCD business likely had a negative effect on the early quarterly numbers and the most recent quarters would be influenced by SDC’s QD/OLED large panel business to a degree.

RSS Feed

RSS Feed