The EU Falls Behind in 5G Rollout

That said, the report does indicate that such deployments carry risks, such as privacy issues, threats to national security, supply chain dependencies, and cyberattacks, as 5G is more dependent on software than previous communication systems. Citing studies that have shown the potential impact of cyber crimes could be as high as €5t, or ~6% of global GDP, such fears pushed the EU toward the 2019 Network & Information System Cooperation Group’s initiatives to prevent ‘hostile state actors’ from ‘privileged access’, applying pressure to a vendor, or by invoking legal requirements. With few hard (legally binding) and many soft (non-binding communication) laws, the EU built a framework for controlling cybersecurity. Of course the ‘hostile state actors’ mentioned above refer to China and more specifically Huawei (pvt) and ZTE (000063.CH), both of whom were and remain the object of continuing US campaigns relating to the security of their telecommunication equipment.

The report also indicates that the cost of 5G deployment across all EU member states through 2025 is estimated to be between €281b and €391b, with the bulk of such investments being made by EU member nations themselves. Between 2014 and 2020 5G development was supported with €4b, coming from both the EU budget and the European Investment Bank, which has provided loans of €2.5b for nine 5G projects in 5 member states., along with the Recovery & Resilience Facility, which will add another €724b in grants and loans for such future projects. With all of this available capital one might expect the EU to be a leader in 5G rollouts however the report goes on to point out that under the 2016 EU 5G Action Plan member states were to have launched early 5G networks by the end of 2018, full commercial 5G services in at least one major city by the end of 2020, and uninterrupted 5G coverage in urban areas and main transport paths by 2025, adding (last year) that all populated areas should be covered by 2030.

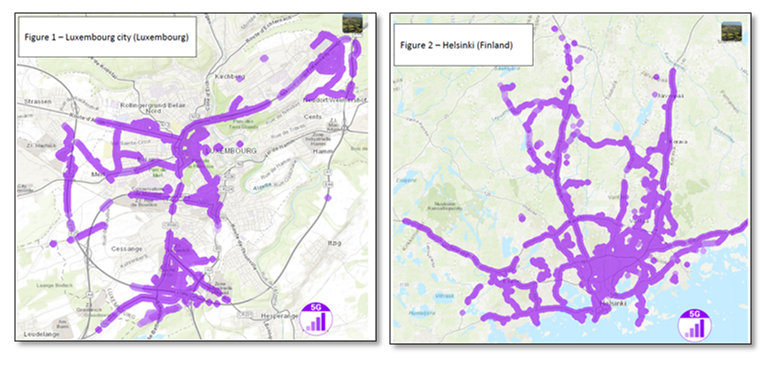

By the end of 2020 23 of the 27 member states had achieved the goal of 5G access in at least one major city and by the end of 2021 that number had increased to 25 of the 27, however a recent study cited in the report indicated that only 11 member states are expected to meet the ‘uninterrupted coverage’ goal by 2025, and that 5G coverage (including both EU and non-EU countries) in Europe will reach only 35% in 2025, while the US is expected to reach 51% by that date, with no definition for quality of service. The report indicates that a lack of clarity as to what ‘fully commercial’ services might mean, citing the difference between Luxembourg City, where 5G is available on only a few streets to Helsinki, where almost the whole territory is covered, is a stumbling block that continues to limit actual deployments, but on an overall basis the report goes further as to which members might be able to meet plan goals and who might not.

In some cases, particularly for the high band, carrier demand was weak, but conflicts with spectrum use across borders of non-EU countries are a problem, as some of those countries use the 5G low band for TV broadcast, and negotiations for the release of that spectrum vary considerably from country to country. But the issues relating to the 2019 China security threat are also an impediment to 5G rollouts. While the idea of a uniform and broad 5G security directive across the EU was the objective of the 2019 plan, as Chinese 5G vendors became a ‘national security threat’, each country had their own take on the problem and implementation, which limits any coordinated effort across EU member states, some of whom had already decided on key vendors when the problem became a focal point.

The report goes further citing interviews with representatives of member states who considered the criteria for vendor selection ‘open to interpretation’, with 11 of member states national regulatory authorities voicing similar concerns, and a number of EU countries have included Huawei in their 5G equipment purchasing plans. As of the end of 2020 40% of network equipment vendors in EU states were non-EU sanctioned vendors and 60% of core 5G equipment was from non-EU vendors, while 64% of EU state 4G customers were using Chinese communication equipment and the cost to ‘rip and replace’ Chinese equipment purchased since 2016 has been estimated to be €3b.

All in the report did not paint the coordinated picture of 5G deployment across EU member states that some might have hoped for, with only some of that weakness attributed to COBID-19. The report suggests that by the end of this year a common definition of 5G quality of service (speed & latency) should be developed, and all member states should include the original and updated 2016 goal plans in their 5G national strategies, while continuing to negotiate with non-members as to the allocation of spectrum. But the real problem still seems to be security, and as none of the 5G member state rules are legally binding there seems to be no way to coordinate a uniform security plan, especially one that can come up with real replacement cost estimates and a way for those with imbedded Chinese equipment to be compensated for its replacement.

While we in the US are concerned over the 5G spectrum conflicting with aircraft altimeters, private enterprise controls much of 5G’s rollout across the US, and while each state and city might have rules that modify those plans a bit, it seems to be nothing like the difficulties facing EU countries and their EU and non-EU neighbors and while the report’s suggestions are lucid and convincing, implementing them is really the problem.

RSS Feed

RSS Feed