The Hostess with the Mostest

When it comes to emitters, the light emitting element of OLED displays, there are two basic categories that emitters fall into, the first being fluorescent emitters and the second being phosphorescent emitters. Simply put, phosphorescent emitters produce, in theory, 3 times the light of fluorescent emitters, so OLED producers are always looking to use phosphorescents in combination with other stack materials. Unfortunately, while red and green phosphorescent emitters exist and are commonly used in RGB OLED displays, blue phosphorescent materials have proven far more difficult to synthesize for a number of reasons, leaving only blue fluorescent emitters as that 3rd component of RGB OLED displays.

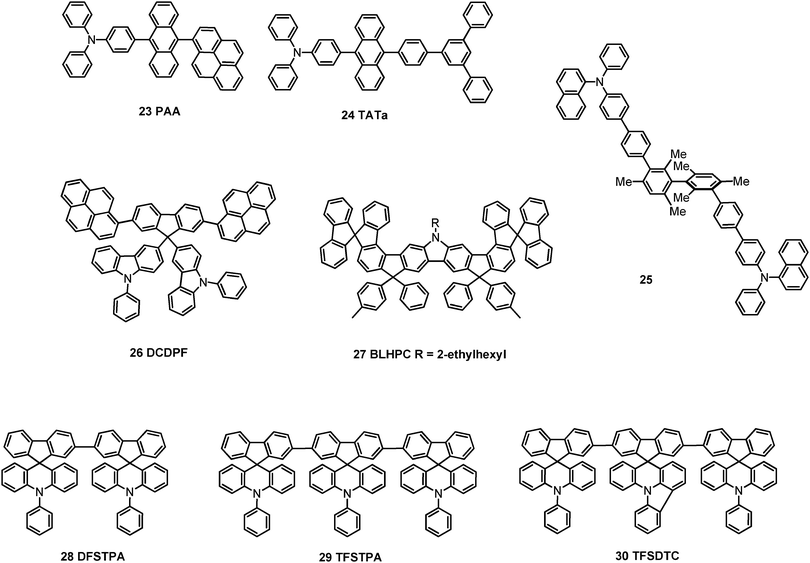

This has ramifications as to a number of display metrics, however all three emitter materials are combinations of a ‘host’ and a ‘dopant’, which when combined form the emissive layer of an OLED. With a wide variety of host materials and an every changing list of organo-metallic dopants, the combinations are almost endless, with new molecules being developed continuously. As each new molecule or combination is developed, they are tested by OLED producers and if they provide enough of an advantage over existing emitter combinations, they are adopted.

As Universal Display is the only producer of phosphorescent emitters due to its IP ownership, red and green host materials are able to be developed by other suppliers that will ‘help’ the red and green emitters to operate more efficiently., however in the case of blue, which is currently a fluorescent emitter, both the emitter and the host can be developed by suppliers, which makes for a more competitive market.

LG Display (LPL) currently the only volume producer of OLED TV displays, does not use the RGB combination process for its OLED TVs, but uses a yellow/green phosphorescent emitter from UDC and a blue fluorescent emitter, which when combined produce while light (WOLED), which is then converted to colors using a color filter. As this two color combination is half fluorescent and half phosphorescent, and therefore seeing less of an efficiency improvement that the RGB combination receives (66%), LG Display is constantly pushing to refine its structures and materials to increase efficiency, leaving the competition open to all potential OLED (blue) emitter and host material suppliers. This means each is constantly pushing its development teams to build a better blue emitter/host ‘mousetrap’ to garner LG Display’s fluorescent emitter material business.

Changing materials in the OLED stack is certainly something that the production folks at LG Display do not look forward to, as stack material changes can garner changes to layer thickness, types of conjunctive materials, and potentially changes as far forward as TFT structure or values. Any change that might need significant downtime to implement costs the company lost revenue and lower margins, so changes are not taken lightly, and in LG Display’s case, for that reason, LGD uses different materials at its fabs in South Korea than it does in its fab in China, with the Chinese fab using a newer blue host.

The blue host material being used at LGD’s OLED fabs in Paju, South Korea is produced primarily by Idemitsu Kosan, but LG Chem (051910.KS) began supplying blue host to its affiliate last year, having licensed the technology from Idemitsu. However LG Chem purchased a number of patents relating to blue host from Dupont (DPT.FP) in 2019, and has developed a new blue host that is to compete with the blue host materials supplied to LGD’s China OLED fab, some of which is being produced by DuPont for others as an OEM. If LG Chem is successful in its effort to become a ‘new blue host’ supplier to LGD’s China fab, they will have the opportunity to be a supplier when LGD converts its two fabs in South Korea to the newer, more advanced stack materials later this year and in 1H ’22, and with the limited number of blue fluorescent emitter and host suppliers, LG Display will gain the supplier diversity that it needs to avoid any potential limitations on supply from Japanese producers and an affiliated ally.

RSS Feed

RSS Feed