The Inevitable

While demand in the IT space (notebooks, monitors, and tablets) has been strong for most of the year, recent weakness in notebook and Chromebook demand has some brands thinking twice about how they will order for the remainder of the year, but nowhere in the CE space has there been more volatility than with TVs. A strong 4Q 2020 and a record 1Q 2021, seemed to set the tone for the TV set industry earlier this year with North America being the generator of much of the unit volume and sales growth, but much of that TV enthusiasm came from the 2nd (December 2020 – January 2021) and 3rd (March 2021) stimulus checks paid to US taxpayers.

However between May ’20 and June of this year, TV panel prices increased rapidly as South Korean panel producers Samsung Display (pvt) and LG Display (LPL) began a program to lower or eliminate LCD large panel production. While these plans were curtailed to a degree by the rising prices, component shortages gave TV set brands a reason to ‘pad’ orders, for fear that they would be given a smaller than normal allocation from capacity constrained panel producers. TV set brands continued to be encouraged after the strong 1Q this year, but without a new US economic stimulus in 2Q, things started to unravel quickly.

Panel prices had risen so much at the panel level that set manufacturers could not keep from raising prices at the retail level, and while this was done slowly the cost differential was eating into margins. In 2Q TV panel shipments began to decline, with the industry blaming component shortages, although panel producers still insisted they were not significantly affected by such shortages, leading to our conclusion that ‘real’ demand was waning. We believe there were two factors that led to the demand slowdown. Panel price increases that led to consumer facing TV set price hikes, and the COVID-19 vaccine, which began to give consumers the ability to return to a degree of a normal lifestyle and reduced the need for TV viewing and replacement/upgrading.

TV brands however continued to hope that momentum would pick up in 2H as is typically the case, with only Samsung (005930.KS) lowering its expectations for full year shipments from 48m units to 45m units (6.25%). TV panel shipments continued to slow, yet panel producers were still raising prices up until mid-year, when things began to deteriorate more quickly, with TV aggregate panel prices declining 27.2% (through September) from their peak in July, with expectations that further declines would add to that this month[1]. Shipments have also declined, and while final September data is not yet available, the trend line projection would continue that trend.

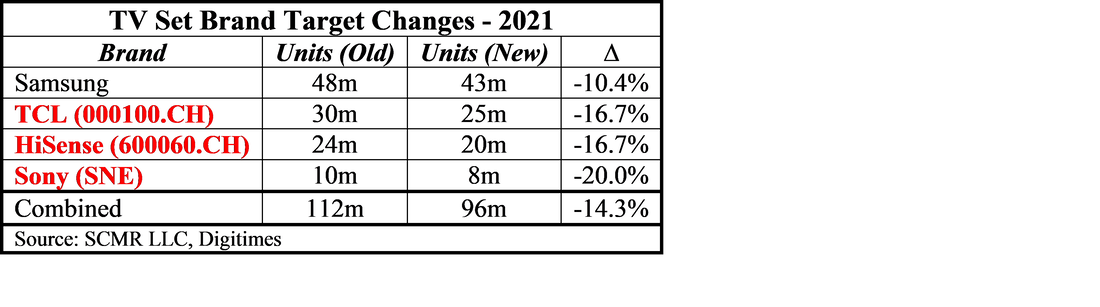

It seems TV set brands have now come to the realization that they might not meet the goals that they set for themselves late last year and have begun lowering expectations. This sets off a reaction across the industry with panel producers first offering volume deals to maintain high utilization rates and then lowering production rates avoid overproduction. Samsung has again lowered it’s TV set expectations for the year from 45m to 43m units (6.7% and 10.4% from original estimate), while other brands have made larger cuts after holding out for much of the year. Not all TV brands express their target changes publicly, but just the four in the table below represent over 50% of TV unit volume currently.

[1] Preliminary expectations for October would indicate aggregate TV panel prices would be down 38.5% from the July peak by the end of this month,

“Change always seems impossible until it’s inevitable.” – Sarah McBride

RSS Feed

RSS Feed