TV Data Dance

Without being able to subscribe to every service that provides TV set shipment data, we have always collected snippets of information that are part of press releases, quarterly calls, Ks & Qs, and conversations with suppliers, along with the hard data that is occasionally allowed out into the world of non-paying users. In particular, we try to collect enough hard quarterly data to compile what we call an ‘aggregated’ estimate for TV set shipments, based on no less than 3 sources (usually more), from which we can derive an average and a deviation to both reduce the effect of outlier estimates (average) and to test the confidence levels of estimates across a quarter (deviation).

Having worked years ago for one such aggregator/consultant, we understand how data on CE products is collected and what goes into formulating the estimates that are so heavily relied upon by the media and businesses. That said, we also know the non-data influences that go into those estimates, and, depending on the firm and the analysts, the potential intensity of their effect on the results.

With all of that said, as an adjunct to the hard data that we do collect, we are currently building a model that will take into account not only the hard data, but will try to quantify the influence of a variety of other factors and arrive at a hard near-term estimate and a longer-term directional prediction that takes into consideration some macro factors, and a few litmus tests on certain more emotionally driven factors that are subjective and carry less weight, but do have an influence on results and can help to predict DOT (Direction Over Time). We note also that we will be using AI, not to perform calculations or for writing assistance, but to help to gather sentiment information. We hope to have the model function effectively by mid-year and will continue to put together the aggregated data we always have in the interim.

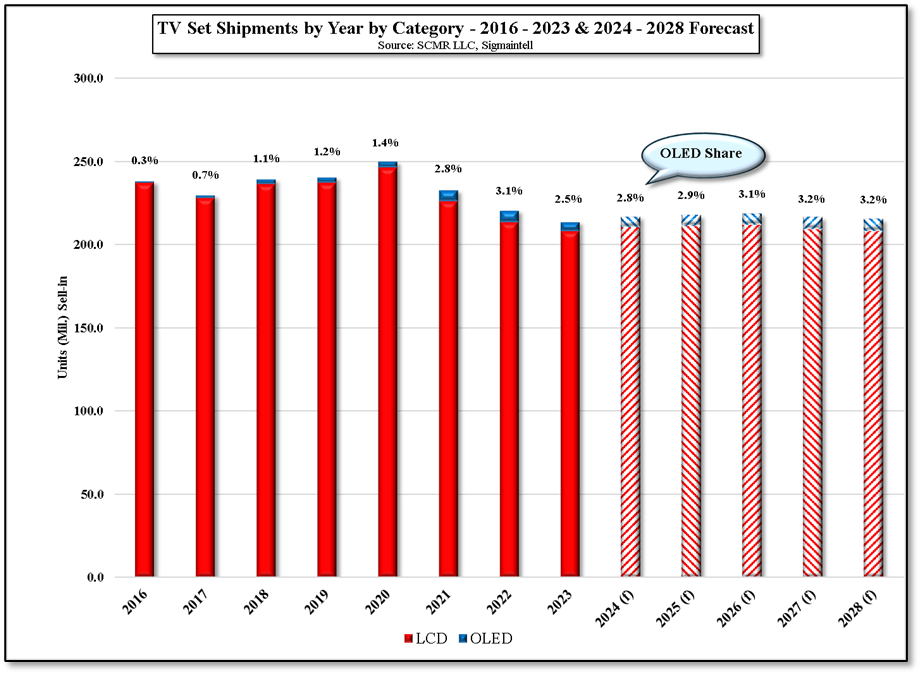

In that regard, we were fortunate to be able to access estimates for TV set shipments from one particular source that includes both historic (from 2016) and forward-looking (2028) TV set shipment estimates, and while we are showing them here, we note that these are single source estimates, not our usual aggregated estimates. The reason we show them is because they are an updated and complete set for the years 2016 to 2028, essentially 13 years without missing data. While the totals are most important, the data also breaks down the TV set category between LCD TV and OLED TV, making it easy to visualize the relative size of the OLED share.

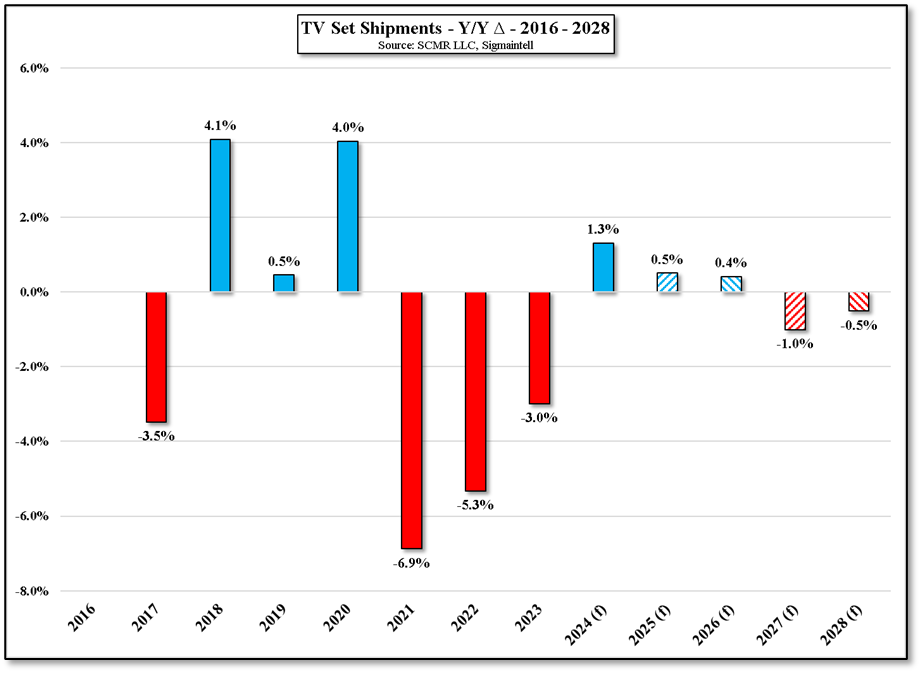

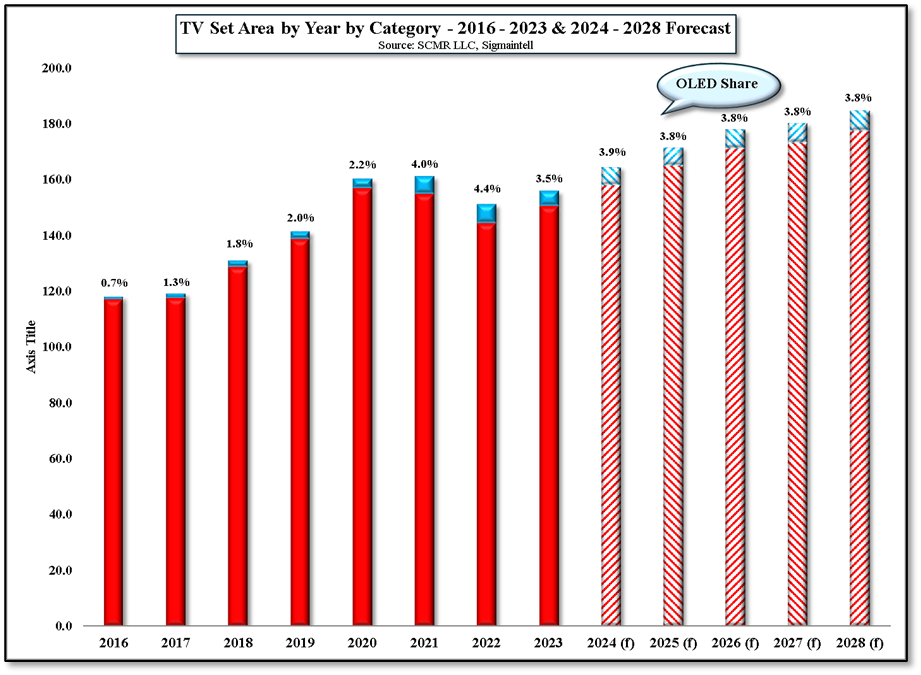

Again noting that this is single-source data, it can be seen that TV shipments have been on a general decline since 2020, a rather steep decline that ended in 2024 with a modest increase in TV set shipments, followed by expectations for almost flat shipments for this year and next, and declines into the out years. TVs are no longer the communication hubs they have been in the past, now competing directly with smartphones, leaving TVs as more of an entertainment function as its preferred venue, which make unit growth difficult outside of larger screen sizes. In terms of TV set shipments, in either the 2016 – 2024 or the 2016 – 2028 timeframes, the CAGR is negative. As noted, TV set size has been a positive for the segment with 5.4% growth in TV set area in 2024, although area growth, while positive, is expected to see progressively less growth through 2028. The area CAGR for the 2016 – 2024 period is 3.8% and is 3.3% for the extended period.

All in, the TV set business now has roots in share growth rather than unit or area growth, and that leads to a highly competitive environment. AI, a potential draw for smartphones and laptops, is not as visible to consumers with TV sets as it is with other devices that can access generative AI, although AI-based imaging applications are of great benefit to TVs, even if the average consumer has no interaction with their function and notices little difference. That leaves size and price as the magnets to draw in consumers and there are certainly limits for both, but we do expect the Chinese LCD display machine to keep pushing the average TV set size higher as they squeeze out the costs of 100”+ sets over the next 2 years. That said, we keep our expectations for shipment growth low over the same period.

RSS Feed

RSS Feed