TV Panel Demand – Hard Reality

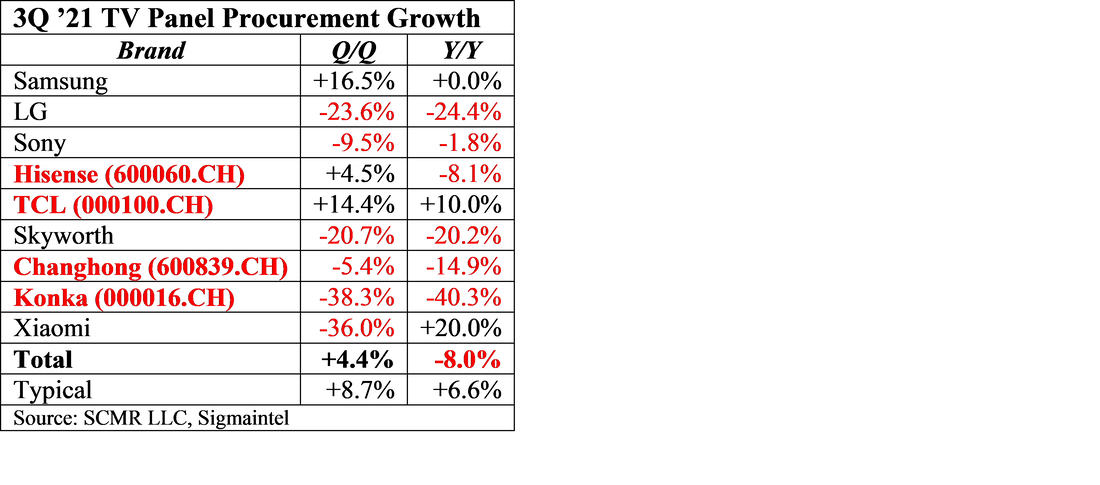

Typical large panel shipment growth has been 13% (5 year average) on a half/half basis and typical (5 year average) growth in large panel shipments in 3Q (q/q) has been 8.7%. While headlines might read that TV vendors are increasing panel procurement in 3Q, the numbers tell a bit of a different story. Large panel procurement is expected to be up 4.4% in 3Q, just below half of the 5 year average and will be down 8.0% on a y/y basis, with only three of the top TV brands seeing a q/q increase and only two seeing y/y increases. Samsung Electronics, one of the three increasing panel purchases over 2Q levels, has been unable to meet its panel requirements due to component shortages, while Xiaomi (1810.HK), who has been growing its TV business despite the slowdown, seems to have over anticipated that growth last quarter and will see a decline in large panel purchases of 36% q/q, despite still being up 20% y/y.

While many LCD panel producers have reduced their exposure to the TV panel market, it is still a significant revenue generator for producers and is an even more important part of capacity utilization given the size of TV panels, so the impact of relatively weak TV panel sales is considerable. More importantly it gives some indication as to which brands have built set inventory that now might be a bit ahead of realistic sales expectations or that their earlier set targets were too high. Here’s how the data looks for 3Q panel procurement:

RSS Feed

RSS Feed