Universal Display

The company generates material sales from contracts with OLED suppliers and license/royalty fees based on its IP, either based on a yearly flat license fee (Samsung Display (pvt)) or a royalty based on device production value (LG Display (LPL) & Others). This puts UDC in a position to capture much of the growth in the OLED display business, and over the last few years has grown sales as the OLED display market has grown, although as a JIT supplier quarterly sales can be volatile as customer order patterns rarely correlate to short-term capacity expansion or industry unit volume growth. OLED demand growth is based on three general product categories, mobile devices (smartphones/tablets/watches), IT products (laptops and monitors), and TVs. OLED IT products are the newest and likely fastest growing category from a relatively small base, while OLED TVs are well-established although a small (~2%) share of the overall total TV market, and OLED displays are now the most popular display technology for smartphones.

OLED capacity growth comes from primarily from the expansion of OLED fabs, primarily Gen 6 (smartphones, tablets, laptops) and Gen 8 fabs (TVs), as demand grows, but basing material growth on industry capacity growth can be difficult as while there is considerable incremental OLED capacity growth both planned and underway, utilization and yield can be as important or more so than stated capacity growth. From UDC’s perspective however, fab utilization is more important than yield, as an underutilized fab requires less OLED emitter material, while a fab with poor yields still requires OLED materials for all displays, even if they do not pass qualification.

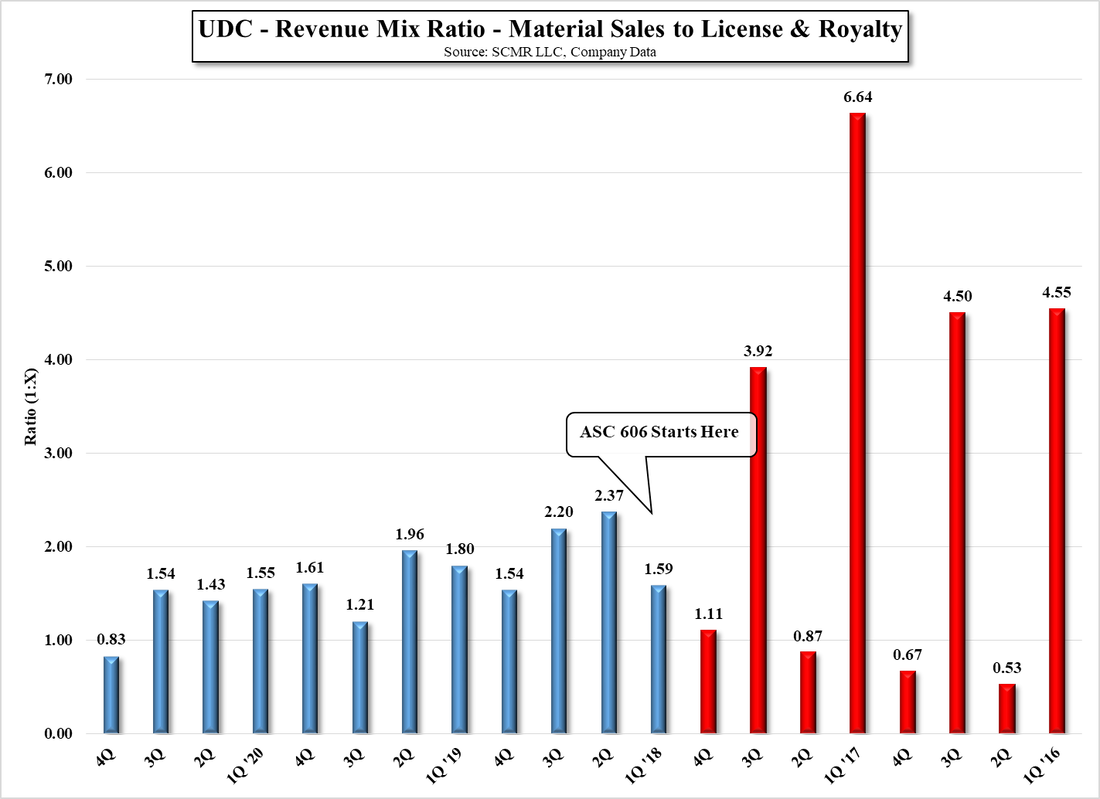

Material sales have represented between 53.6% and 59.9% of sales over the last three years, with our estimate for 2022 being 58.1% of total sales, with the balance primarily derived from license/royalty revenue, however in 2018 the adoption of ASC 606 revenue recognition rules changed the way UDC recognizes revenue. Previous to that rule the company recognized license revenue from a major customer (Samsung Display) when it was paid, which was twice yearly, with license and royalty revenue from other customers recognized as received (albeit with a 1Q lag). Under ASC 606, license and royalty revenue is recognized as a function of material sales, with the estimated value of the contract being trued-up each year. So instead of large swings in license and royalty revenue, the mix ratio remains more rational between 1.4 (material to license/royalty) and 1.6.

There are also subtleties in the three OLED materials that UDC markets. Red and green OLED emitters are used in all RGB (Red, green, blue) OLED devices, which would include all applications mentioned above except OLED TVs, while OLED TVs use a yellow/green OLED emitter, although UDC does not break out yellow/green OLED material sales separately. This leaves one missing color, blue, which is not currently available in phosphorescent emitters. Almost all OLED material suppliers are researching the development of a blue Phosphorescent emitter material, particularly as UDC’s material IP would not cover such a material (although device IP would still be in effect), leaving open the ability to supply major OLED display producers, however UDC has a significant blue phosphorescent development team that has been working on the project for years.

The company made comments about its progress developing a blue phosphorescent emitter during its 4Q conference call that offset a bit of disappointment over the company’s 2022 guidance, which was a bit below consensus. While the details about actual specifications for UDC’s most current blue OLED emitter were not given, the company did state that it expects to meet ‘preliminary goal specs’ by the end of this year and followed with the introduction of an all phosphorescent OLED stack (meaning red, green, and blue) in 2024. This is the first time that the company has given a timeline for the introduction of a competitive blue OLED emitter and host, which seems to have ignited a fever for the shares today. While we are certainly encouraged to hear that UDC continues to make progress toward the development of a blue phosphorescent emitter, we believe there are still many hurdles that have to be crossed before UDC can claim being the winner in the ‘blue’ race.

While UDC’s blue development project has certainly included conversations with major customers about the specifications they need for such a material, some of those specifications are moving targets, with a balance between three categories that would determine the usefulness of a blue phosphorescent emitter. They are efficiency, or the ability of a material to convert electrical energy to light, the color point, or the actual ‘blue’ color itself, which is considered a ‘deep blue’ as opposed to a ‘light blue’, and the lifetime, the time it takes for the material to degrade to a specific point. The difficulty is developing OLED materials comes from the balance between these three major factors, and while there have been advances made in each of the categories, it is the combination of all three that would make such a material commercially viable and as competition from other display technologies continues, those specifications also change

The inclusion of a blue phosphorescent emitter in an RGB OLED stack would also lead to design changes, such as the balance between the amount of each color needed and the sub-pixel arrangement, and the TFT backplane used to excite each sub-pixel. While these are not insurmountable changes, they also go toward the production changes necessary to include an efficient blue phosphorescent emitter and weigh on how quickly OLED producers can make those changes when a blue phosphorescent material is introduced into a mass production environment. We note also that the industry did not instantly adopt green phosphorescent emitter material even when it met industry specifications years ago, so we look toward the adoption of a blue phosphorescent emitter across the industry as a gradual one.

All of this said, we don’t want to suggest that UDC is not making significant progress toward the development of a phosphorescent blue emitter, quite the opposite, but we caution investors to focus on UDC’s ‘nearer’ term potential which could easily be overshadowed by chatter about the ‘blue wave’. UDC’s guidance for 2022 ($625 - $650m) implies a single-point growth rate of 15.2%, which we believe is a relatively conservative view of the prospects for OLED materials this year, particularly in the face of silicon and component shortages that have limited display production over the last few months. Some of the factors that could help to lessen those shortages might also be reflected in reduced unit demand, and the fact that UDC has material price agreements with its customers that make it difficult to quickly adjust material prices to rising raw material costs, put us in agreement with a conservative approach to growth this year, at least at this point, but we expect there is considerable room for incremental growth as OLED displays move into the IT space and OLED TV production continues to expand.

RSS Feed

RSS Feed