Universal Display – Part 1

As always with Universal Display, there are number of moving parts that can affect quarterly numbers and the company reminds investors regularly that such factors can disconnect quarterly results from industry trends, but on a longer-term basis, which is the proper way to look at the OLED display space, we believe the trends tend to coincide. This has been even more apparent since the advent of accounting rule ASC 606, which tied royalty and license revenue recognition to material sales for long-term contracts and reduced some of the wide swings in royalty and license revenue seen before the rule was put in place.

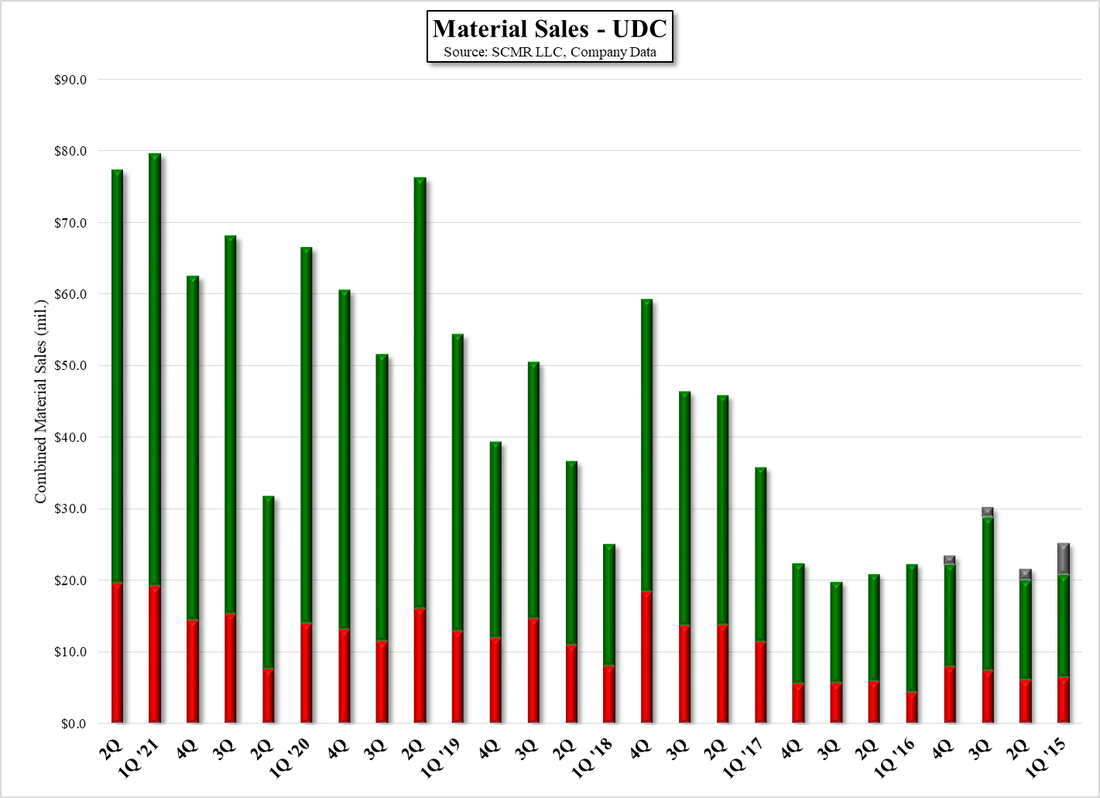

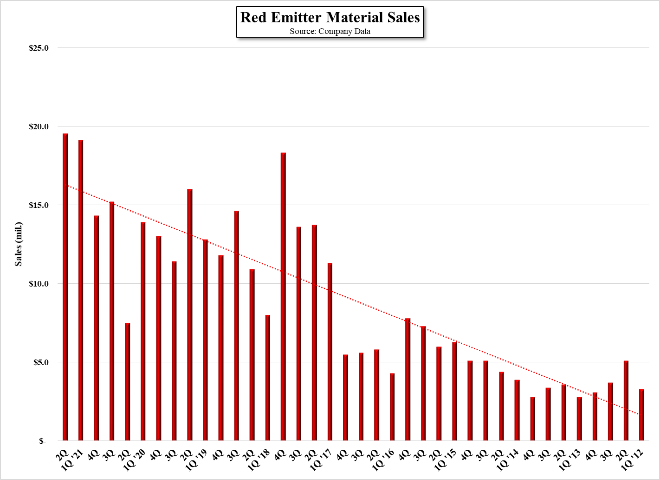

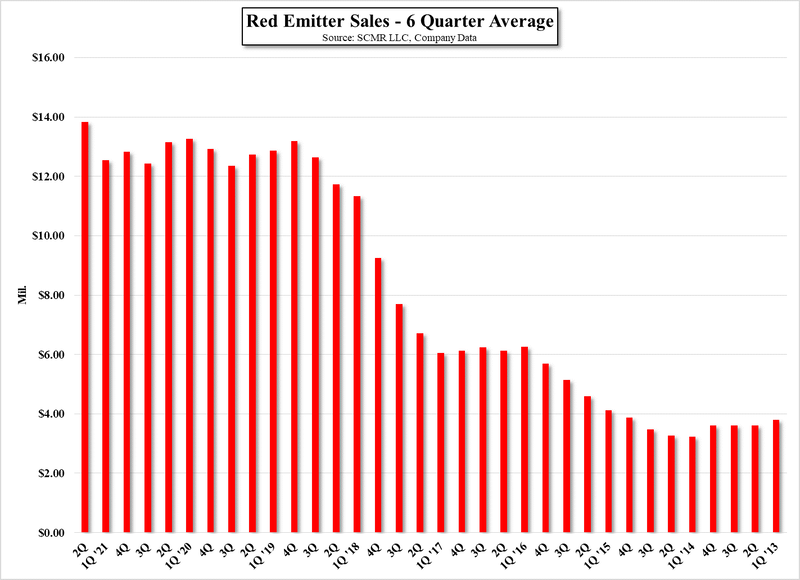

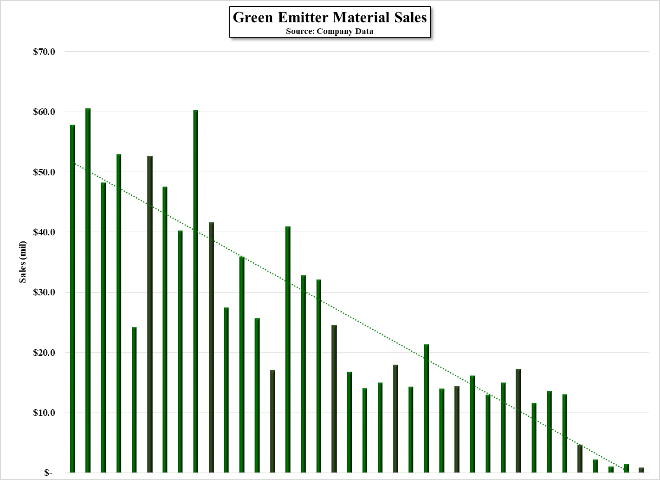

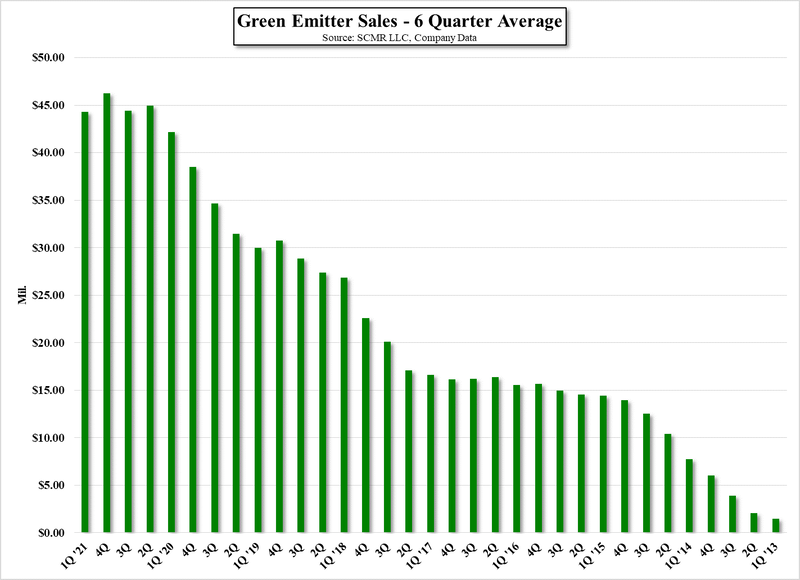

UDC reported material sales of $77.4m, down 3.0% q/q and up 123.7% y/y, although the y/y comparison, as with many display companies, is against a very weak quarter last year during the onset of COVID-19. Material sales overall have been growing, as seen in Fig. 1, with the last two quarters above the long-term trend line. Even breaking down the material sales into the two primary components, red emitter and green (includes yellow/green used by LG Display (LPL)), both remain above the trend lines. Red OLED emitter is a component of all RGB OLED devices, which would include OLED smartphones, OLED tablets, and OLED notebooks and monitors, so again on a long-term basis, the growth of red emitter material would be linked to the growth of those products. Green and green/yellow OLED material is used both in the same RGB displays indicated above, and is the primary emitter component of OLED TVs, so it is a bit harder to break out the growth of green OLED material as to product category.

Further complicating the breakdown of UDC’s sales is the fact that the regional breakdown, which in the past tied in closely with South Korean customers Samsung Display (pvt) and LG Display, became distorted when LG Display began producing OLED TV displays at it fab in Guangzhou, China, as those sales fall in with Chinese OLED producers and become harder to isolate. This situation makes disaggregating UDC’s short-term sales considerably more difficult, and should push investors to rely less on quarterly results and more on yearly results, but that is not the world we live in, so UDC’s shares retain the volatility that trading parameters dictate rather than long-term growth.

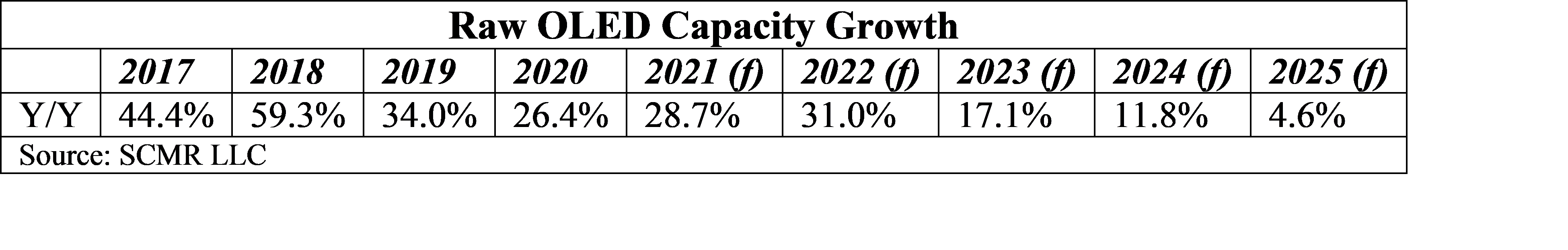

There are two positive factors that will affect UDC’s long-term growth in material sales and license/royalty income. The first is capacity growth, which is simply the timeline for OLED expansion and Greenfield OLED fab projects. As we focus on projects that are either underway or have passed the early planning stage, we see OLED capacity growing as indicated in the table below. This implies that out years will not include projects until they have been confirmed, so while we model beyond 2022, we expect 2023 and beyond to change considerably going forward. Chinese OLED suppliers, such as BOE (200725.CH), Tianma (000050.Ch), and Visionox (002367.CH) are operating OLED production fabs, but relative to South Korean producers, are still in the relatively early stages of product development and full scale mass production. China is determined to unseat South Korean OLED panel producers from their dominant position in the global market, and as they did in the LCD space, they will continue to expand production until they can capture significant share, which bodes well for the capacity that will further stimulate UDC’s sales.

The other positive factor is panel size increase, which we have noted previously, and as LG Display continues to expand its OLED TV offerings by increasing panel size and adding capacity and the small panel OLED market, which has been primarily focused on smartphones, is beginning to expand into notebook and monitor panels, which will begin to absorb OLED capacity over the next few years. With the penetration rate of OLED displays in smartphones nearing 50%, much of the incremental OLED capacity that will be added over the next few years will be dedicated to that market, but as these new OLED application grow, it will push the need for incremental capacity to feed these applications. In fact there has been speculation that Samsung Display is considering refitting an idle LCD Gen 8.5 fab to produce OLED IT products, and while such plans are not yet in our model, they would be incremental to what is shown in the table below.

Of course there are offsets, particularly the desire by OLED panel producers to reduce the cost of OLED production, a portion of which could be based on replacing current OLED emitters with more efficient ones, and while UDC works toward these same goals for their customers, in theory such more efficient materials could result in smaller quantities being needed to produce the same results. This has been and remains an issue for some investors, who look at any quarterly decrease in material sales as validation that OLED producers are becoming more efficient, both wasting less emitter material and developing ways of using less to achieve the same results. This is something UDC has been grappling with since its inception, but misses two points.

First, one of the comparisons that LCD panel producers use against OLED displays is brightness, with LCD displays the brighter option. OLED panel producers have found a number of ways to improve the brightness of OLED displays, but improving the OLED device’s ability to generate a brighter display is primarily a function of the materials in the OLED stack, so a more efficient material, meaning one that can convert more energy into light, would certainly get the attention of panel producers as they would be better able to compete against other display technologies

Second, UDC’s OLED material contracts with producers are based on material volumes, which trigger set points at which the cost of the material to the purchaser declines. Once that volume reaches a ‘terminal’ point, the price remains at the lowest level for the life of that OLED stack. If UDC is able to generate a new OLED emitter composition that has better characteristics that the previous material, customers will switch, which resets the price table to its highest point, improving material margins. This incentivizes UDC to produce new and more efficient OLED emitters to attract its customer base toward these premium products, and while that is counterintuitive to some, it is the basis for UDC’s ability to generate material margins in the 65% to 75% range. While this quarter’s material margins were 67%, after 1Q’s 74%, we see this as a relatively short-term move similar to material cost increases seen by many others in the display space, and we expect a return to higher material margins over the next few quarters.

While the ups and downs of UDC’s shares are vitally important to some investors, we find many are principally focused on quarterly results that can boost performance, but looking at the OLED industry from the perspective of overall growth is a far better way to capture that growth without the distraction of overinflated or underinflated expectations. We will continue to delve further into Universal Display next week, with more data for those that are interested in how UDC plays into the display space and the growth of the OLED segment.

RSS Feed

RSS Feed