Up on the Tightrope

The unusual tariff circumstances that have been the case since the installment of the current Trump administration, have made it a difficult year for panel producers and the CE space in general. Not so much for the sale of panels, but for trying to predict consumer demand patterns. With each EO from the White House, producers and brands have struggled to find a way to understand true consumer demand, exclusive of those buying in front of expected tariff impositions. Thus far we have yet to speak with any distributor, retailer, or component supplier that says they have a realistic plan or a way to decipher Trump’s trade policies, but in typical style, brands have been taking the initiative and have been pulling in orders to try to beat what are very ‘fickle’ tariff deadlines.

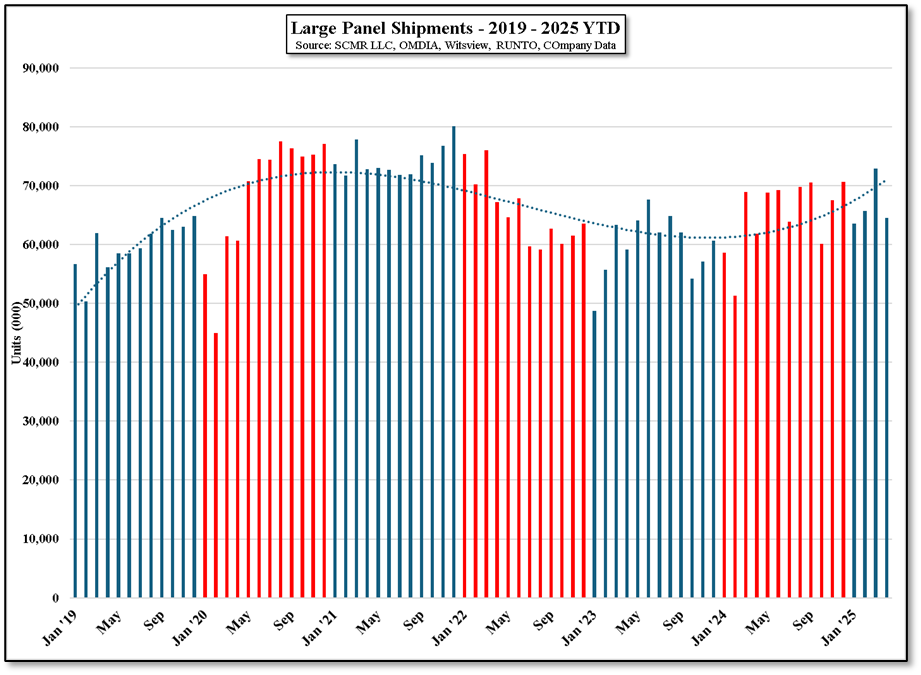

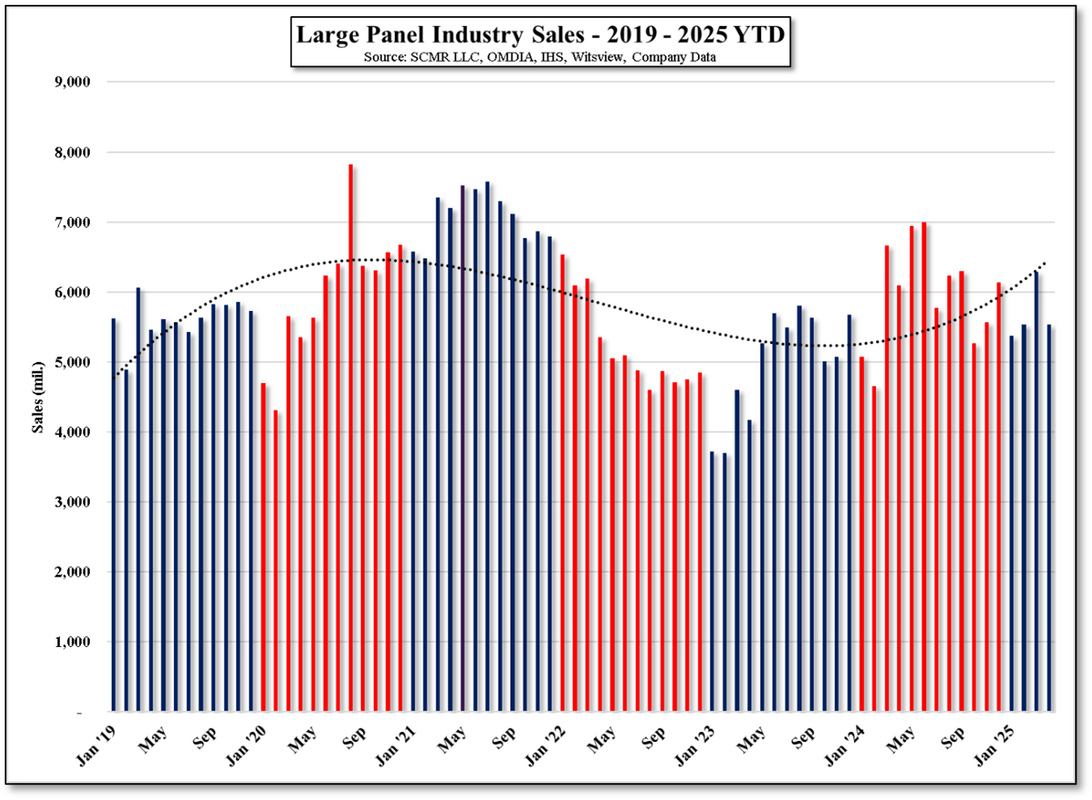

Brands, anticipating a slew of ‘reciprocal’ tariffs on a broad number of countries and the 100%+ tariffs imposed on China, pulled-in forward month orders before the imposed April deadline, although they found that most tariffs threats were rescinded or postponed only days after the deadlines were met. Both Figure 1 and Figure 2 (Large Panel Shipments and Sales) show such peaks in March as brands pulled in 2Q shipments to make sure they had sufficient pre-tariff inventory in the US. With both worldwide reciprocal tariffs and those specific to China postponed until early July, the pressure was off brands, and they were able to resume somewhat normal purchasing `levels. Below we show the first four months of the year and how large panel shipments compare with the 5 year averages. April sees a return to those averages as tariff talks continue with an early July deadline.

We expect that as the early July deadline approaches, something similar to February/March will occur again, but a bit less so as inventory levels remain high at least for now. Should the White House rattle sabers again in July and then postpone, we expect brands will begin to pay a bit less deference to the fear of higher cost product from additional tariffs and will try to maintain more reasonable inventory levels in the US. You can only make threats a few times before you have to prove that they mean something and the effect on the US consumer is going to make those threats a bit of a balancing act for the administration as was quickly discovered last month. Walking the tightrope….

RSS Feed

RSS Feed