Vizio Files for IPO

So Vizio actually dodged a big bullet by not joining forces with LeEco and has been developing its TV set business, starting by the unusual step of finding a home in big-box retailer stores, when they found that the more typical TV retail outlets did not want another brand competing against key brands like Samsung (005930.KS) and Sony (SNE). Vizio was able to establish its brand with giant stacks of TV sets that were usually right near the entrance to such stores and always seemed to be on sale. Vizio has been able to produce TV sets that are less expensive than name brands but have almost or the same feature set without any major technical problems, and has established a strong share in North America, which has been as high as #2 for much of the last two years on a unit basis.

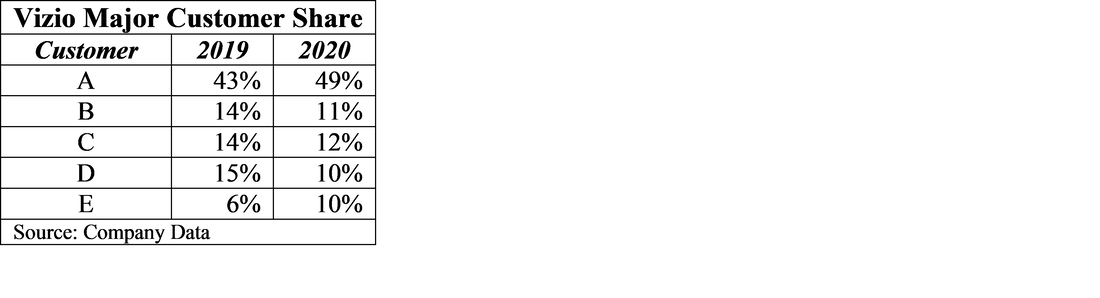

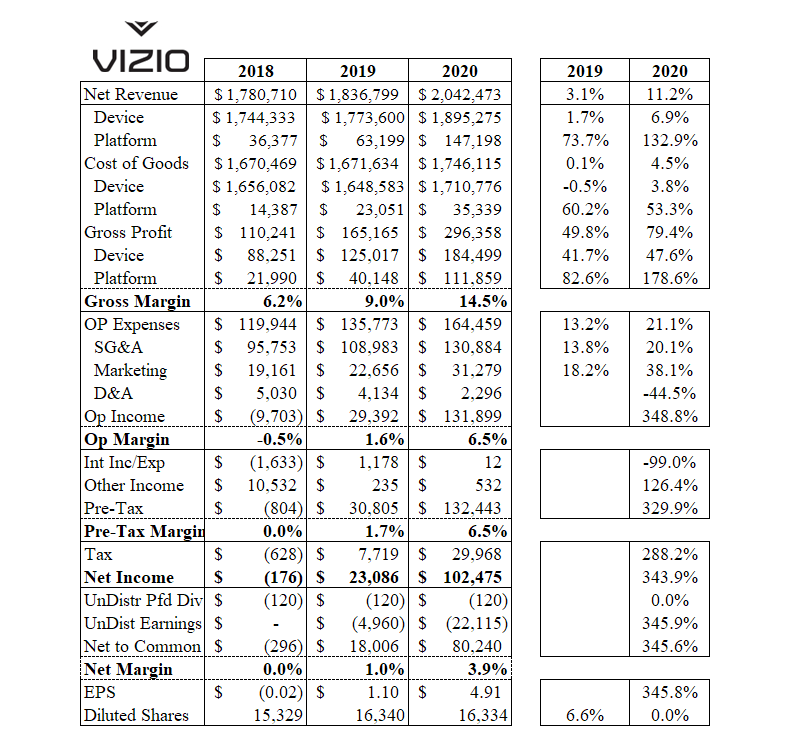

Built into Vizio TVs is their Smartcast OS, which is the support vehicle for streaming services and the company’s somewhat controversial ACR system which identifies user content and helps advertisers target relevant ads. All in Vizio runs a mostly outsourced model with Vizio’s TV set and sound bar production done on an ODM basis, with a mostly ‘hands off’ approach from the company after design input. The company has a concentrated sales platform in that its four largest retailers made up 85% of device revenue last year, with Best Buy (BBY), Costco (COST), Sam’s Club (pvt), and Walmart (WMT) all contributing greater than 10% each, none of whom have long-term contracts.

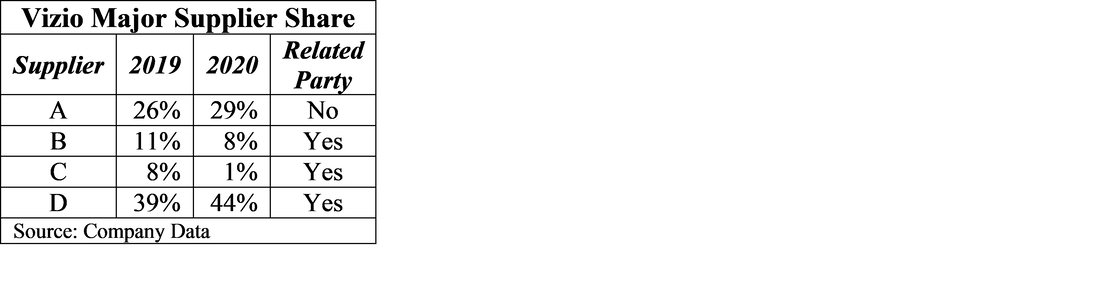

Suppliers:

RSS Feed

RSS Feed