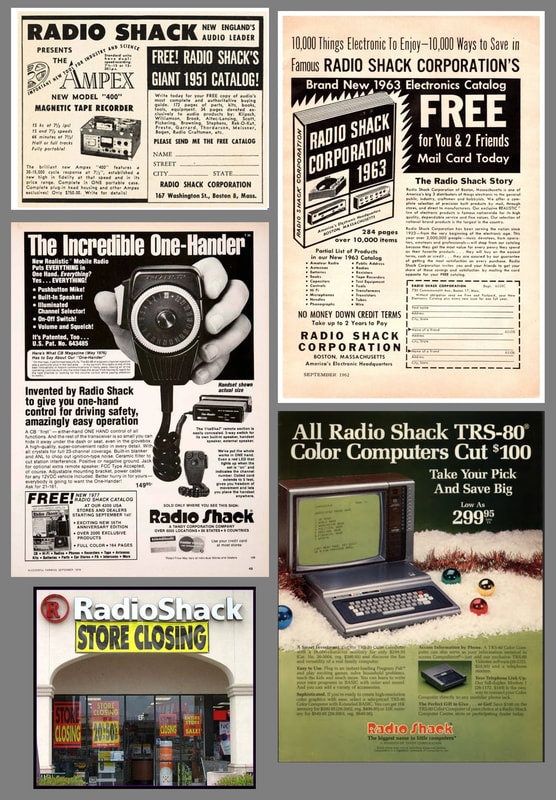

The Shack is Back!

Tandy cut the vast number of nuts and bolt type SKU’s that the Shack offered, found cheaper private label suppliers, required that store managers had a stake in the stores they ran, and refocused the stores to cater to those looking for lower priced products. By the 90’s the company was the largest manufacturer of personal computers and, for a short while, was the largest global electronics retailer. Unfortunately Tandy decided to divest its computer manufacturing business and replaced much of its private label products with 3rd party brands while opening 17 big box stores (Incredible Universe). Four years later it sold the few profitable IU stores in the chain and closed the rest.

By the late 1990’s much of the electronic components that RadioShack sold became available online and RadioShack was slow to enter the online game, but did catch the cell phone wave in the mid-2000’s. While it dominated the retail cell phone space for a while, a long string of unsuccessful ‘reformations’ and management changes took their toll and the company gained the title of the retailer with the worst customer experience for six consecutive years. RadioShack stock continued a slow decline through the 2010’s and the company tapped into a $250m loan in 2013 to survive. Unfortunately the conditions of the loan limited the company from closing more than a small number of unprofitable stores and sales continued to decline through 2015. In February of that year the company defaulted on its loan, the stock was delisted, and the company was forced to file for bankruptcy.

A month later a two-part offer for the company from General Wireless (pvt) was approved ($160m for stores and $26m for brand name). The deal included a partnership with Sprint (S), who became a co-tenant at many RadioShack stores, however two years later a Chapter 11 was filed and many of those stores became Sprint-only locations. Much of the RadioShack inventory was liquidated at that time. General Wireless actioned the RadioShack brand name for $17m, leaving it with the company’s warehouse, the authorized dealer network, the e-commerce business and 28 stores. In 2020 the RadioShack IP, dealers, and online operation were sold to Retail Ecommerce Ventures (pvt), a buyer of defunct brands (Pier 1, Stein Mart, Modell’s, Linen’n Things, etc.) with the intent to use the name on a cryptocurrency platform where one could exchange other crypto for $RADIO tokens. It was not a success.

During the first bankruptcy, Grupo Unicomer (pvt) purchased the RadioShack brand for use in Latin America (excluding Mexico) for $5m and in 2023 it purchased the global (70 countries) RadioShack brand. For the first time in many years RadioShack had a presence at the 2025 Consumer Electronics Show to revitalize the brand and attract a new generation of customers. They have also partnered with a number of retailers who offer their products in-store and online, including Amazon (AMZN) and WalMart (WMT). The company currently has 17 product categories leading to over 400 products and will add 200 more this year with a long-term target of 1,000, including 3rd party products, all under the company’s “Low Product Pricing Strategy”.

RadioShack was never known as a high-quality CE retailer, at times, their products were considered junk by many, but it is nice to see the name resurrected by a company large enough and well-managed enough to potentially breathe new life into the name. Whether the concept and brand can survive in what is now a very different CE world remains a question, although Unicomer has been successful with the brand in Latin America for years. Give it a year to 18 months and we will know if RadioShack will prosper once again or fade away forever.

RSS Feed

RSS Feed