Happy or Sad

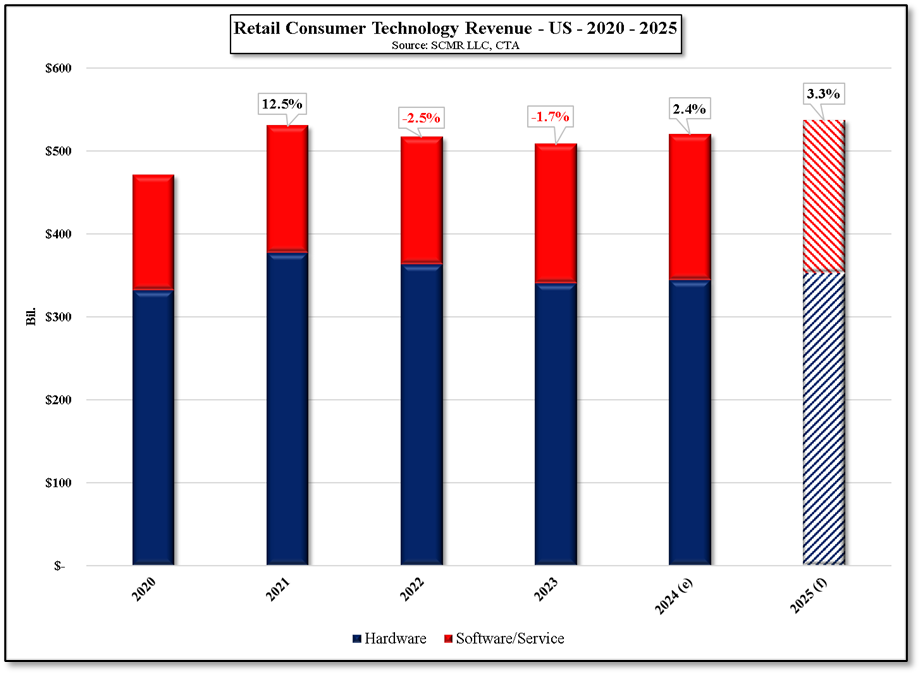

The forecast for 2025, based on the accuracy of the 2024 final estimate, calls for a 3.2% increase in US Consumer Technology spending in 2025, comprised of 2.6% hardware growth and 4.6% software & services growth after 2024’s 2.5% growth (1.1% hardware and 5.2% software & services). The optimism for the hardware segment, which comprised 66.2% of total spending in 2024, is based on the replacement cycle for hardware purchased during the COVID pandemic, the ending of support for Windows™ 10, and, of course, AI, as well as new wearable form factors. While software & services are expected to see less growth in 2025 than in the previous year, the main driver is also AI, under the heading of AIaaS, or AI as a service.

The study predicts that the greatest decline in demand, in either scenario, would be felt in the laptop and tablet segment, along with monitors and gaming consoles, where the best-case scenario generates a 40%+ decline in demand. Other product categories, again in the best-case scenario, see declines from 26% (smartphones) to 14% (desktop PCs), while the worst-case declines run between 22% (laptops and tablets) to 7% higher than the best-case scenario for Li-Ion batteries. We note that these are very difficult calculations to make, and we expect have included a relatively small, if any, contribution from the negative psychology that such tariffs might foist on US CE consumers, which we expect will further dampen demand as near-term inventory pricing gives way to tariffed inventory as the year progresses

That said, we expect brands to enter the CE space in 2025 extremely cautiously, as planning production against the potential variability of US CE demand is an unenviable task. More likely, that hesitancy will lead to a weak 1Q, with the hope for a better 2H, as country-by-country tariff deals are worked on by the new administration. We expect any resolution on trade with major partners will sound good when they are announced but will have to be carefully monitored as the year progresses to avoid a large ‘catch-up’ 4th quarter or missed targets, so we give credit to anyone willing to take a stab at tariff impact, knowing that the scenario could change in a minute and likely will.

RSS Feed

RSS Feed