Fun With Data - E-Paper in China

E-paper displays reflect light rather than generate it as LCD or OLED displays do, which allows them to be used in high-brightness environments (sunlight), but this also limits their use in dark environments. However, the most significant characteristic of e-paper displays is their power usage. LCD and OLED displays are active devices in that in order to operate, every pixel needs to be electronically ‘refreshed’ many times each second. While this allows for rapid changes and smooth image movements, it requires constant power, either from a battery or a line source, regardless of the information being displayed. E-paper displays only draw power when the image is changing, which means static images, such as the price of an item in a store, do note draw power, and therefore would allow a battery to last far longer than an active display, especially in situations where there is little or no change in what the display shows.

An obvious example of an effective use of e-paper is the e-reader, made popular by Amazon’s (AMZN) Kindle and the Barnes & Noble (BNED) Nook, with Amazon still the leader in the e-book space, followed by Kobo (4755.JP) and others. While e-readers are popular on a global basis, that market has developed slowly in China, both because of the intense focus on smartphones as indicated by the many Chinese smartphone brands, but also a cultural preference for physical books over electronic readers, although that seems to be changing.

China’s e-paper tablet market (online) generated sales of 1.834m units last year, a small number compared to the country’s population and the ~290m smartphones that were sold on the mainland last year, but that number was up 49.1% y/y and far exceeded expectations (1.56m units), and online e-reader unit volume increased by 34.4% to 834k. The two other main segments of the Chinese e-paper tablet market, smart office books and smart learning books also grew, up 21.1% and 199.3% respectively. That said, both the e-reader and smart office tablet segments saw sales down as prices for those devices declined, while sales in the e-paper educational tablet segment grew 18.5% y/y, making it the largest category (42.8%) in terms of sales.

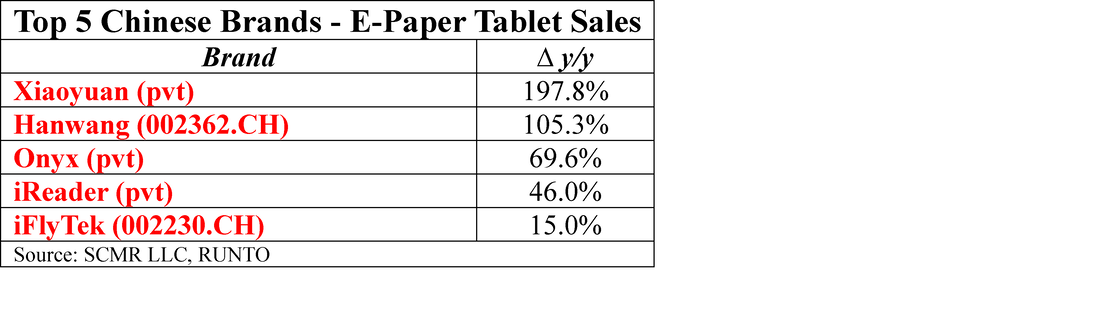

The major Chinese e-paper tablet brands also saw significant growth last year, with the top 5 brands generating 89.3% of sales for the category, up 11.9% from the previous year, and as can be seen in the table below, generated significant improvement in y/y sales. The number of new e-paper tablet products released in China last year also increased, but we believe the most significant change in the Chinese e-paper market is color.

RSS Feed

RSS Feed