Samsung Says Galaxy S21 is selling wel

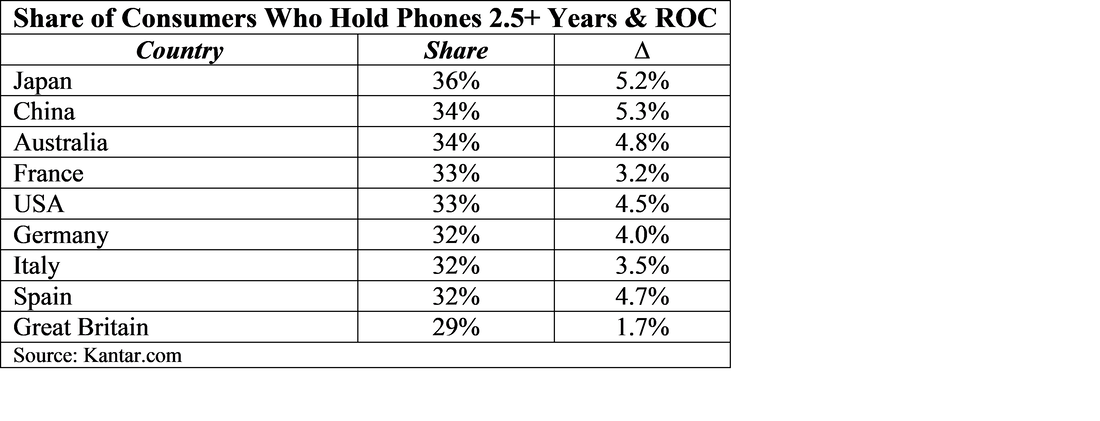

Samsung noted that sales of the Galaxy Buds Pro wireless earphone sales were also double last year’s volume and that they expect a demand spike to occur with the S21 series between March and April, when 2 year contracts for previous models expire. That said, while we don’t have data specific to South Korea, we noted yesterday that the share of those consumers holding their smartphones for 2.5 years or more rose last year in many countries according to a Kantar survey, with Japan and China leading the pack with 36% and 34% respectively, with a y/y increase of 5.2% and 5.3%. We expect given that South Korea is home territory for the Galaxy smartphone lines, the retention rate would likely be a bit lower, but we expect it still might be increasing as it gets progressively harder to add extraordinary features to new models and price becomes more of an issue.

To Samsung’s benefit, they did lower prices relative to last year, and the S21 Ultra has received positive reviews for some of its more progressive features, but the South Korean market is a bit biased toward Samsung, so we wait for data from other countries to see if that popularity carries through. We note also that Samsung has been rumored to be expecting to ship 26m units of the Galaxy S21 this year, slightly above last year’s S20 series volume, which was considered a disappointment. The S21 Ultra is expected to represent ~30% of sales, which was ahead of last year’s equivalent model share, and would seem to be a bit lower than actual sales in Korea. If this holds true, it could push Samsung to maintain or increase the feature-set difference between the lower and upper models of the Galaxy S22 next year.

RSS Feed

RSS Feed