Flexible PCBs – Where are we?

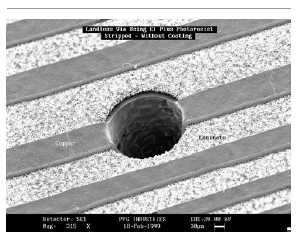

The vias mentioned above were copper plated holes .015” only a few years ago, and were drilled with precision drill bits that lasted a short period of time due to stress and breakage. Vias are now as small as .001” and are created with laser drills rather than physical bits, and traces, the lines of conductive material that connect components on a PCB board have moved from .01” to .002” (that’s 1/100 of an inch to 2/1,000 of an inch!), while components with dimensions as small as .015” x .008” are machine-placed on boards at multiple parts per second rates. Lasers are also used to image the traces and other markings directly on the PCB board prior to etching, eliminating the 10 scale drawings that were commonly used to pattern boards only a few years ago.

Flexible boards themselves, which are still made of polyimide, a polymer that has excellent thermal characteristics and chemical resistance, can now be laminated together without adhesives that can weaken when heated or flexed, but the drive to create new PCB board level products is gaining momentum as demand for mobile products increases, and PCB manufacturing processes continue to evolve. This pushes PCB, and particularly flexible PCB suppliers to constantly upgrade tools to further automate manufacturing and remain competitive in what is a $13.5 market that will grow at a CAGR of 11% through 2025 to $33.4b[1].

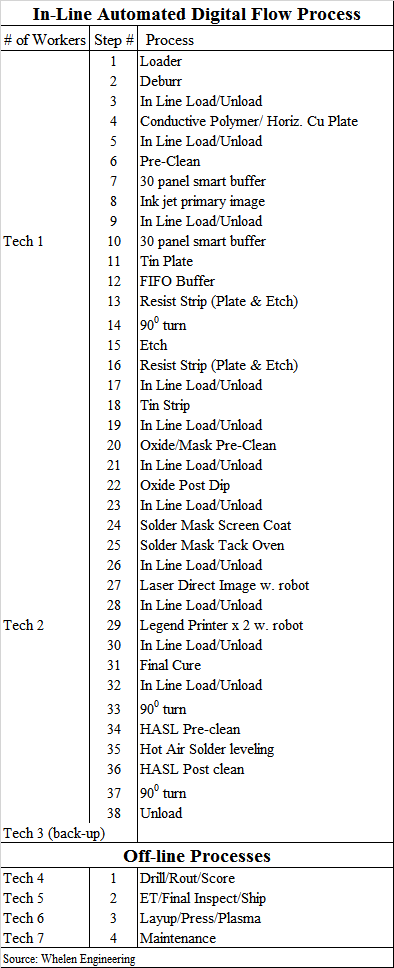

During the last 15 years, the PCB industry has moved from Europe and North America to China, given its low labor cost, weak environmental regulation, and significant government support, however automation and new in-line process equipment can level the playing field as headcount requirements decrease rapidly, with traditional factory headcount of 38 and an automated in-line process headcount at 7. When paired with wastewater and chemical recycling systems, cost advantages of 50% can be reached, even at low utilization rates, with ROI’s at less than 3 years.

More to come on the state of the PCB industry….

[1] TMR Research 3/2017

RSS Feed

RSS Feed