New Samsung Foldables

The competitive nature of the foldable smartphone market however is a bit less so than in the generic smartphone world where there are hundreds of active brands and almost 140 models released YTD and expectations for unit shipments range from ~1.3b to ~1.4b, while foldable smartphone shipments are expected to be between 14.5m and 17.1m units thus far. That said, Samsung’s foldable offerings represented ~84% to 88% of the total market last year, and while that share might be reduced a bit this year as the new entrants gain some momentum, we expect Samsung will remain the dominant player in the space for 2022 with a target of 13m foldable units in 2022.

While Samsung is expected to remain the dominant player in the smartphone foldables market, as new competitors emerge, it will become increasingly important for Samsung to maintain competitive pricing for its foldables which typically carry a significant premium over competitive brands. Justification for such premiums comes from Samsung’s experience in both display production, a function of its affiliate Samsung Display (pvt), its ability to develop or co-develop a number of key components in such devices. And its massive advertising campaigns. That said, tablets that are in the 8” size tier range in price from as little as $89 to $150, although without 4G/5G connectivity, there is also a bit of price pressure from tablets, so we expect Samsung will be working toward keeping the price of the next generation foldable smartphones at the previous level or lower.

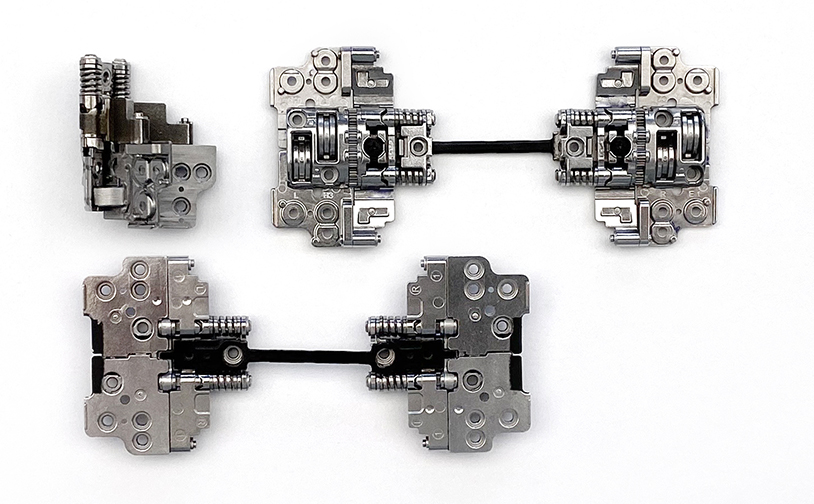

As the cost of the display will likely still be the most costly piece of the foldable BOM, the hinges which allow the phone to fold without creasing the display are also a high cost item that does not appear in a normal smartphone BOM. Samsung Display (pvt) should be able to reduce the cost of the display as long as the specs don’t change drastically from last year (7.6”), so there has been some speculation that Samsung will eliminate one of the two hinges on the Fold 4 to reduce the device cost. While there will still be rollers on either side of the folding mechanism, the hinge itself is now expected to be in the middle, similar to Huawei’s most recent foldable release, the P50.

Samsung has been developing its hinge technology with KH Vatec (060720.KS), a precision casting company that specializes in foldable hinges among other metal smartphone products, and is said to have not only reduced the number of hinges on the new devices but to also have reduced the size, allowing the phones to fold more tightly, making it thinner overall, something consumers have mentioned as a drawback to foldables. Whether this new hinge arrangement and the higher expected volumes for Samsung’s foldables this year will give the company room to lower the price while maintaining margins remain to be seen, but we expect that Samsung will either have to offer a new ‘model’ type foldable device this year, such as a ‘slider’, or push down the price of both existing models to generate increased unit volume this year. The good news is that consumers seem to be able to trust that they will not have a device that will last for a year or two and need to be replaced, but that puts more pressure on price in order to gin up consumer interest to the next level.

RSS Feed

RSS Feed