Tracking the Russians, Apple Style

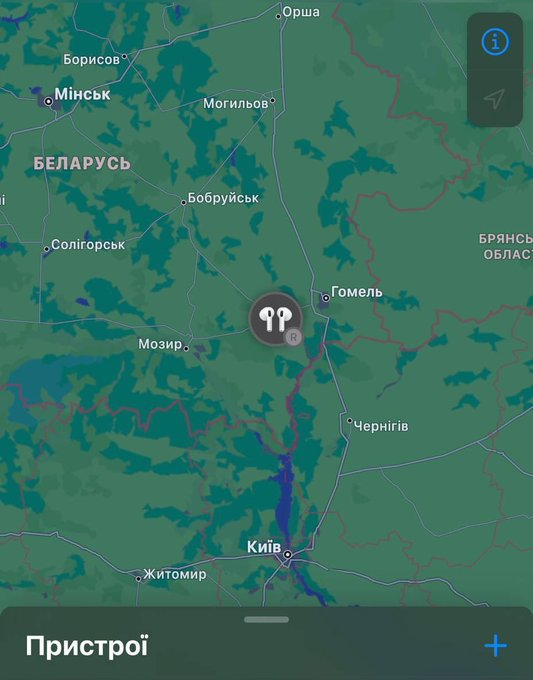

It turns out that by using the ‘Find My’ application, the Ukrainian military has been tracking looted Apple devices as the looters move with the stolen devices, including when they made a recent retreat into Belarus, according to the staff of the opposition leader in Belarus, providing the map below. This is a step up from location data available from FitBit (GOOG) devices that had been used in earlier conflicts to locate hidden military bases. As the ubiquity of Apple products and social media have made passing Apple’s ‘Find My’ information so precise and easily passed to the proper authorities, it seems that the Russian troops, in their excitement to ‘own’ an iPhone, have given the Ukrainian military the ability to use that naiveté to their advantage. Perhaps Apple should offer to ship a few hundred thousand older iPhones to Mariupol in plainly marked crates that somehow fall into the hands of the Russian military…

RSS Feed

RSS Feed