Chinese display glass manufacturer starts new plant operation

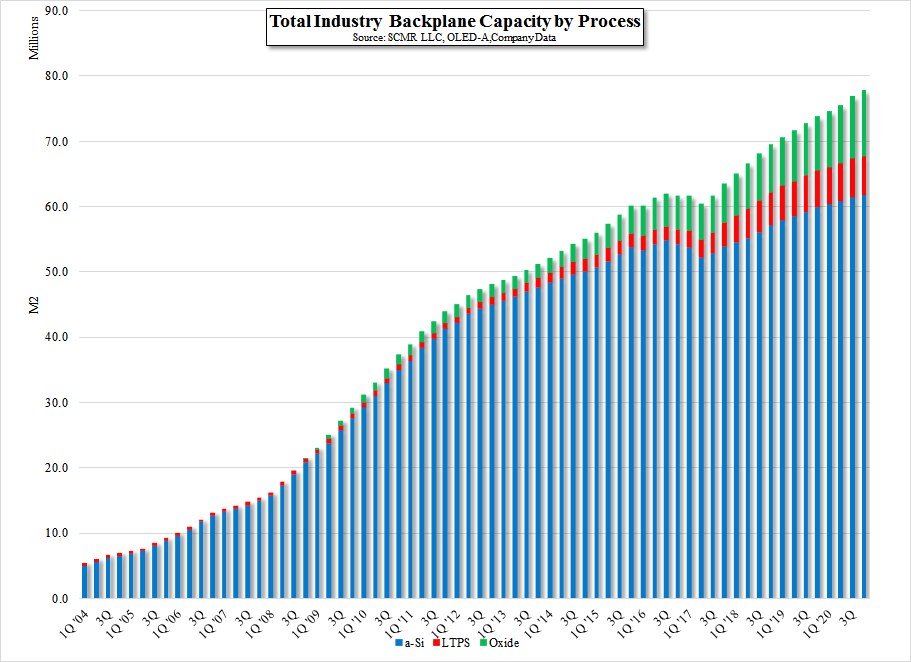

The Chinese central and provincial governments continue to build out display supply chain capacity to gain control over their display production. While China is expanding display capacity faster than any other region, they remain concerned that much of the supply chain is controlled by foreign companies, and has both short and long-term programs to reduce that dependence. Subsidies have been the main tool used to help Chinese display supply chain participants gain traction in both the local and world markets, and we expect that to continue until display market saturation is reached, in similar fashion to how China developed its LED market, and then went through a period of rationalization where hundreds of small suppliers closed and a few large firms remained. We don’t expect this to happen soon, but it is inevitable when a particular region is bent on gaining share as aggressive as the Chinese have been. They have a long way to go in the display market but it would be foolish for any investor or company to not consider Chinese Display supply chain participants as competitive equals.

RSS Feed

RSS Feed