Just Sayin’

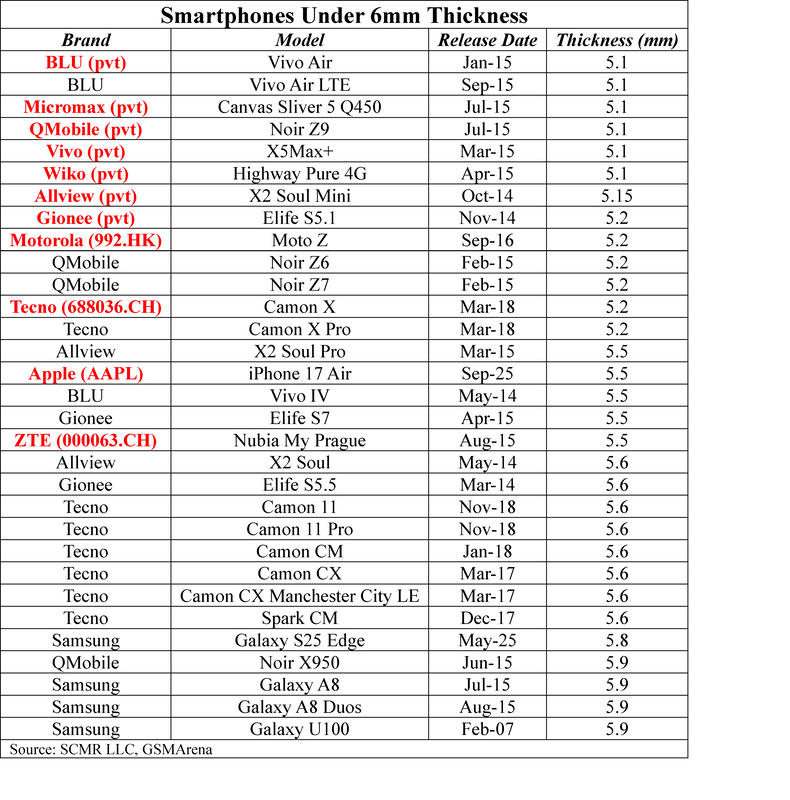

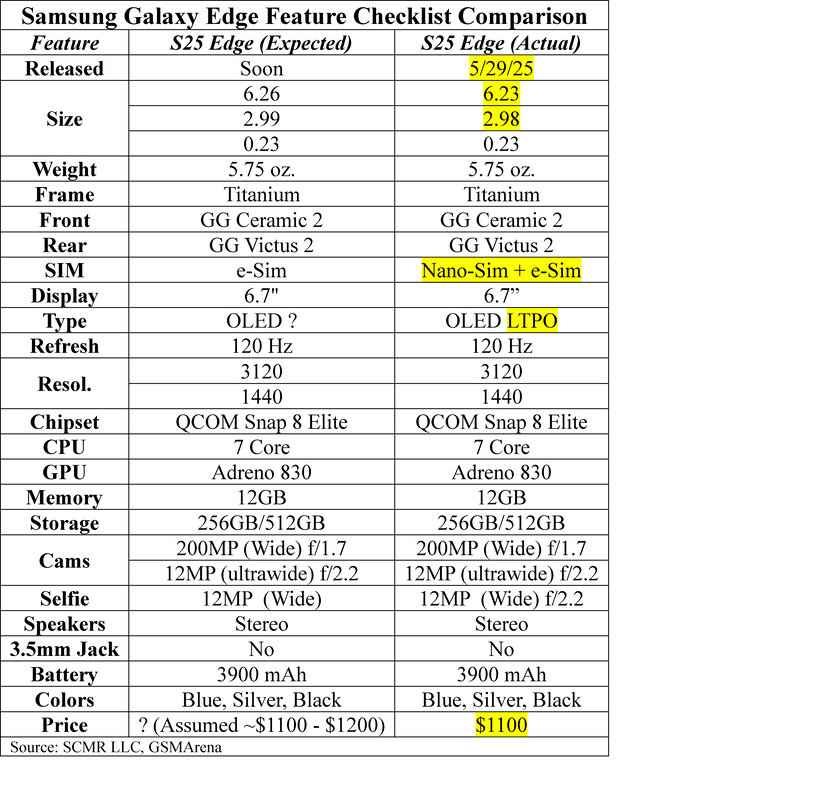

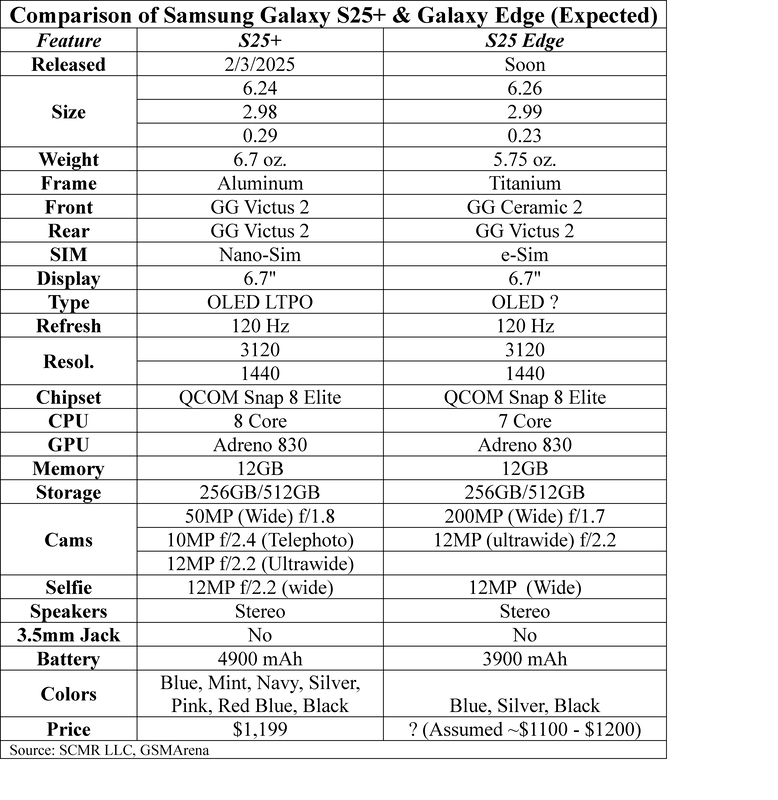

It would seem that brands could be a bit wary about how AI will play out on mobile devices as it is quite difficult to tell whether the Ai flavor-of-the-month is pushing consumers to buy a new phone, so Samsung (005930.KS) has taken another track, and thin is in. The just announced Samsung Galaxy S25 Edge is a mere 5.8mm thick, a 29.3% reduction from this year’s Samsung Galaxy S25 Ultra flagship smartphone. Here are just a few of the gushingly positive comments the tech press has made about the just announced Samsung Galaxy S25 Edge, their newly designed ‘super thin’ smartphone.

- "Thinner than a credit card..." - The Economic Times

- "Samsung's Galaxy S25 Edge is already turning heads in the tech world...for its sheer thinness." - The Economic Times

- "The S25 Edge is one of Samsung's thinnest flagships to date." - Techloy

- "The Shockingly Thin Samsung Galaxy S25 Edge Feels Great to Hold..." - PCMag

We are sure that the ‘thin’ trend will have some sustainability, at least until something else comes along, as Apple (AAPL) (see below) is expected to be releasing the iPhone 17 Air, a substitute for the iPhone Plus model, with the iPhone 17 Air rumored to be only 5.5mm thick. If both Samsung and Apple follow the trend, almost all others will join until one of the three largest components, the battery, the display, and the camera modules hits a limit. Batteries can be made thinner by increasing the length and width, which, in theory, should make it easier for the battery to dissipate heat, but at the same time the thinner phone allows less room for the thermal interface that transfers the battery heat to the frame of the phone, so it’s a tradeoff. The display itself is quite thin but the connector that attaches the display to the internal circuit board is also a limiting factor, and lastly the camera module needs a certain amount of depth to operate properly, also a gating factor.

All in, while thin is in currently, we expect thin as a smartphone feature to run its course relatively quickly unless primary component producers are able to work dimensional magic without compromising performance. There is also the feeling of holding the phone in your hand when you use it, which changes with thickness and weight, but in a device that must fit into a pocket, less is more.

RSS Feed

RSS Feed