Samsung Cuts TOF Cams

While we have gone into considerable detail as to why Samsung made the decision to abandon ToF, we expect the most recent change is one based on cost, with the elimination of the ToF module a cost saving measure on these mid-priced smartphones in a very competitive segment of the market. Of course there is the marketing jargon that says the company feels it is better to focus on developing better quality cameras than on maintaining a high number of different camera types on its phones, which is the antithesis of the thought process a year or two ago when the battleground was who could put more cameras on their phones, but with silicon and component prices still at high levels, Samsung’s marketing motivation has shifted from quantity to quality for next year’s mid-range models.

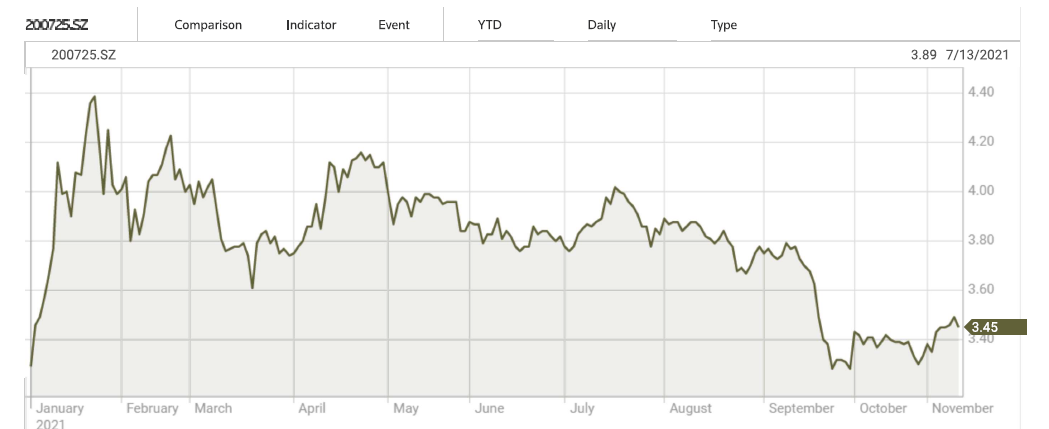

Underneath all of the pro/anti ToF rhetoric, is the fact that Samsung Electro-Mechanics (009150.KS), the Samsung affiliate that produces many of Samsung’s camera modules, had made a decision about the ‘type’ of ToF sensor it was to develop a number of years ago, choosing what is known as ‘indirect sensing’ over the ‘direct sensing’ choice made by ToF camera competitor Sony (SNE). When Apple settled on Sony’s solution battle lines were drawn between the two types of ToF sensors and competition heated up, tightening margins and putting pressure on SEM to reduce costs in order to counter what Sony was promoting as superior ToF technology (see table below). We believe SEM was not able to bring cost down low enough for parent Samsung Electronics to justify the cost given the weaker characteristics and the decision was made to eliminate ToF from flagship models and now from mid-range priced models.

All in, Samsung’s continued insistence that consumers do not use the functions associated with ToF sensors as a justification for removing them still rings hollow with us, and seems more like a justification for the need to cut costs, as was the ‘environmental’ justification of removing chargers from the box when consumers purchased a new phone last year (Apple did the same), but ToF lives on outside of the Samsung world, and as we noted in our 6/10/22 seems to be finding its way into other applications in the CE space, while remaining an integral component of the various forms of driver assistance systems and fully automated vehicle systems. While we might be a bit bruised by Samsung’s continuing battle against ToF in the smartphone space, we see its value increasing across a wider swath of applications…

RSS Feed

RSS Feed