Corning – Quick Notes

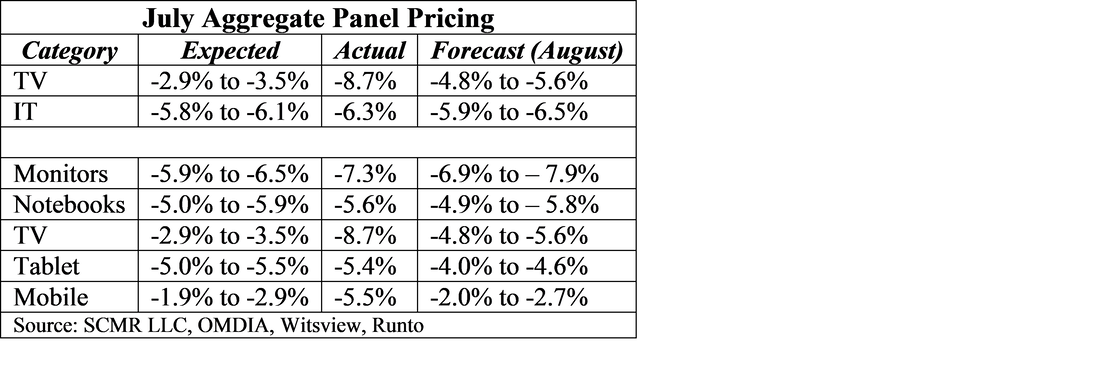

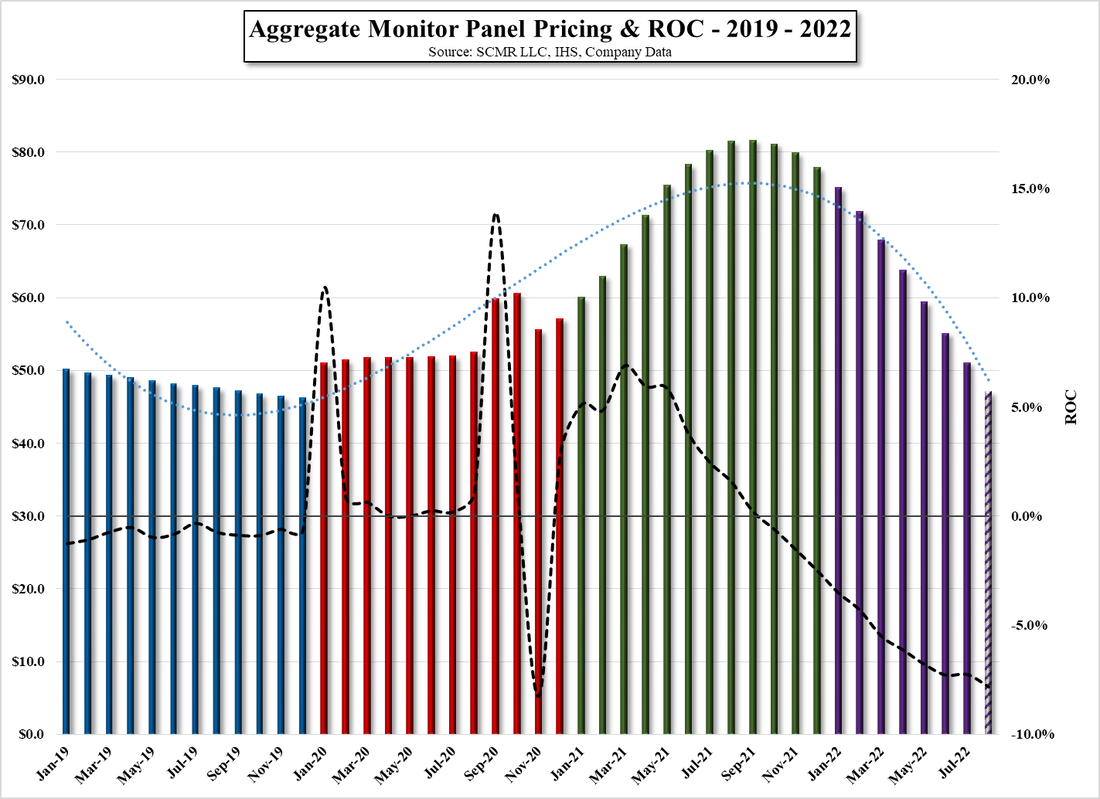

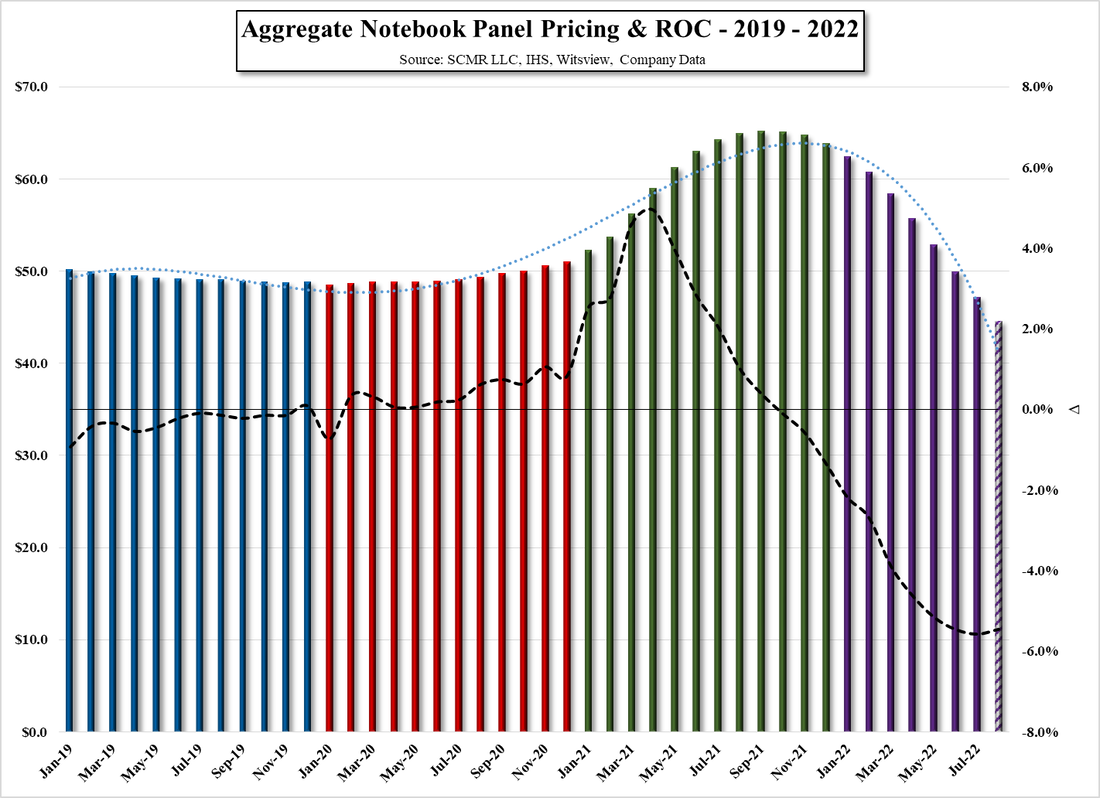

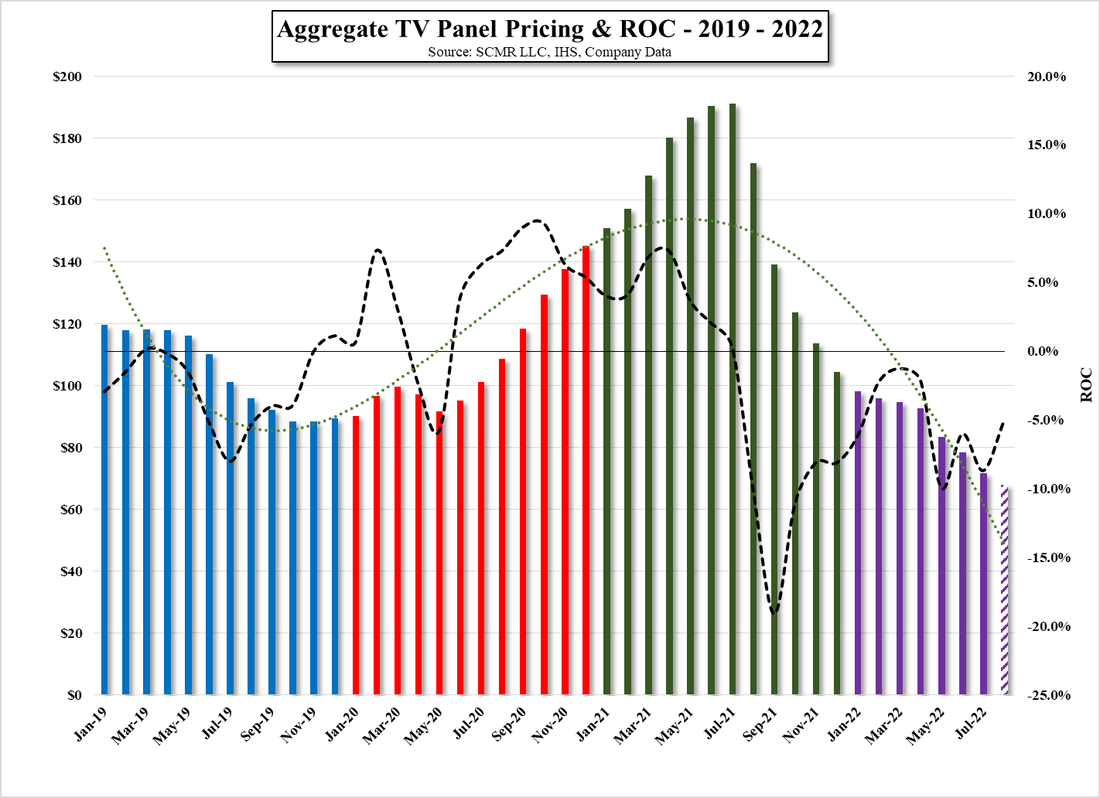

Given our focus on CE, we note that display sales were down 8.4% q/q and down 6.5% y/y as utilization rates were cut by panel makers in June to give the industry time to absorb excess inventory and (hopefully) stem large panel price declines. Glass pricing was up slightly in 2Q but Corning expects display glass pricing to remain flat in 3Q despite the lower volumes as a seemingly rational approach by the major display glass producers to take capacity off line is the basis for those expectations. We do note that until recently display glass producers have been running capacity near full utilization and tank cleaning, repair, and modernization has been postponed. Now that demand has slowed such work can be done as warranted, but the question of whether that capacity will be returned to production or held in reserve is still an unknown.

We expect the three major display glass producers, Corning, AGC (5201.JP) and NEG (5214.JP) to maintain reduced capacity through 3Q and likely into 4Q, but our concern is more from Chinese glass producers who have yet to prove themselves as other than price competitors. Given the opportunity to capture share, particularly on the Mainland, price is their leverage as they are subsidized by the government. As the year will likely generate losses for Chinese glass producers, share gains would serve to bolster their standing with the local and provincial governments so there is a chance that pricing pressure could be seen before the end of the year however we believe that the more rational behavior of the majors will be able to maintain relatively stable glass pricing through the end of this year, with early 2023 being a more opaque pricing environment.

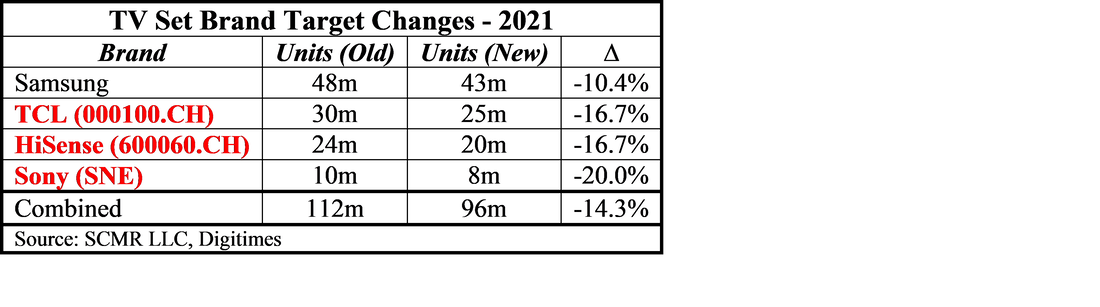

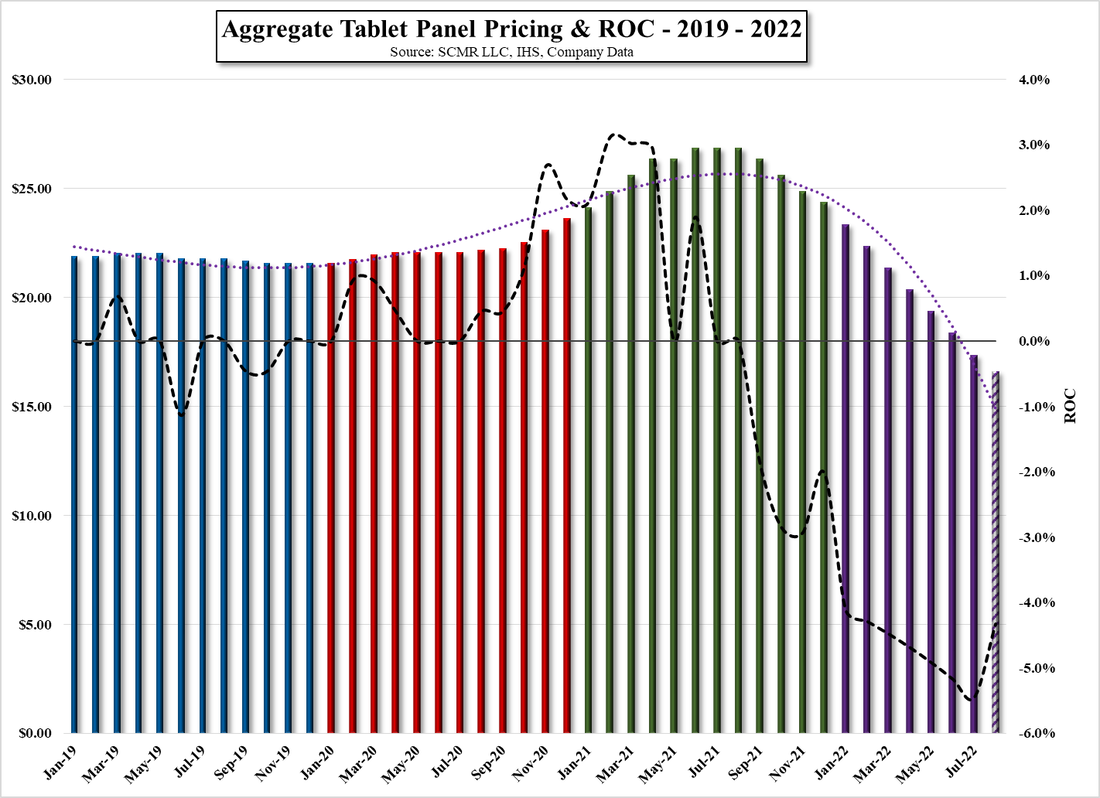

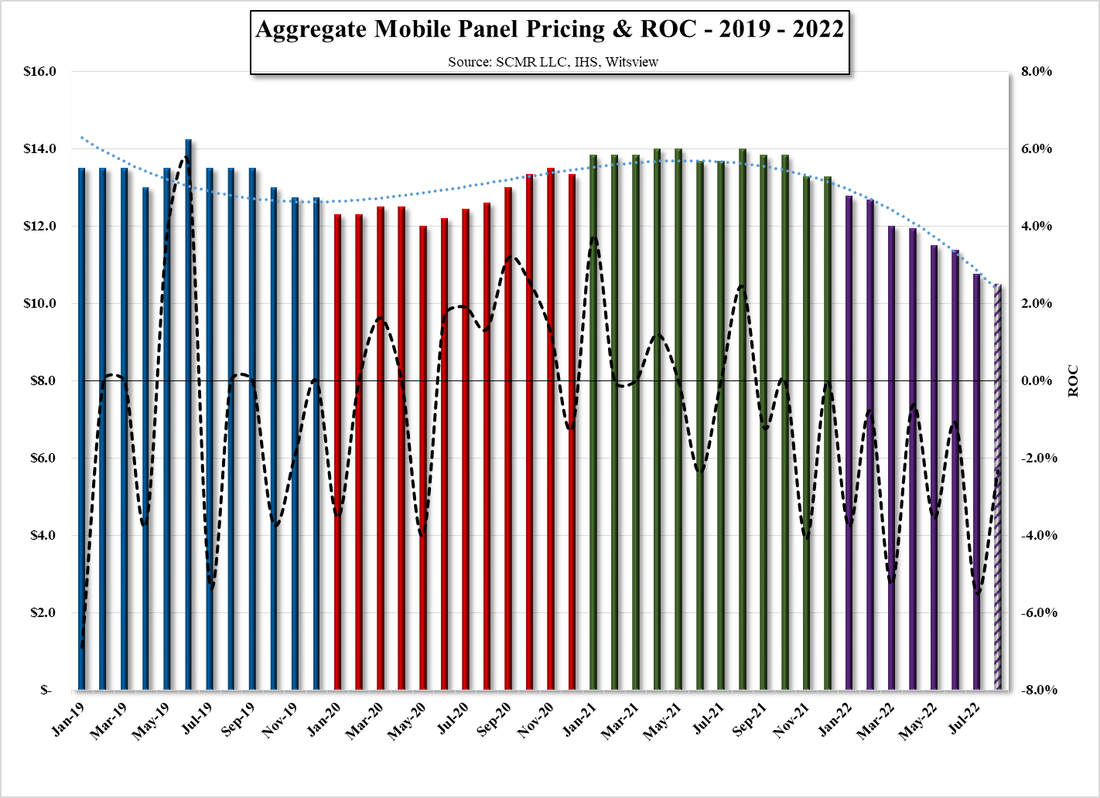

With optical growth offsetting the weakness in display and the specialty materials end market (smartphones), we would expect to focus more on how carrier build-outs are being affected by the current inflationary environment in 3Q and 4Q to gauge how long optical growth will be able to offset display weakness. While TV set shipments typically improve in 2H, we expect this year will see a weaker 2H than 1H unless prices deteriorate so quickly that consumers feel obligated to take advantage of such discounted pricing. However, as we have previously noted, there is still high-cost TV panel, component and set inventory to be worked down before the impact of lower panel prices can be felt at the consumer level and while we have seen some component and raw material price declines, they will take some time to work through the supply chain. Price elasticity remains but the effect of inflation on consumer buying power coupled with IT demand pull-ins earlier this year make for a teeter-totter situation that shows no clear cut direction yet and Corning’s full year grow is quite dependent on the balance between its product categories. A shift in one direction or another could be the swing factor between the 6% to 8% predicted for the year or adjusted guidance in 3Q.

RSS Feed

RSS Feed