Skymall Obit

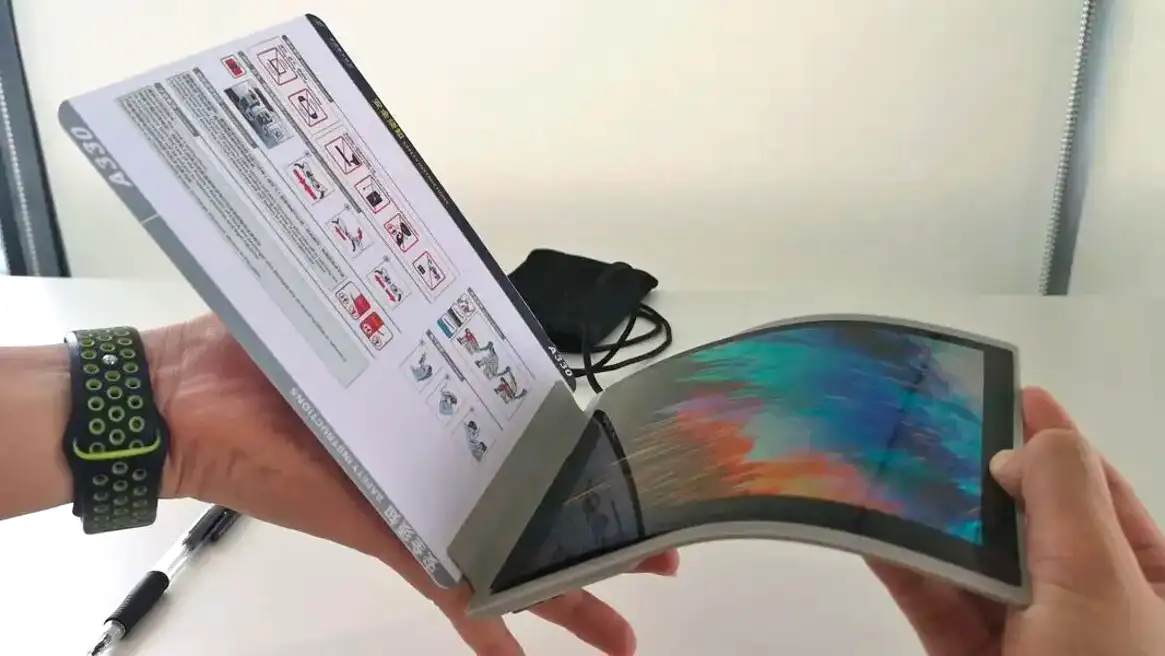

But that is all going to change according to a project involving Royole (pvt), a Chinese display manufacturer who is credited with releasing the first foldable smartphone, the Flex Pai. In a partnership with Airbus China (AIR.FP) put together in 2018, the companies have been working on replacing the typical airline magazines like SkyMall and those particular to a specific airline (many of which have been terminated as a result of COVID-19), with something a little more sophisticated and potentially practical, an OLED magazine.

The device, which is just entering actual test mode on one plane, is an iPad-like OLED display device that is flexible enough to be called a ‘magazine’ but still able to be used to order food (accepts credit cards), read ‘digital’ magazines and newspapers, stream TV and movies, and even give access to the internet. Of course, there is hardware that must be installed on the plane and internet access would be governed by the plane’s Wi-Fi capabilities, but the idea is to replace both paper magazines and the back-of-the-seat entertainment systems that are currently on most airline flights.

While the product is not quite ready for release, it helps airlines from having to clean magazines after each flight (really?) and maintaining the oddball seat display systems that are currently available, bringing it down to cleaning just an iPad like device. We expect there will be a system for checking passengers as they leave the plane in case they ‘accidentally’ place the device in their carry-on luggage, but despite our long-standing criticism of Royole, at least the concept is valid and could one day be an alternative to paper.

The question will be whether it is priced correctly, both to other carriers and to advertisers. While flyers tend to be a captive audience, ad and content pricing also needs to reflect a reasonable rate that leads to a sale, such as an in-flight movie or similar content, and the system needs to have access to content that does not limit the passenger’s choices to make secondary purchases. These are not simple tasks, especially while flying at 40,000 feet, but at least the device itself is beginning to take shape. Airlines themselves will likely be a bit cautious about spending for such new projects after the ravages of COVID-19, but if there is no more alcohol on flights, what else is there to do but read, watch movies, or buy stuff. Isn’t that what OLED was invented for?

RSS Feed

RSS Feed