Mesh in Space

Twenty-five years later analog telephones became available on a point-to-point basis but eventually morphed into an exchange based system that were connected via trunk lines to become networks and eventually was converted from analog to the digital systems used today. IP networks opened the internet to billions of users and the GSM mobile network became even larger, expanding on the PSTN (Public Service Telephone Network). However each network type has its drawbacks, some requiring copper or optical fiber connections between nodes, while others need many towers due to topographical issues that block signals, making it difficult or expensive for such networks to reach isolated customers.

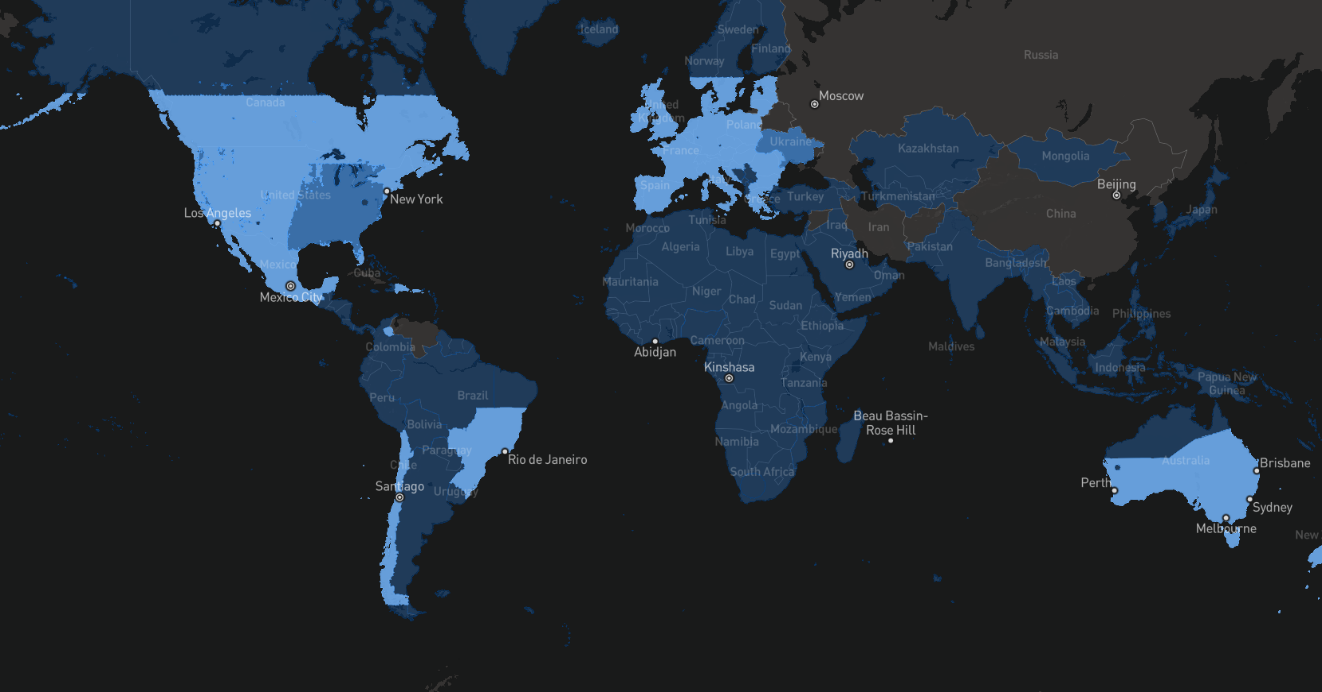

Satellite networks offer a chance for potential connection availability for anyone with an open view of the sky, but in order for a satellite network to be fully available there has to be a vast number of satellites in what is called low-earth orbit, so there is a satellite overhead at all times. LEO satellite networks have not proven to be economically viable for the average user and satellite networks such as Iridium (IRDM) and Globalstar (GSAT) have not quite reached the cost levels that would make them available to a large swath of the global population, which is why Elon Musk came up with the idea of Starlink (pvt), a mesh network of LEO satellites that will blanket the earth by the end of 2023.

Starlink’s almost 3,000 working LEO satellites create a high-speed, low-latency broadband network that costs $110/month (after a one-time hardware fee of $600) for regular internet service or $500/month for business users ($2,500 hardware fee). As the satellites are in orbit at 341.75 miles above the earth, as opposed to geostationary satellites, which are ~22,236 miles above the surface, during the time it takes for a signal to reach a geostationary satellite and return (~240ms) the Starlink satellites can receive and send 70 signals, resulting in a latency of ~20ms vs. 600+ for geostationary satellites. The antenna, which is ~13” or 24” depending on your applications is mounted on the roof, pole or wall, and is self-aiming, with the only requirement being an open view of the sky. The antenna connects directly to a router (supplied).

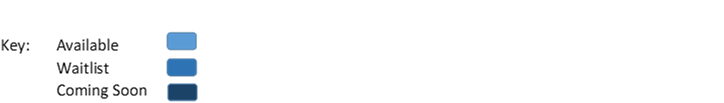

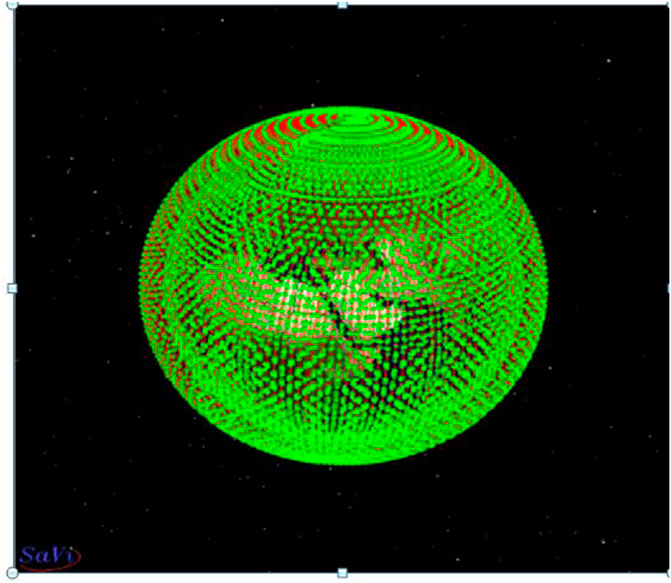

The Starlink satellites travel at ~16,776 mph, orbiting the globe in between 90 and 110 minutes and are organized in three layers or shells that are at three different heights above the ground, allowing not only communication between satellites of a particular level, but also between levels. The Starlink satellites are designed to be small, allowing a typical launch to carry between 34 and 60 satellites, leaving room for potential failures, and after 62 launches with 3,293 total satellites in the payloads, 3,025 are in orbit with 2,989 in operation. The rest are either not working properly, have lost propulsive capabilities, have reentered the atmosphere or are in a decaying orbit for a 96.77% operational success rate and one that has improved markedly from early launches (see Figure 2).

Of course this all sounds wonderful but it is a bit more complex than the Starlink press might lead one to believe. Mr. Musk’s has plans for as many as 42,000 satellites in order to get full global coverage (12,000 in the initial 3 shell project), which means the full roll-out will take a considerable amount of time and money. Earlier this year one launch of 49 satellites ran into a geomagnetic storm which disabled 40 of the satellites, which are said to cost ~$500,000 each, and while the cost/unit will likely continue to decline, the cost of ~39,000 more satellites could result in less coverage or higher prices for consumers. As to the service itself, a report earlier this year indicated that the Starlink consumer service median download speed was 104.97MB/s with upload at 12.04MB/s as compared to the median for broadband providers of 131.3MB/s download and 19.5MB/s upload, although it is faster than other satellite networks. That said, it varies considerably by location, with Starlink ahead in a number of countries.

Given that Mr. Musk has estimated the cost to fully build out the Starlink network to require an additional $20b to $30b, aside from Mr. Musk’s personal fortune, the company is always looking for government funding to offset the cost of the system and the Rural Digital Opportunity Fund, an FCC program established in January 2020 to bring broadband to over 5m homes and businesses that have been unable to gain voice and broadband service with at least 25MB/s. With $20.4b to be awarded over 10 years the FCC is auctioning off blocks of locations in auctions, with the winners required to meet a number of performance requirements.

SpaceX was one of two winners (LTD Broadband (pvt) was the other) in the $9.2b auction that took place about a year and a half ago, but the FCC has issued a decision that concludes that neither winner would be able to provide the service given the requirements. Starlink’s winning bid would have provided the company with $885.5m to provide 100MB/s/20MB/s service to 642,925 locations across 15 states and while the FFC stated “Starlink’s technology has real promise. But the question before us was whether to publicly subsidize its still developing technology for consumer broadband—which requires that users purchase a $600 dish—with nearly $900 million in universal service funds until 2032. After careful legal, technical, and policy review, we are rejecting these applications. Consumers deserve reliable and affordable high-speed broadband. We must put scarce universal service dollars to their best possible use as we move into a digital future that demands ever more powerful and faster networks. We cannot afford to subsidize ventures that are not delivering the promised speeds or are not likely to meet program requirements.”

Starlink is not going down easy and has filed an Application for Review with the FCC, essentially asking for a review of the decision on the grounds that it was flawed in both policy and law and it contained data that was off the record and ‘cherry-picked’, showing the FCC’s bias toward fiber, and that under the funding rules it is not required to meet the RDOF speed requirements until 2025. Strangely the FCC Commissioner Brendan Carr agreed with Starlink, citing the faith that other government agencies have in the Starlink network including a recent $1.9b deal with the Air Force to provide internet service at military bases and that it would cost ~$3b to run fiber to the same areas that would be served by Starlink. No date has been set for the review, but we expect there will be much in the way of legal fireworks before it is all sorted out, although we expect Starlink to continue its launch plans regardless of the outcome.

RSS Feed

RSS Feed