Sony Says ‘No’ to New Orders

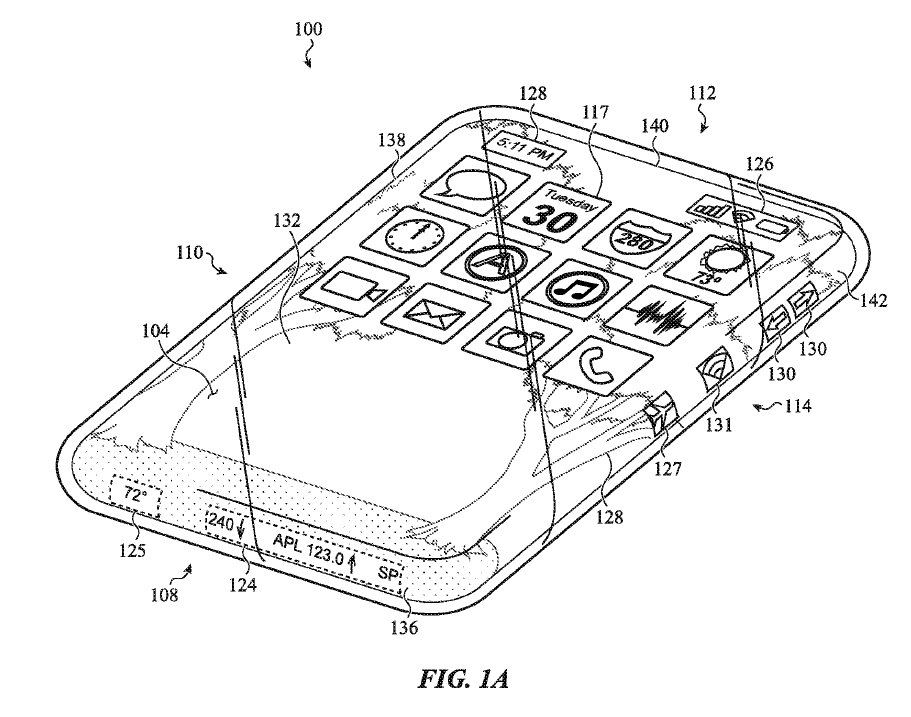

Such ‘mirrorless’ cameras fall into an unusual class, as technically your smartphone camera is considered ‘mirrorless’ , as are many point-and-shoot digital cameras, but in this regard the term is used for cameras with interchangeable lenses. The big difference however is the addition of the EVF, electronic view finder, which shows exactly what the image will look like using current settings, allowing the user to adjust those settings to optimize the image before taking the shot. Additionally such systems can include an image stabilizer, which keeps the sensor steady, even when shooting without a tripod, allowing for slow shutter speeds (better for low light) that would be impossible for most SLRs.

That said, as such devices continue to increase semiconductor content, they fall prey to the same shortages that other CE products are seeing, and given the more specialized nature of some of the components, they tend to be short run products that get bumped by high volume silicon. Sony is not alone here, as Nikon (7731.JP) was forced to delay the release of a new interchangeable lens camera for 45 days when factories producing components in Asia were shuttered due to COVID-19.

Its not like the camera business can easily withstand a bad month or quarter either, as the increasing quality of smartphone cameras has pressured stand-alone camera sales for the past few years, leaving manufacturers and component suppliers wary of increasing capacity, and while the industry saw a bit of a recovery in 1H, with Sony and others raising forecasts, August saw y/y shipments go negative, followed by a 30% drop in September. Sony says they will minimize the impact of the shortages by redesigning and sharing parts, as well as increasing inventory, but the former takes time and the latter caused prices to rise further for other CE products.

RSS Feed

RSS Feed